Release tracking has become an important post closing service across the country. If you are curious about release tracking, this post will give you a lot of helpful insights.

Table of Contents

- Background

- What is Release Tracking?

- The Process of Release Tracking

- Reasons Why the Title Commitment is not recorded?

- How does Release Tracking help?

- Release Tracking Vendors

Background

Lenders often put a legal claim on the property to safeguard themselves against unforeseen scenarios of buyer default and non payment of the mortgage. This legal claim is known as a lien on the mortgage.

However, if the buyer pays all the mortgage, which they seldom do, they entitled to receive a payoff letter from the lender that serves as a confirmation of mortgage realization.

The lender should then visit the county office on the buyer's behalf to make sure that the title commitment has been recorded and the lien is released. Since lenders operate from far away distances these days unlike before, the title commitment never gets recorded many times, putting the buyers at risk.

This is why it is essential to follow up on individual cases to make sure that the title commitment is recorded and the lien is released from the mortgage. And this is where Release Tracking comes into play.

What is Release Tracking?

Release Tracking is a service that searches through official records to confirm that instruments identified in the Title Commitment have been properly recorded within a stipulated contractual time which ranges from 30-90 days.

The Process of Release Tracking

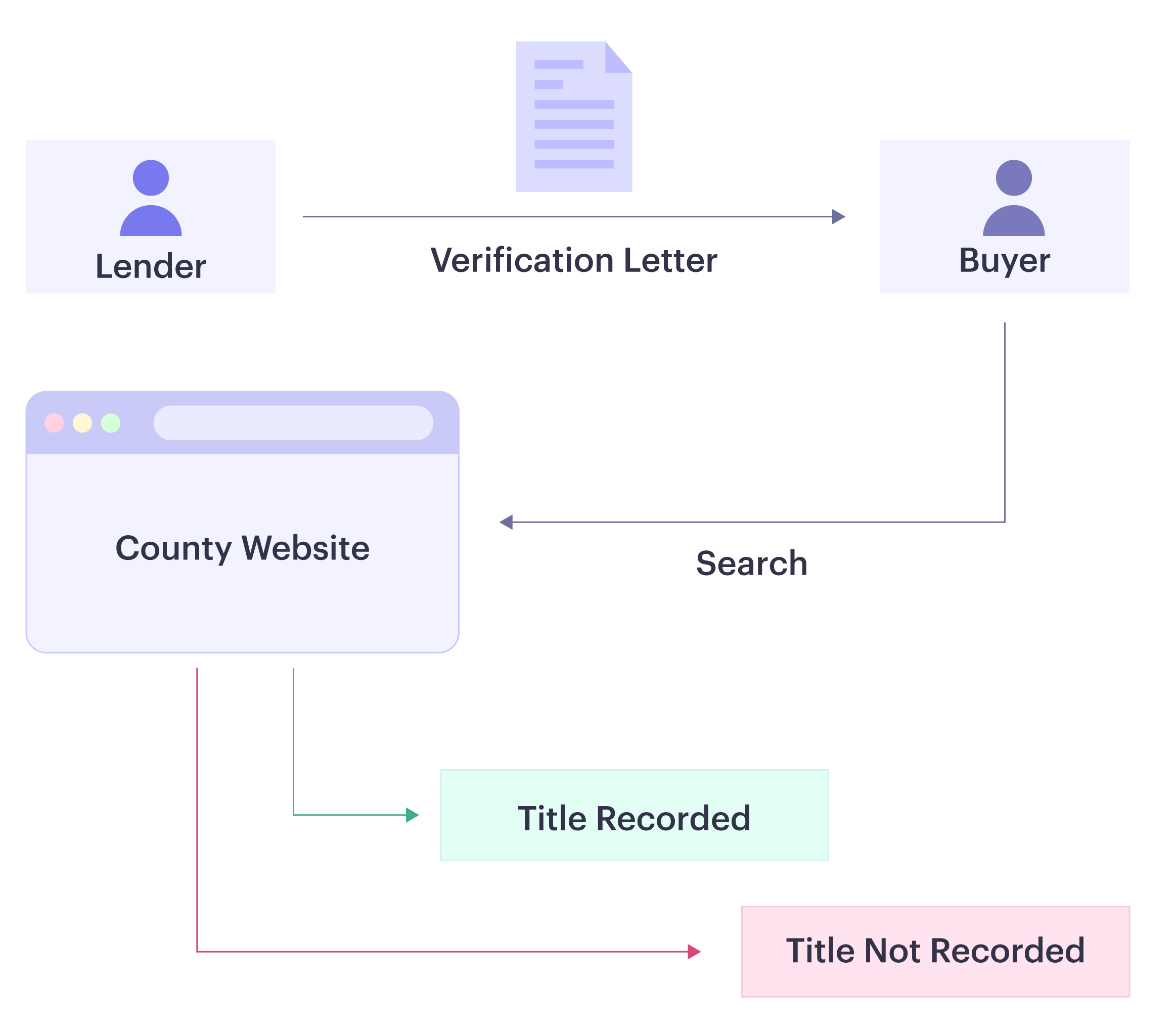

Release Tracking starts with the verification letter that confirms the full payment or realization of the mortgage. The lender then makes sure that the title commitment is recorded in the county office and a document for the release of the lien is generated.

If however, the lender fails to do so, the buyer can confirm it themselves by running a search through the county clerk’s website using the name, document type, and other details.

Since these records are publicly available, an unrecorded document will not show up in the search results implying that the document has not been recorded in the county.

Reasons Why the Title Commitment is Not Recorded

Scattered Process. Earlier, the buyer, the lender, and title offices used to be situated in the same town. Many times they knew each other personally that made the process more personal. The lender would personally confirm the release of the lien by making sure the commitment was recorded.

However, due to the lack of physical presence of the lender these days, these discrepancies occur at significant rates.

Unreadable Documents. This is the biggest reason that makes the county offices reject certain documents that jeopardize the entire process. More than 10 million documents are rejected annually by county offices across the United States due to the fact they are unreadable.

Poor Notary Seal. Another major roadblock towards title commitment is poor notary seals. Many times, the notary seals are not properly applied to the documents. It may also happen that the ink of the notary seal is not properly visible. All of these could lead to the rejection of the title commitment and prevent the release of the lien.

Sent After Statutory Time Period. The statutory time period for recording the title is 30 days according to the Uniform Residential Mortgage Satisfaction Act (URMSA) after mortgage satisfaction. If the document does not get recorded within 60 days, it attracts penalties.

Sent to the Wrong County. It often happens that documents and paperwork for title commitment end up in the wrong county. These documents are rejected and do not get recorded unless they are sent to the county office where they belong.

How does Release Tracking Help?

Now that we learned about the reasons, let’s see how release tracking helps in solving these challenges.

Making the Process More Connected. Release Tracking compensates for the disconnect that far away lenders have with county offices located in too far away places. With release tracking, you can be sure that the county office has recorded the title commitment irrespective of the lack of physical proximity.

For Timely Recording and Release of Lien. The title commitment must be recorded within 30 days after the lender has issued the verification letter to the buyer. Release tracking services search through the county website to verify the status of the title commitment and then taking the necessary steps to get it recorded. It protects the buyer from circumstances where the title is not transferred to them despite mortgage satisfaction.

To Safeguard Against Delay Arising from Illegible Documents. Illegible documents are one of the prime reasons behind titles not getting recorded. Release tracking services make sure that all the documents are error free and eligible to be recorded.

Avoid Expensive Title Curative Work. Releasing liens from a disputed property could cost a lot of money due to curative work. Release tracking can stop that from ever happening by making sure that the title is recorded and there are no disputes around ownership of the property.

Release Tracking Vendors

- Proplogix. Provides a number of closing services along with release tracking.

- EasySoft. EasySoft is a legal solution software that bundles release tracking services for their clients.

- Require. Gorequire is a Virginia based company that provides release tracking services and a list of other title curative services.

- FNF Family of Companies. FNF is a leading name in the title industry for its wide set of title services that also includes release tracking.

- FasTrax. FasTrax is a popular provider for release tracking services based in California. They also provide title clearing services.

- Clear Choice Tax and Lien Service. Florida based company that specializes in lien search. They also provide release tracking services.

Release tracking is an important post closing due diligence service that ensures peace of mind for property owners by making sure that the title is recorded. We hope you found the post insightful to prepare your post closing checklist.