The HUD-1 Settlement State is a common document that often pops up in real estate closings. The HUD-1 Settlement Statement is quite similar to the Closing Disclosure, however, the Closing Disclosure (CD) is exclusively used for loans that are RESPA compliant. The Closing Disclosure is derived from the HUD-1 Settlement Statement and has been in use since 2015 for all government backed mortgages.

While the HUD-1 Settlement Statement is largely replaced by the Closing Disclosure these days, it is still used to settle cash transactions, reverse mortgages, and other loans that need not be RESPA-compliant. This is why it is important to understand the HUD-1 Settlement Statement.

In this post, we look at the various cost components of the HUD-1 Settlement Statement and try to break it down in detail for you!

Table of Contents

- What is the HUD-1 Settlement Statement?

- Type of Loan

- Summary of Borrower’s Transaction

- Summary of Seller’s Transaction

- Settlement Charges

- Total Settlement Charges

What is the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a form used for real estate closings used to process and approve reverse mortgages and non government loans that are not RESPA compliant.

Before the Closing Disclosure made its way into the market, HUD 1 was the main document that used to clearly state all the cost components the buyer and the seller are going to pay at closing. The HUD 1 is still seen with lenders and agents but its importance has certainly reduced in the present day.

Let's dig into the HUD-1 Settlement Statement and look into each section of the document to give you a thorough understanding.

There are a total of 5 sections in the HUD form. These 5 sections have subsections that we will be highlighting with specific color codes as shown below.

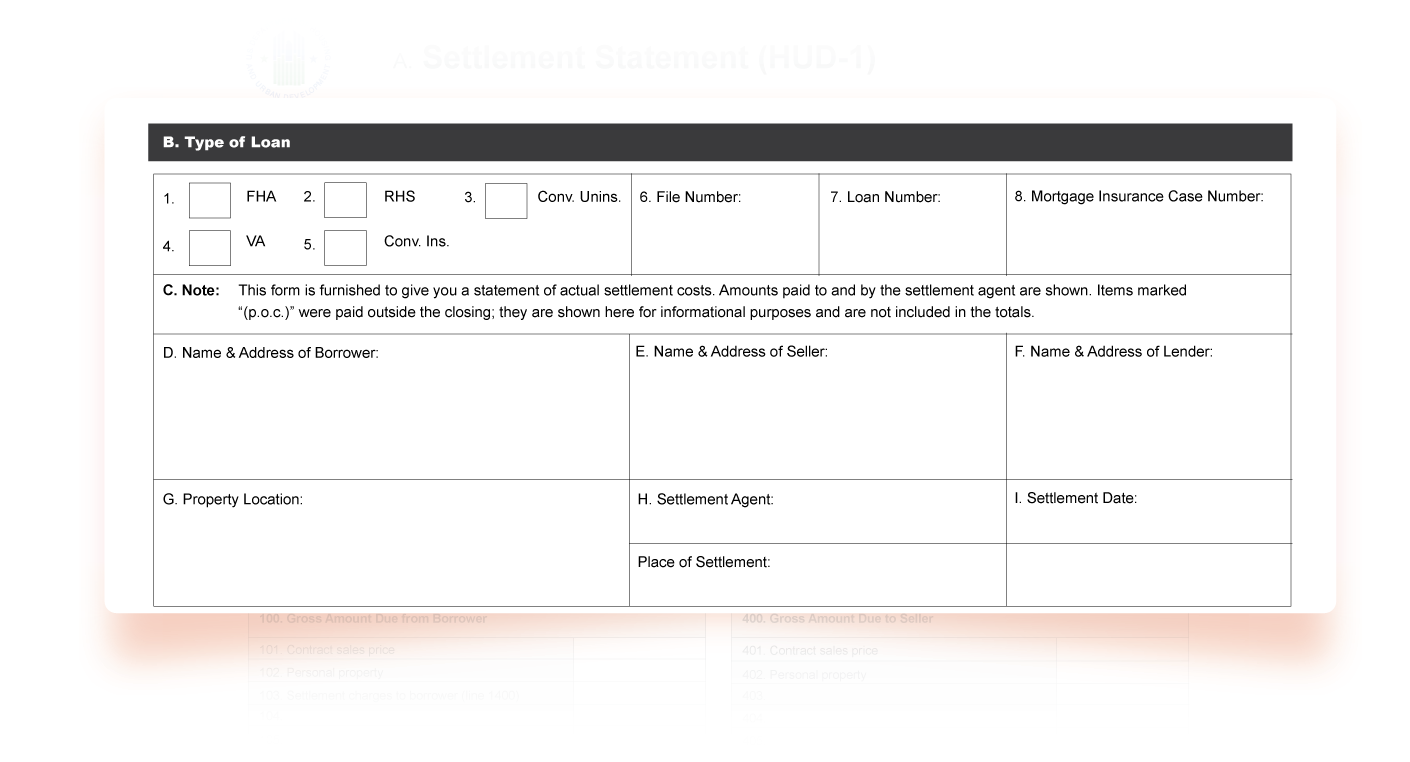

Type of Loan

This part shows the type of loan the borrower is applying for. You can also find the names for the buyer, seller, lender and settlement agent, location of the property, and the closing date in the section.

Buyers and sellers should make sure that their respective details in this section are correct and free from misspellings. Giving correct information in this section is important and all parties should verify that from their respective ends.

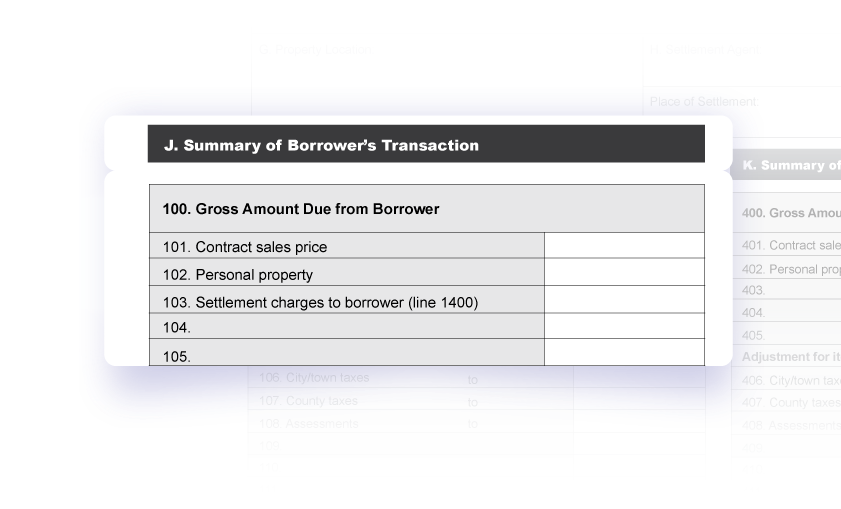

Summary of Borrower’s Transaction

This section gives an account of all cost components that are debited from or credited to their account. This section is divided into 3 major parts called the 100s, 200s, and 300s. The summary of seller’s transactions is listed opposite to this table as anything debited from the buyer is credited to the seller and vice versa.

100 Gross amount due from the borrower

The buyer is supposed to pay these costs.

101 Gross sales price of the property the buyer is supposed to pay.

102 The price of any appliance or other article that the buyer wants to purchase with the home and must pay to the seller.

103 Total settlement charges due on the buyer. The detailed break up of settlement charges is given in the last section 1400.

Adjustment for items paid by the seller in advance

The costs that the seller has agreed to pay instead.

106 Taxes with respect to the town or city where the property is located.

107 Taxes levied according to the respective county upon the sale of a property.

108 Assessments are charges paid by the seller for property inspection, appraisal, etc.

120 The total amount that the buyer must pay.

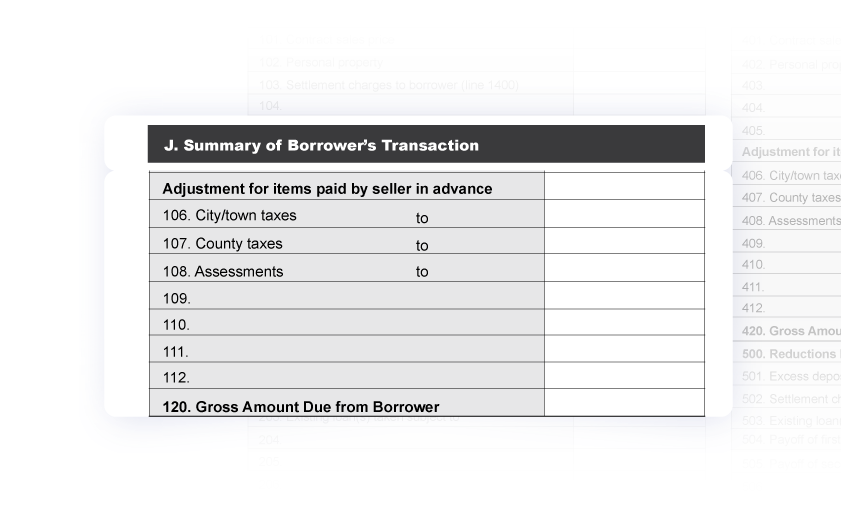

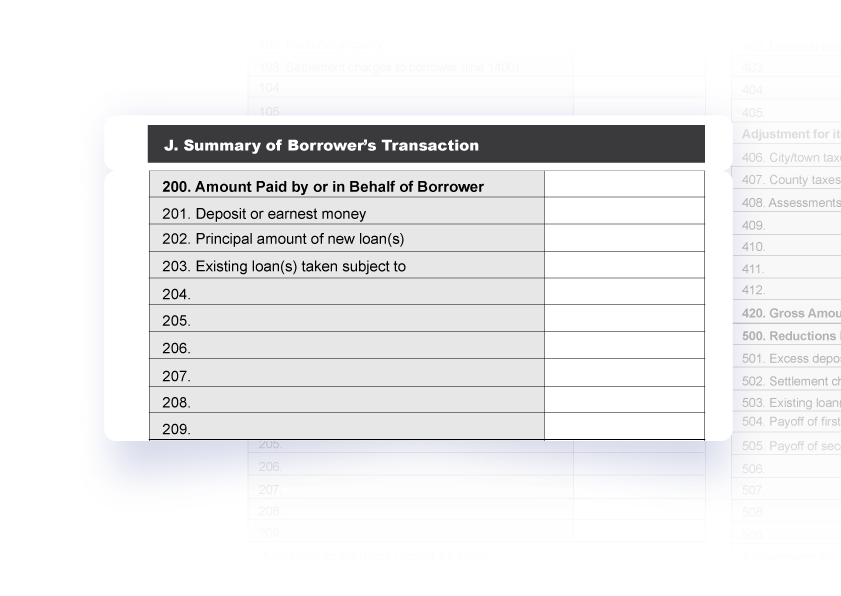

200 Amount Paid by or on Behalf of Borrower

This section lists cost components that the buyer will receive during the closing process.

201 The amount paid as earnest money during acceptance of the offer and credited to the buyer and debited from the seller’s account listed on 501 or 506.

202 This is the new loan amount paid to the buyer.

203 This cost applies if the buyer is transferring the title using an existing loan.

204 - 209 These are miscellaneous costs that the buyer was promised to pay by the seller after negotiation.

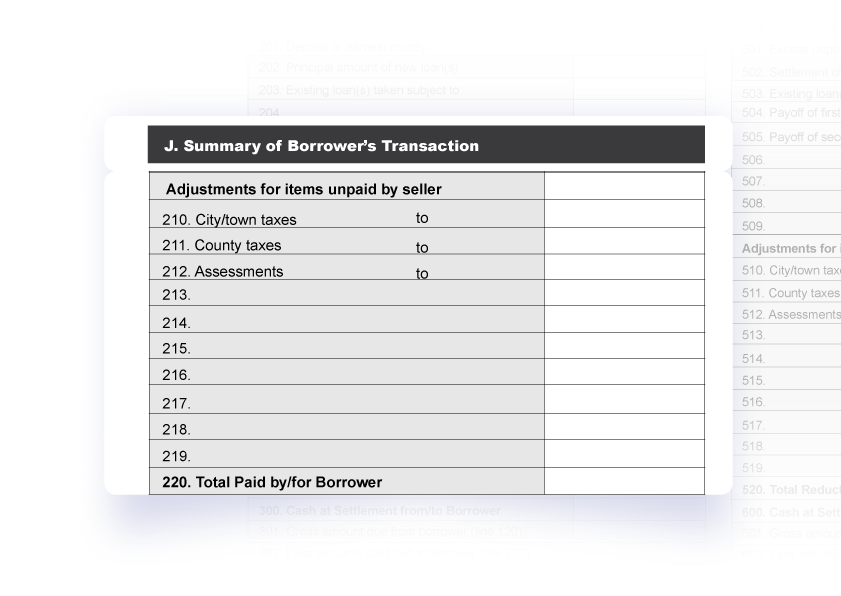

Adjustments for items unpaid by seller

The costs that the seller has refused to pay instead.

210 Taxes with respect to the city or town where the property is located.

211 Taxes paid by the seller to the respective county.

212 Assessment charges for inspection etc.

213-219 Additional or miscellaneous charges.

220 The total amount of all the items under 200.

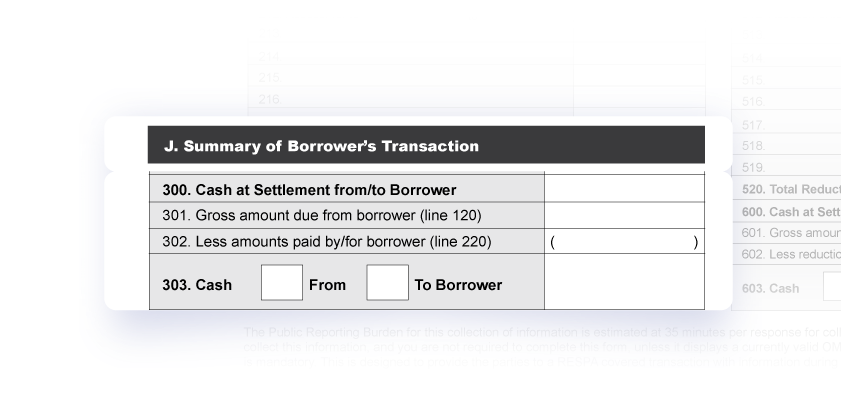

300 Cash at Settlement from/to Borrower

This section will have entries provided the buyer has decided to opt for a cash payment.

301 The total amount that the buyer must pay in cash.

302 The total amount of all the items under 200 in cash.

303 Shows if the money is going to the buyer or vice versa.

Summary of Seller’s Transaction

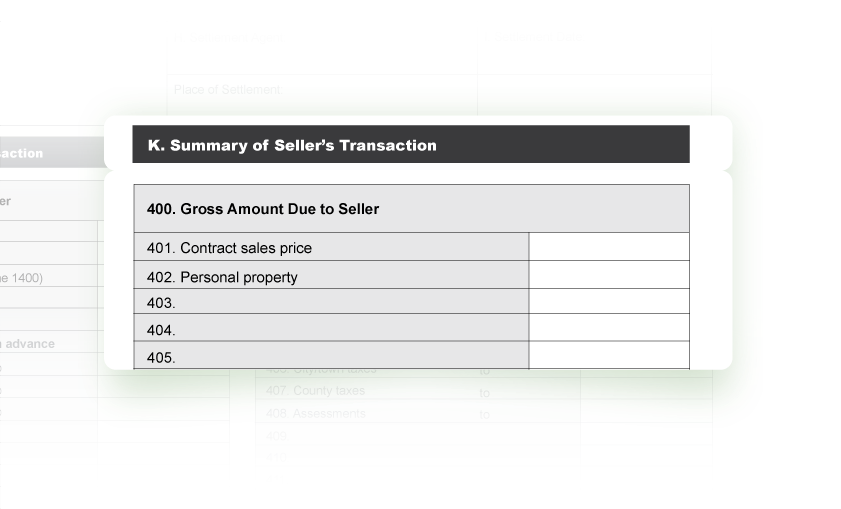

400 Gross Amount Due to Seller

The 400s deal with price components that the seller is about to receive.

401 The gross sales price of the property the seller is supposed to receive.

402 The price of any appliance or other article that the seller has sold along with the house to the buyer. The seller will be supposed to receive this amount.

403 - 405 These rows can account for amounts such as rent that the buyer may owe to the seller a portion of uncollected rent.

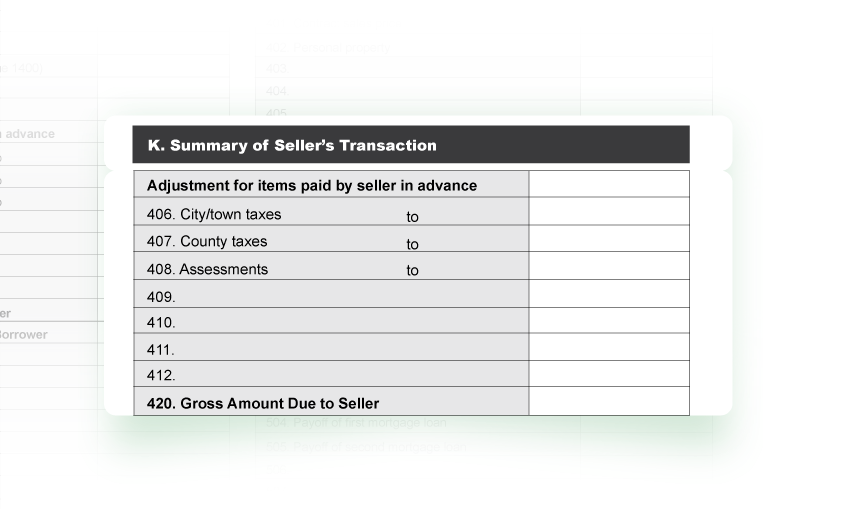

Adjustment for items paid by the seller in advance

These prices are already paid by the seller as prorations and they might be entitled to receive some amount back from the buyer.

406 Prorated amount paid for as city/town taxes.

407 Prorated amount paid for as county taxes.

408 Prorated amount for inspection etc.

409-412 Other adjustments and prorations.

420 The total amount the seller is supposed to receive.

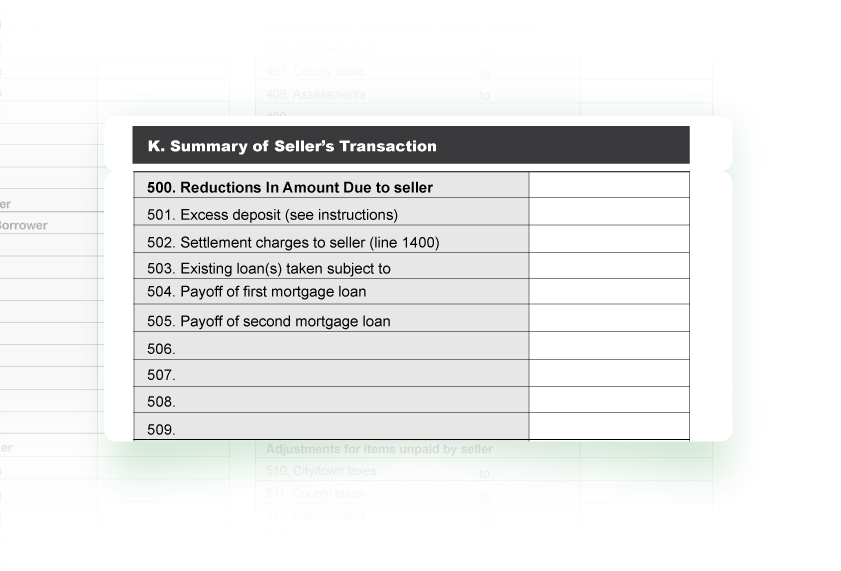

500 Reductions In Amount Due to seller

These costs are deducted from the seller’s account.

501 Excess deposit is generally the earnest money of the buyer that is held by the seller’s broker.

502 Settlement charges that the seller must pay. The last section 1400 gives a detailed account of the same.

503 This applies if the buyer is taking over the existing title and any lien that comes with that. This cost is upon the seller.

504 The first mortgage payoff that the seller is liable to pay.

505 The second mortgage payoff that the seller is liable to pay.

506-509 These rows can account for costs associated with other liens.

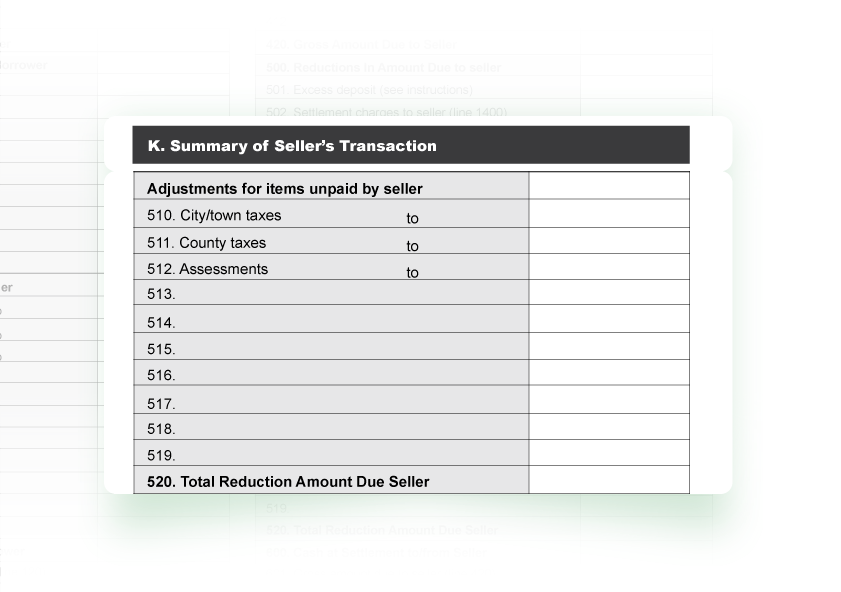

Adjustments for items unpaid by seller

This section lists the cost components that the seller may still owe to various third parties.

510 Taxes with respect to the city or town where the property is located.

511 Taxes paid by the seller to the respective county

512 Assessment charges for inspection etc.

513-519 Additional or miscellaneous charges

520 The total amount of all the items under 500z

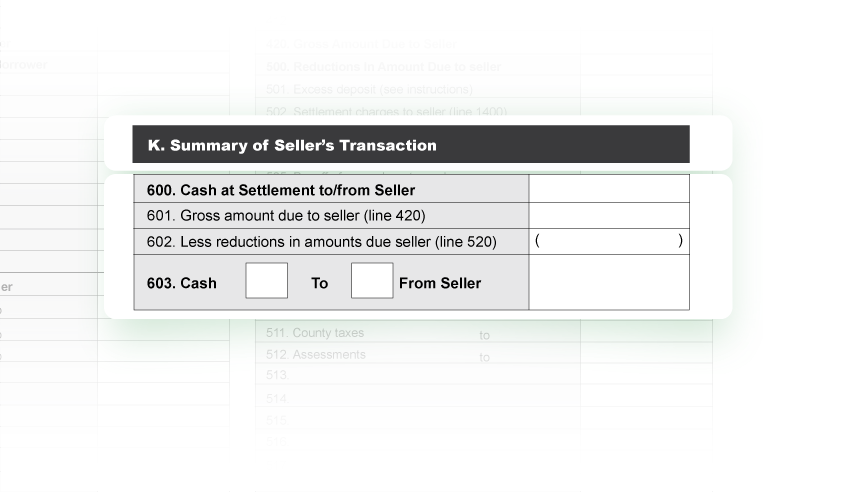

600 Cash at Settlement to/from Seller

This section will have entries provided the seller is receiving a cash payment. Generally, the seller will receive the amount and may have some amount to be paid as well.

601 The total amount that the seller should receive.

602 The deductions from 502.

603 Shows if the money is going to the seller or vice versa.

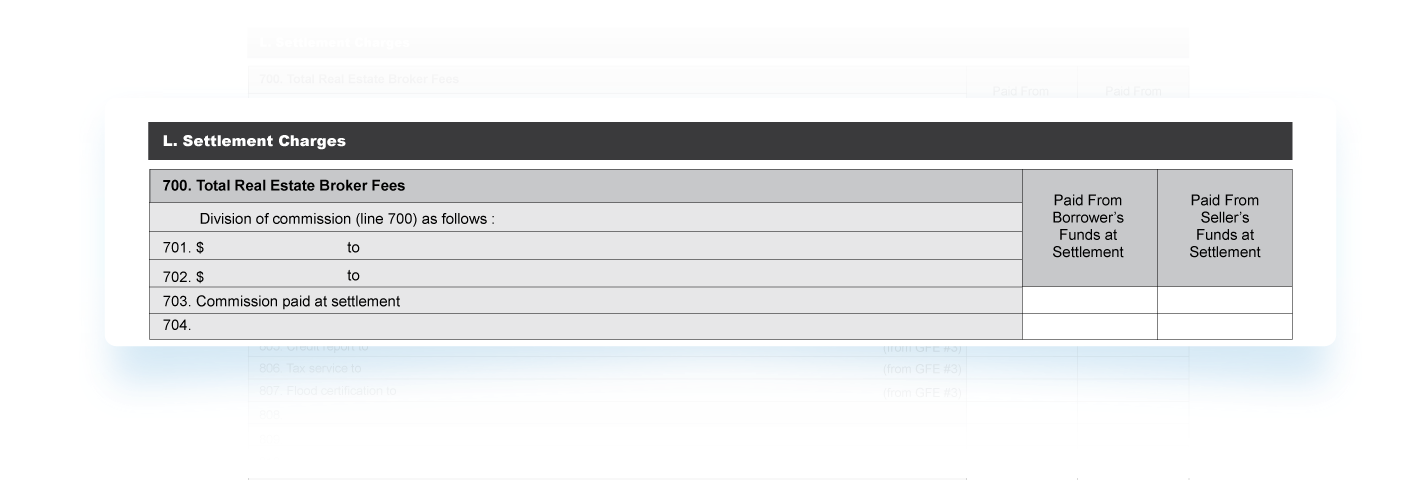

Settlement Charges

Settlement charges also called the section L and feature prices that both parties are supposed to pay to transfer the title and complete the transaction. Costs on the left column are paid by the buyer, and costs shown in the right column must be paid by the seller. The settlement charges are segregated into 7 different categories. These are as follows:

700 Total Real Estate Broker Fees

This is the amount that must be paid to the respective broker for buyer and seller. It is generally deducted from the amount deposited.

701 and 702 Used simultaneously to fill up amount for the two brokers for respective parties

703 Denotes whichever fund (buyer or seller) the commission is paid from

704 Additional charges.

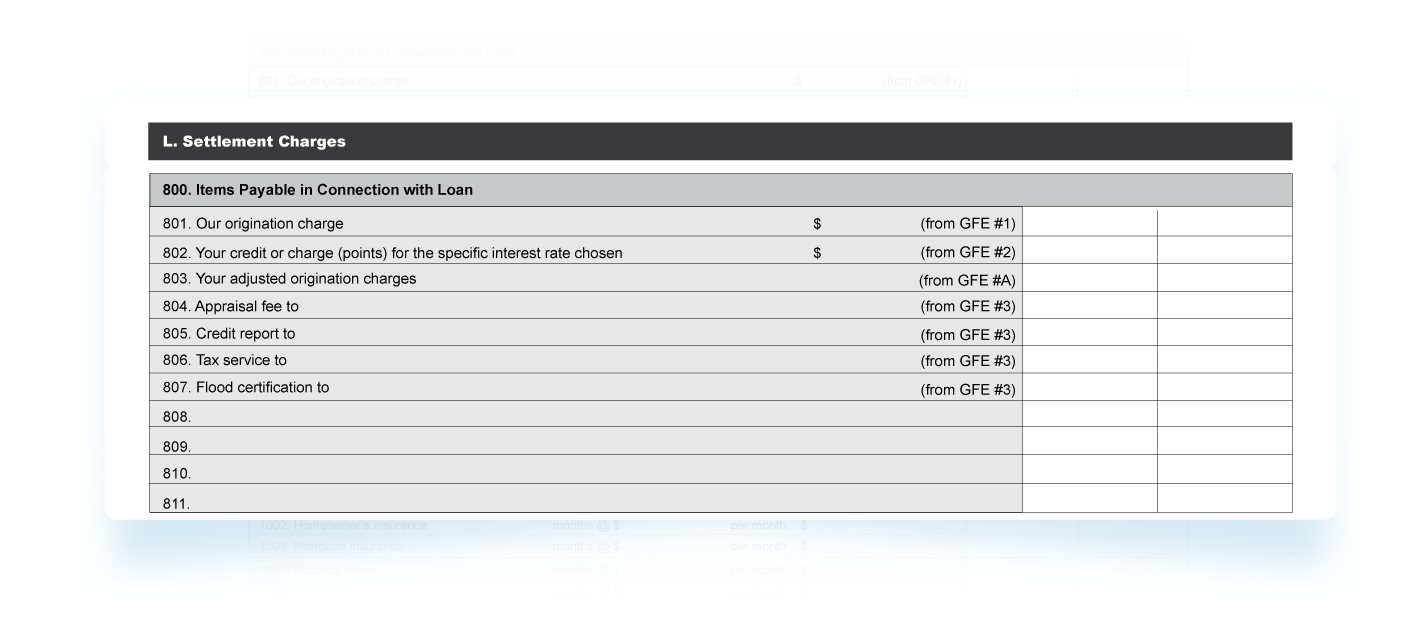

800 Items Payable in Connection with Loan

These charges are levied to process the mortgage to the buyer or the seller. The costs listed here are carried forward from the good faith estimate.

801 The cost of mortgage processing. Often debited from the buyer’s side.

802 Points paid to the lender for a discounted rate of interest. Paid by the buyer often.

803 Applies if you have negotiated to a revised origination fee which is less than the initial quote by the lender

804 Charges paid to the home appraiser. Paid by the seller most of the time.

805 Charges paid to the buyer’s agent for generating the credit report. Paid by the buyer.

806 Real estate taxes.

807 Paid to flood certification companies. Mostly paid by the seller.

808-811 Additional costs associated with processing the mortgage.

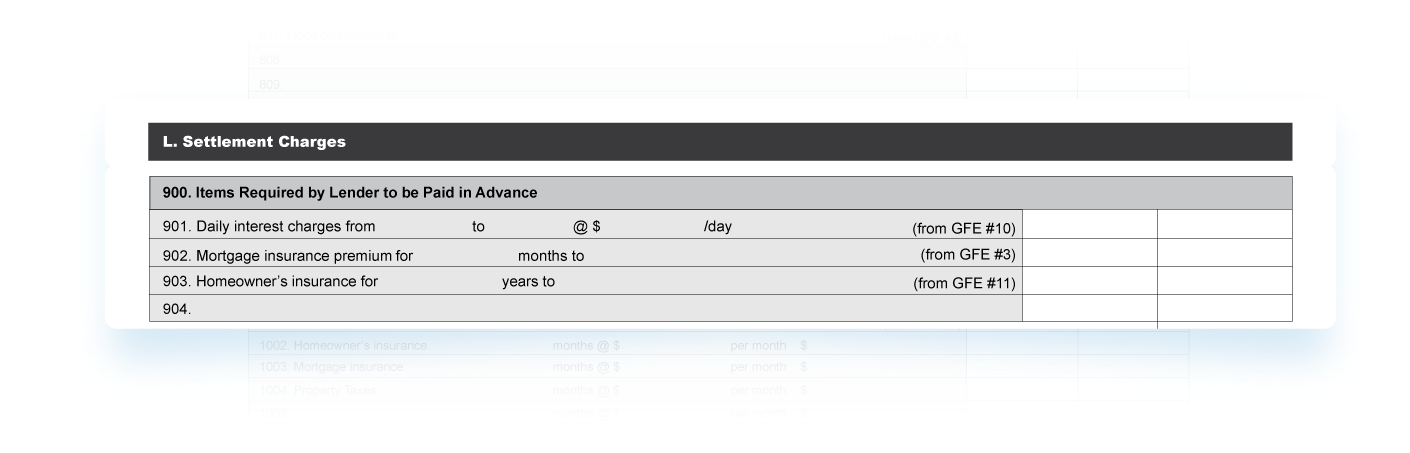

900 Items Required by Lender to be Paid in Advance

These charges are connected to HOA, taxes, and escrow and must be sorted out before the lender can begin the underwriting process.

901 Interest paid by the seller during his stay in the home.

902 The mortgage insurance premium paid by the seller during his stay in the home.

903 HOA insurance paid by the seller.

904 Additional costs that must be cleared before mortgage underwriting.

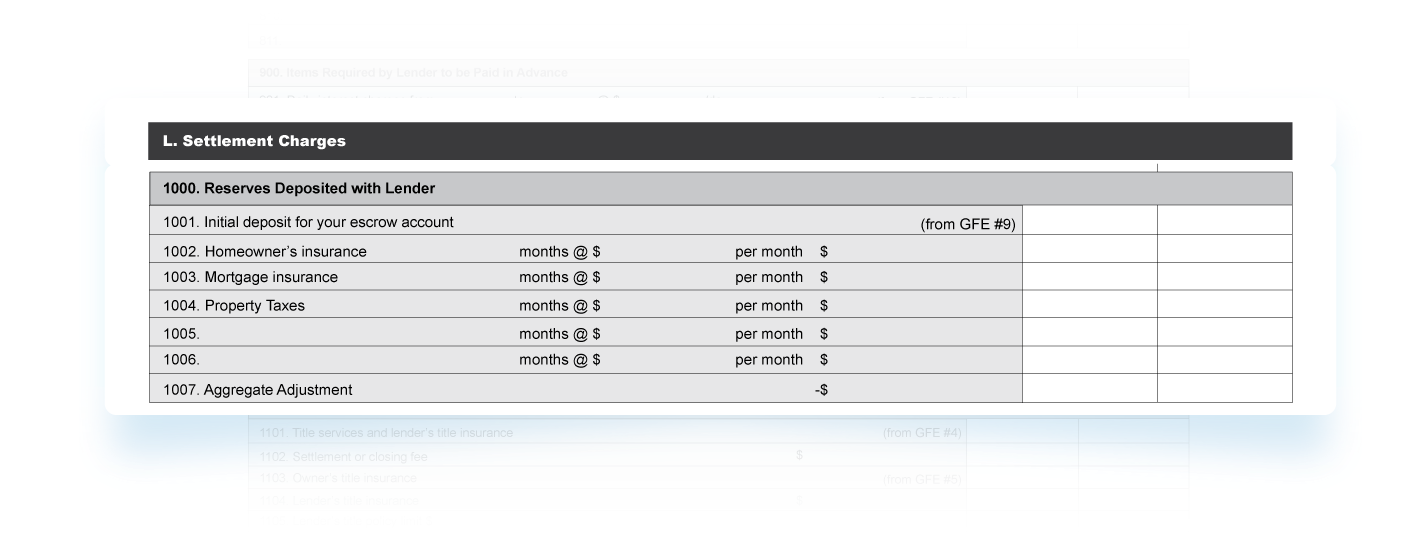

1000 Reserves Deposited with Lender

These costs must be paid by the buyer to the respective third parties. They may also be paid as deposits so that the lender can pay them on their behalf. The sellers can also promise to pay some of the costs and hence they will be paid by the seller in advance.

1001 If the buyer has set up an escrow account and wants to place the deposit in that account it will show up on the buyer’s side

1002 HOA advances could be paid by the buyer for a year in advance. Any adjustments between the buyer and the seller are adjusted accordingly.

1003 Advances for the mortgage insurance accrued in the same fashion as HOA advance.

1004 Property tax advance paid according to the state or county.

1005-1006 Additional advances.

1007 Total amount for 1000.

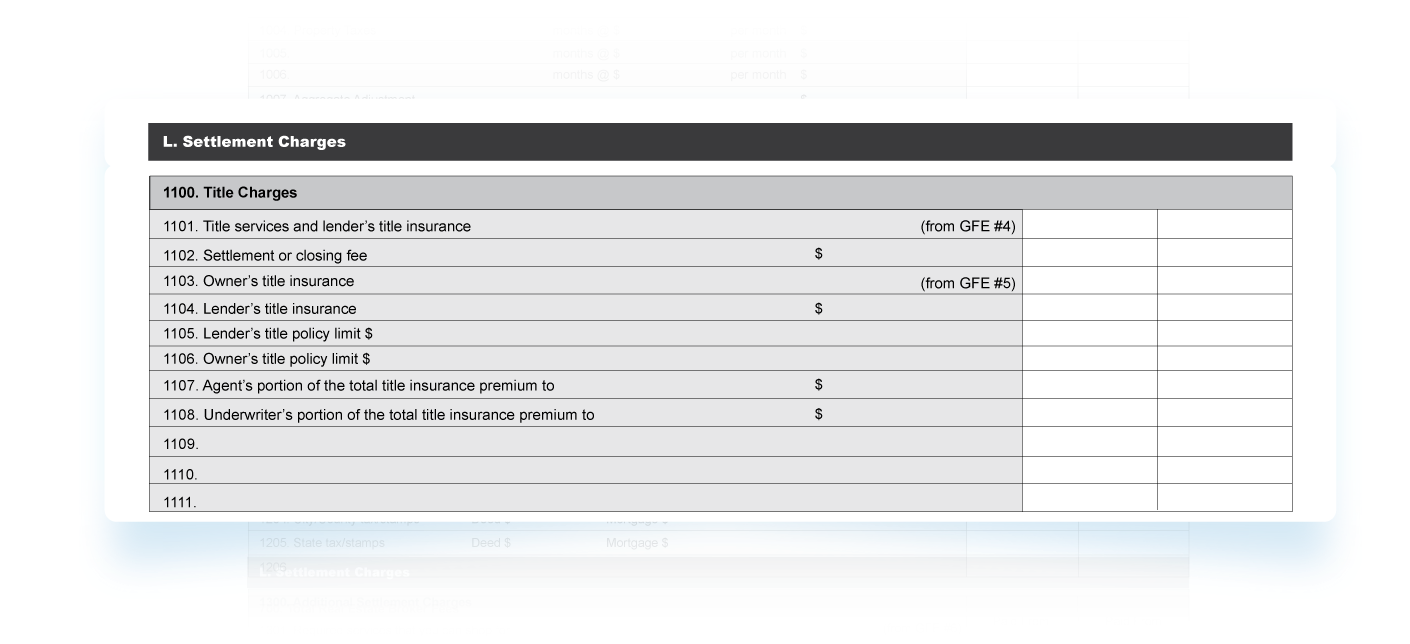

1001 Title Charges

These costs are paid to the escrow and title company. Most of the time they are paid by the buyer but sellers may also pay if there is a mutual agreement between both parties.

1101 Cost of lender’s title services paid by the buyer.

1102 The cost incurred to complete the closing process.

1103 The cost paid by the buyer to ensure the title remains in their name if the seller defaults

1104 The cost paid to ensure the lender is not liable for the mortgage payment if the buyer defaults.

1105 The insurance amount that safeguards the lender in case of a default.

1106 The insurance amount that safeguards the buyer in case of a default.

1107 The amount that the agent is entitled to in case of a default.

1108 The amount that the underwriter is entitled to in case of a default.

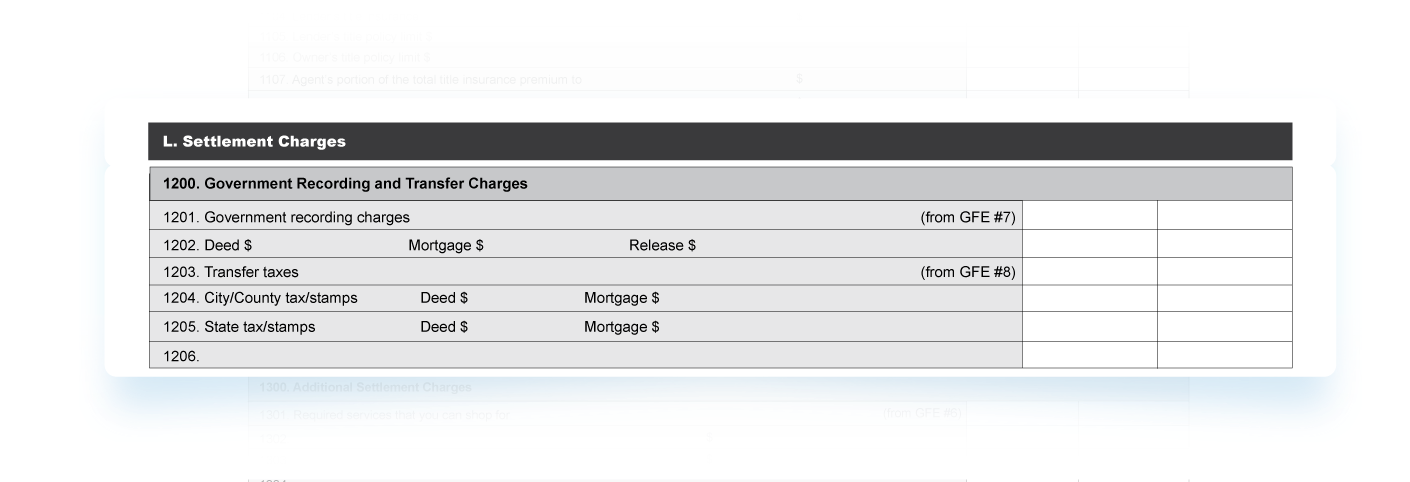

1002 Government Recording and Transfer Charges

These costs are paid to the government for recording the deed and transferring the title to the buyer’s name.

1201 The cost of recording and documenting the deed.

1202 Costs to record the deed, cost to record the mortgage and cost of the release.

1203 Cost of transferring the deed

1204 Costs for stamps, county tax, or city with respect to the deed and mortgage.

1205 Same costs 1204 for a state.

1206 Other costs incurred to record the deed.

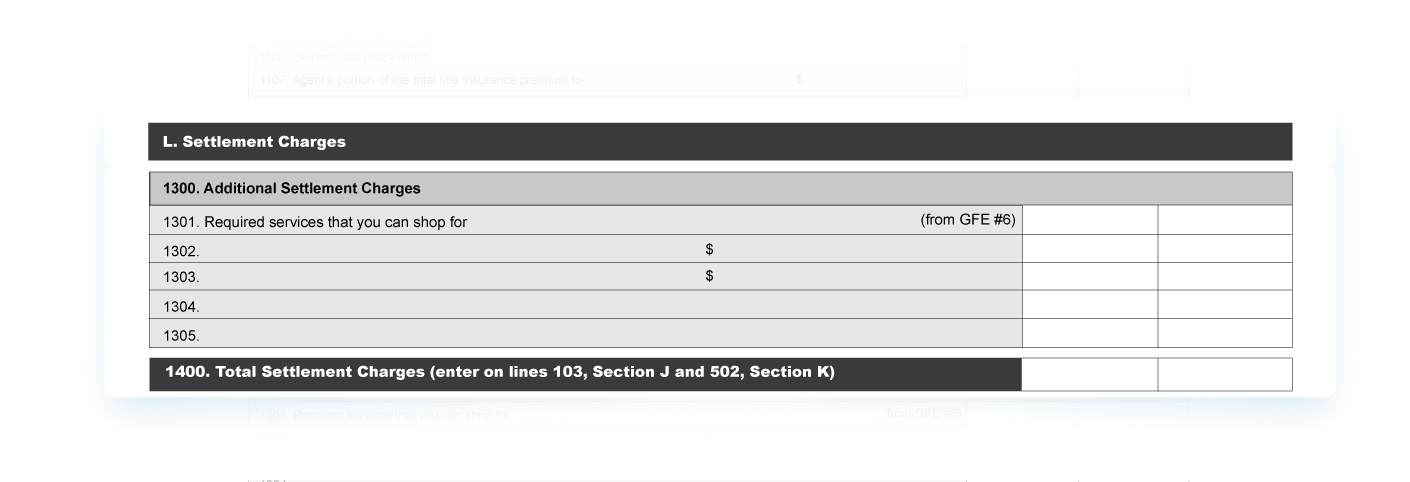

1003 Additional Settlement Charges

1300 is for additional third-party closing charges such as additional costs for escrow, inspection fee, etc.

Total Settlement Charges

The buyer and seller may both incur settlement charges that appear in the 3rd and 4th sections already. This section gives a detailed breakup on the total settlement charges for both the parties involved and shows if there is an increase in the cost compared to what’s given on the good faith estimate or GFE. This section is divided into 4 sub sections. Let’s look into all 4 subsections.

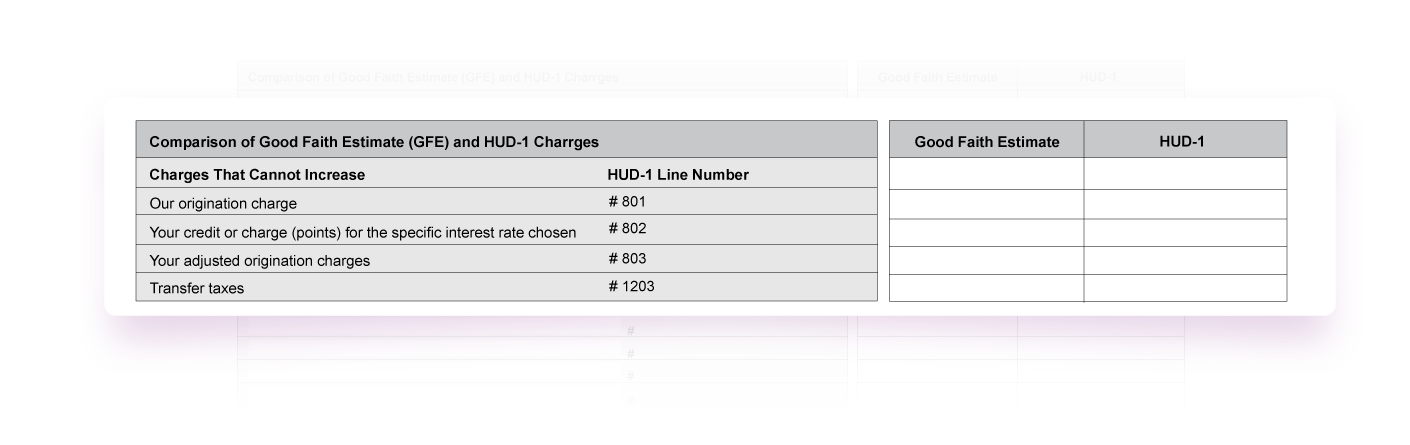

Comparison of Good Faith Estimate (GFE) and HUD-1 Charges

These charges are the ones that remain unchanged when compared to the good faith estimate. Mortgage processing fee, state taxes, credit points, and taxes for title transfer.

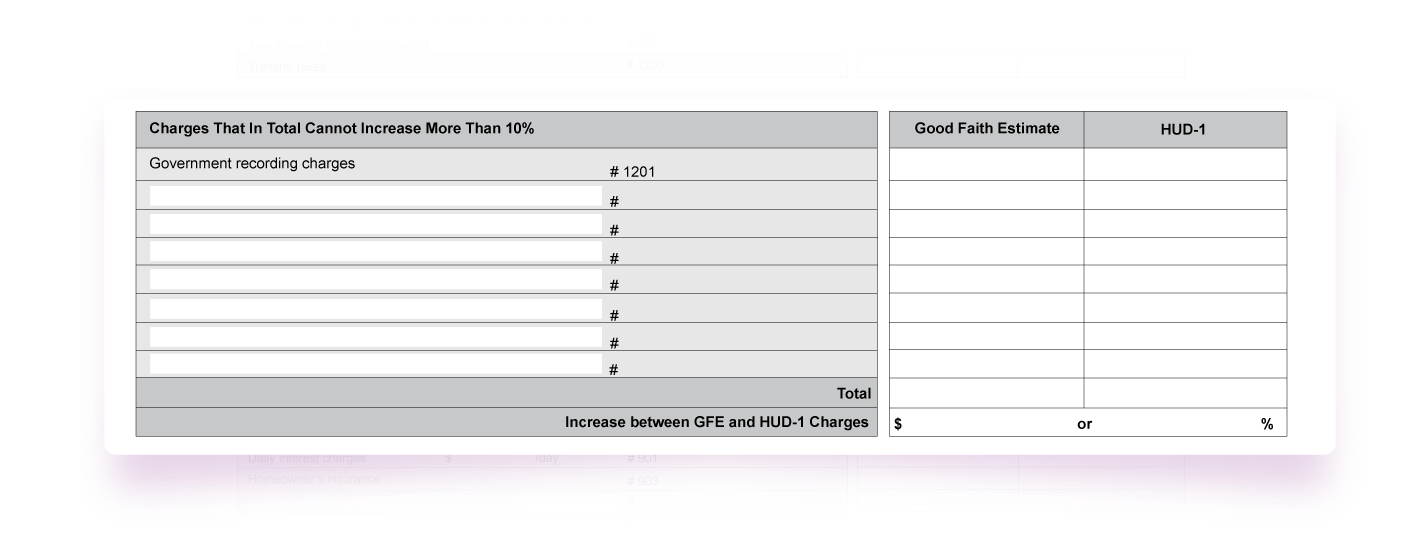

Charges That In Total Cannot Increase More Than 10%

These charges are the ones that can increase up to 10% when compared to the good faith estimate. The government recording fee (1201) is one of the costs that fall into this category.

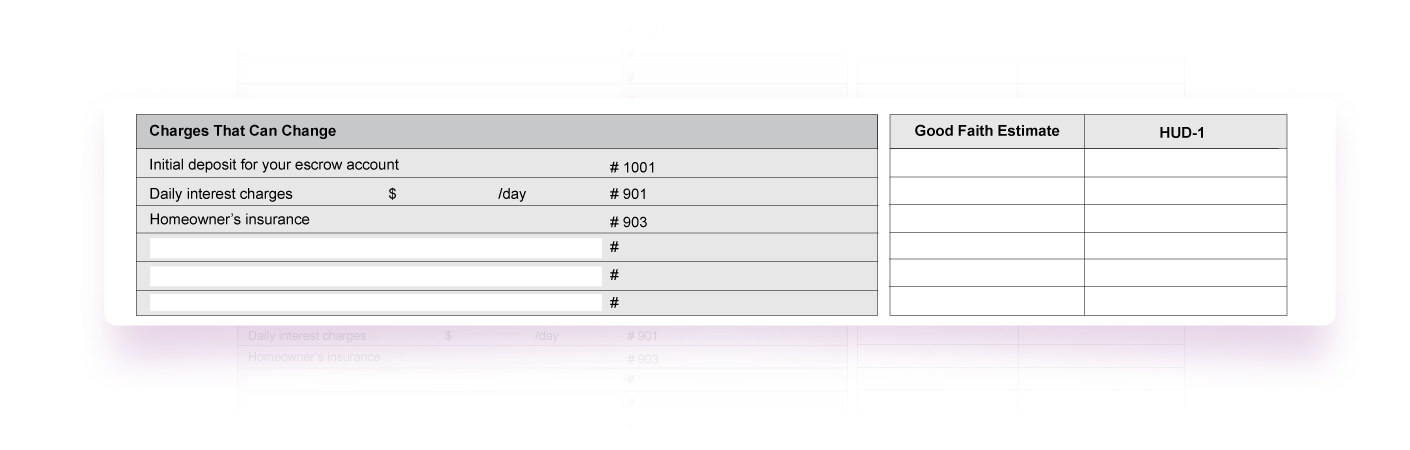

Charges That Can Change

These charges can change in the HUD-1 compared to the GFE. Some of the costs in this section involve escrow deposit(1001), interest charges(901), and homeowners’ insurance(903).

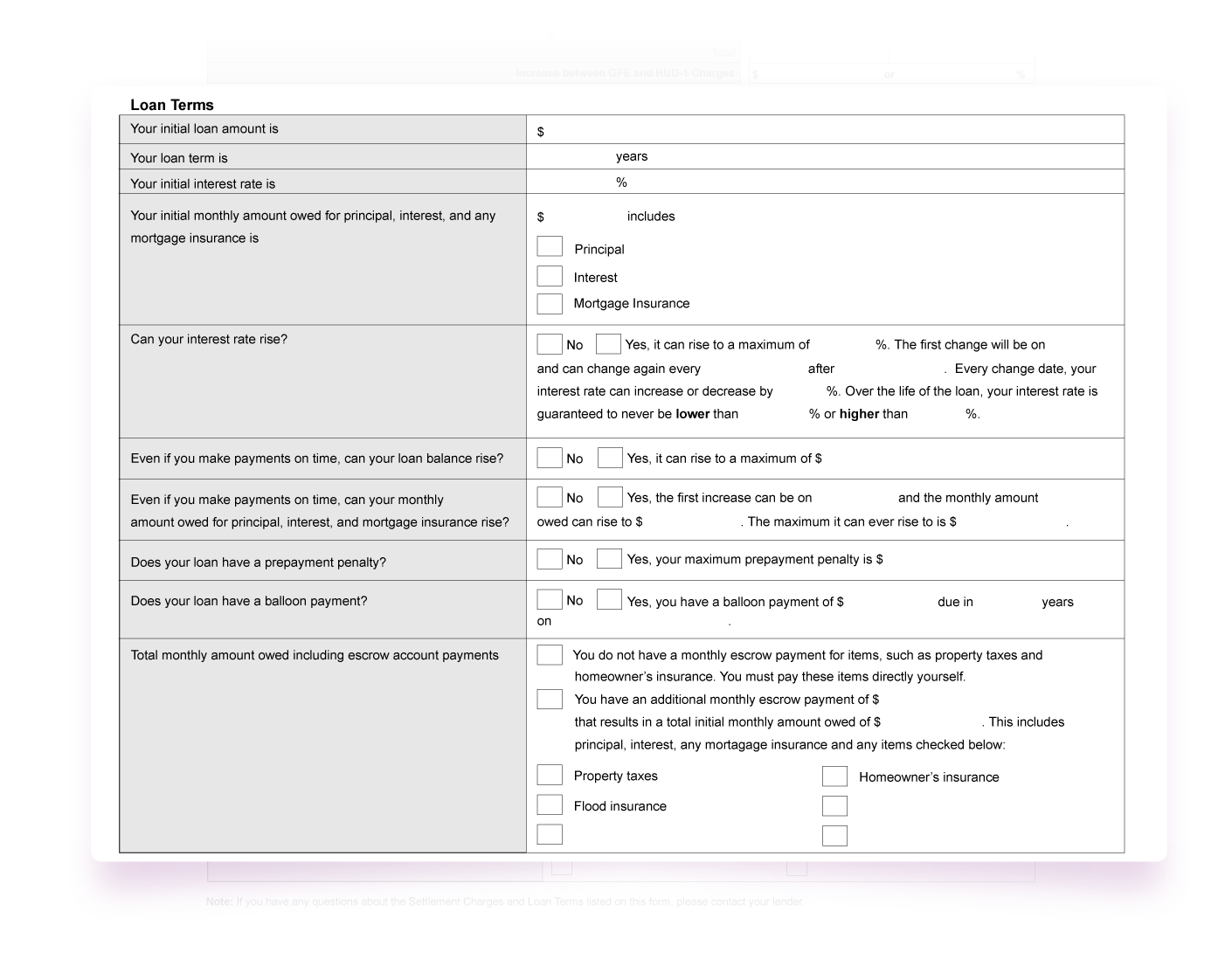

Loan Terms

- The last section of the HUD 1 10 important conditions associated with the mortgage the buyer wants to apply for. These are:

- The amount of the total loan amount

- Payback period of the loan

- Rate if Interest the buyer is obliged in the pay the EMIs with

- The amount already paid by the buyer as principal, interest, and mortgage.

- States if the interest rate is locked and if not by what percentage can it increase.

- States if the loan balance can increase despite paying a part of the principal every month. It should be checked to “no” for an ideal loan.

- States if the principal, interest, and mortgage insurance can increase despite a timely monthly payment. It should be checked to “no” for an ideal loan.

- Prepayment penalty for a loan is not a good sign. It should be checked on the “No” box.

- A balloon payment is another sign of a risky loan. It must be checked to “No”.

- The amount that the buyer owes to the escrow including other monthly payments for taxes.

The HUD - 1 might not be the most popular settlement form today but it is still used on a lot of occasions. Loans from private lenders and non RESPA mortgages rely on the HUD 1 to depict all the costs associated with closing. If you are dealing with the HUD -1 to close a deal, we hope you found this post useful.