Have you been thinking of starting your title insurance company? If yes, then refer to this 7 step process to get started.

The space for title insurance business is attracting a lot of traction these days. Thanks to technological disruption, the closing process has not only been simplified for buyers but also for title companies at the same time.

Undoubtedly, now is the best time to own a title company than ever before. And if you are thinking to do so, we are here to help.

In this post, we are going to take you through a 7 step process to start your own title company. From legal implications to passing the title insurance exam, we've covered all aspects for you to build a solid perspective and prepare better.

So without further ado, let’s get started.

The first step towards starting a title company is to familiarize yourself with the state laws where you wish to start your title company.

Understanding the State Laws

You would need a license issued by the insurance division of the state to run a title insurance agency. In many states, the license is awarded only when the candidate has cleared the title insurance exam. However, before you can do that, you must check your eligibility to start a title insurance business in your state.

The eligibility criteria differ slightly from one state to another but the majority of them more or less remain the same. Here are some common eligibility criteria to start a title insurance business:

- Applicant should be more than 18 years of age

- Should be able to speak and write in English

- Be a resident of the respective State

- No prior criminal record

- Should have the notary bond

- Should have cleared the exam and/or completed the course

Some states could be more specific when it comes to these points. For example, Florida demands that the applicant should not be a resident of another state in addition to being a resident of Florida.

While the license ensures your ticket to a title company, it may not be enough in many states.

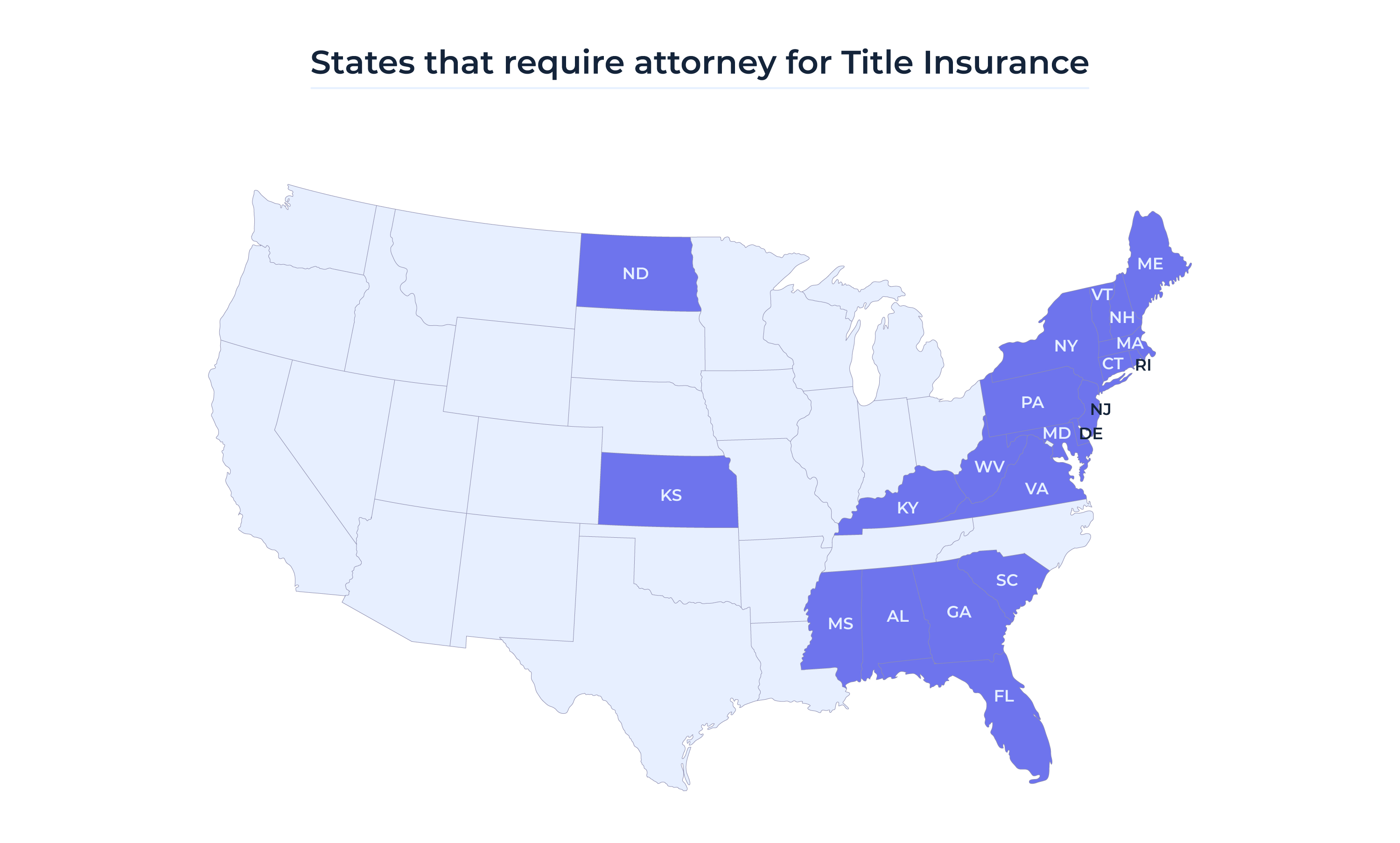

States like Florida, New Jersey, and even New York require an attorney to sign the closing documents. In those states, you must bring on board an attorney in your team before you apply for the license.

In addition to that, some states may require an escrow agent and abstractors to complete the process. Refer to this 2019 survey by NAIC.

Note that these conditions are always changing.

Preparing for the Exam

Most states have their own title insurance exam that a candidate must clear in order to obtain the license. The test can touch upon multiple topics from the real estate domain.

Some common topics could be:

- Basic principles of real estate business

- Ethics in Real Estate

- Legal aspects of Real estate business in the respective state

- Contracts and agreements in real estate

- Property Ownership

- Encumbrances in real estate

- Real Estate closing and settlement

- Property Valuation

- Land Use

You can find many online courses to help you prepare and pass the test. Most of them are reasonably priced and could be purchased online.

The exams are held in some specific locations. If you are in Florida, you can expect the test to be conducted on a military base. In New Jersey, the examination centers could be in an office space. Refer to your state website for accurate information.

Take note that many states won’t require any exam for you to qualify. All you have to do is complete a training module and have your license within a few weeks in your hands.

Getting the Surety Bond

Title companies are supposed to get a minimum surety bond of $50,000. The purpose of the surety bond is to protect the customers by making the title company accountable to do their jobs with sincerity. Note that, the amount differs from one state to another.

In addition to the surety bond, some states may also require an Error and Omission insurance of no less than $250,000. The E&O is meant to cover you in cases of negligence allegedly made by your title company that can potentially threaten the ownership of a property.

Select an Underwriter

Before you go on naming or forming your title company, it is essential to select an underwriter. An underwriter's job is to approve mortgages for transactions with legitimate parties. The underwriter conducts the title search and examination that can potentially affect the quality of your service and the overall experience of your clients.

Get primary information on which underwriter could be the best for your title agency. As far as popularity goes, Fidelity, Stewart, First American, and the Old Republic are the biggest underwriters in the country.

Naming the Company

The first step towards naming the company is to decide on a name. In the digital age, a lot of companies prefer to have a website straight away. This is why it is best to run a search to make sure if the domain name is available or not. You can use godaddy.com and select a domain name.

Once you have the name and the domain to create the company website, it is time to consult an attorney to decide on the company type. Company type affects the taxation and overall tax applicable to your business.

The next step is to apply for the Employer Identification Number of the EIN. The IRS provides the EIN which is required to set up the bank account for the business. All taxation regarding your business will be made using this number.

Tools for your Business

The next step is to handpick the tools you would need for your business. If you have decided to go for the website, it is always best to make the best of the incoming traffic to our site. For that, you would need a floating widget like Elko to provide free quotes along with allowing your customers to place orders at the same time.

If you have decided to apply for remote online notarization, your toolset should also include Audio Video hardware and software, eSignature apps, and a certified RON Vendor.

Refer to our blog on Remote Online Notarization to learn about its legality in your state and the steps to become an online notary on top of your convention title business.

Applying for the License

The last step towards your title company is to apply for the license. Simply go to the website of the insurance regulatory body and submit your request. You can monitor the status of your application. Once your application is approved you can simply generate a print.

Congratulations!, you’ve got your ticket to a title insurance business.