Curious about the Lady Bird Deed? Read this post to understand the reasons that make it an important tool for Medicaid and financial planning.

What is the Lady Bird Deed?

A Lady Bird Deed is an important document to transfer the ownership of the property to a new beneficiary, or an heir upon the death of the owner.

Usually, the heir(s) of the deceased owner is supposed to go through a court supervised legal proceeding to transfer the property in their name. This is called Probate.

If the owner has signed a Lady Bird Deed, the heirs automatically become the rightful owner of the property only after the owner has died. The beneficiaries cannot claim ownership of the property if the owner is alive.

Right now, the Lady Bird Deed is applicable across 5 states. These are Texas, Florida, Michigan, Vermont, and West Virginia. If you do not reside in these states then you could opt for Lady Bird Deed alternatives.

The Lady Bird Deed is a prominent real estate planning tool that makes it important to understand and decipher. This is what we aim to accomplish in this post.

If you are looking to understand the Lady Bird Deed, you have come to the right place. So without further ado, let’s get started.

Table of Contents

- What is the Lady Bird Deed?

- Why is the Lady Bird Deed important and useful?

- Disadvantages of the Lady Bird Deed

- Some Alternatives to Lady Bird Deed are

- Some Important Q&As about Lady Bird Deed

Why is the Lady Bird Deed important and useful?

The Lady Bird Deed comes with multiple advantages. These are:

Bypass, or Avoid the Probate. A probate is a time consuming process that establishes the last testament of the deceased property owner and hence the future ownership of their property. Nobody enjoys going through the probate process and a Lady Bird Deed helps the heirs with that.

When the owner has opted for a Lady Bird Deed, the heirs automatically become the nominees of the property. There is no need for the heirs to record the owner’s death certificate to prove the transfer of the deed.

Save Lawyer Costs. Probate is an expensive multistep process. It takes many days and legal assistance to complete this cumbersome process and that comes for a price. A probate process may include an attorney fee, court fee, bond fee, appraisal fees, and much more.

Most of the probate transactions may cost around 5%-7% of the total value of the property. It is not uncommon to see $7k-$8k charged to carry out the process for a property of $200 000. On the other hand, a Lady Bird deed may cost you up to $300 if you seek professional assistance. Usually, you can wrap it up within $30 if you wish to do it yourself.

Assurance of Ownership. The Lady Bird Deed also assures the owner of continual ownership of the property till they are alive. Lady Bird Deed differs from a transfer deed that gives ownership to the heirs from the time they are signed.

It is obvious that nobody would want to lose their ownership of the property till they are alive and this is where this deed comes as useful. It assures the owner of dignity and respect in the final years of their life.

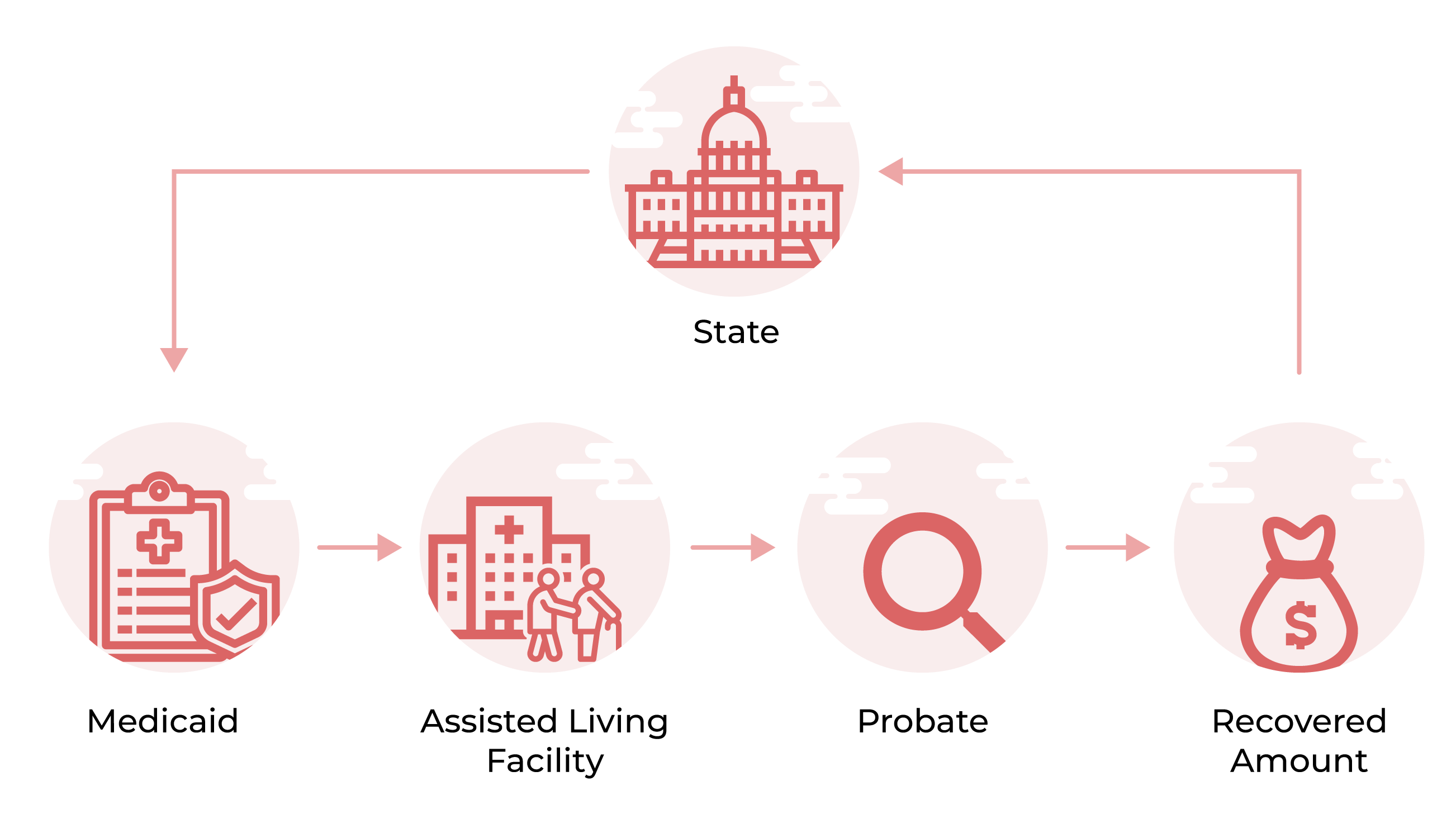

Lady Bird Deed and Medicaid. This is the most important feature of the Lady Bird Deed. Many recipients of Medicaid could face a claim on their estate which is usually done, taking into account the Medicaid estate recovery laws of the State. In such cases, the State may want to recover the amount by making a claim on the assets of the owner.

However, this recovery could only happen when the state runs the property through a probate process and a Lady Bird Deed protects the owner against that.

Tax Planning. The Lady Bird deed comes with a number of tax benefits. First, the owner need not pay a gift tax. This is due to the fact that the deed does not transfer the property immediately to the heirs which makes the transaction an incomplete gift.

Apart from that, you can also prevent re-assessment of the property at current market value and help save property taxes with a Lady Bird Deed.

While there are a number of advantages to this deed, it does have some drawbacks as well. Let’s look into the major disadvantages of the deed.

Disadvantages of the Lady Bird Deed

- As mentioned above, only 5 states recognize the Lady Bird Deed which makes its reach limited.

- Lady Bird Deeds are not the best to decide on when the owner wants their heirs to become beneficiaries.

- It is not the best tool to protect the beneficiaries from unforeseen situations such as divorce, bankruptcy, etc.

- Additionally, this deed is not the best when it comes to transferring the ownership of multiple properties to multiple beneficiaries. In these conditions, trust is a better option as it provides more flexibility to commend changes.

Now that we know the drawbacks of the deed, let’s look at some alternatives that provide the same benefits and fill in the voids inherent with the Lady Bird Deed.

Some Alternatives to Lady Bird Deed are

Revocable Trust. A revocable trust is far more flexible than a Lady Bird Deed. Making changes to an existing Lady Bird Deed involves recording the deed and then putting the new conditions in the public domain. However, the revocable trust can be altered with the help of a lawyer and make the amendments on a single page without much hassle.

Title companies prefer Revocable trusts when there are multiple properties of a single person meant to be distributed among multiple beneficiaries. These cases are susceptible to future changes, making a revocable trust more useful.

Similar to the Lady Bird Deed, Revocable Trusts also allows the recipients or the property to avoid probate however it does not provide an exemption from Medicaid. Medicaid considers such trusts to be assets that are countable for Medicaid eligibility.

Caregiver Exemption. Caregiver exemption allows the transfer of the property to the adult child under the condition that the adult child must have cohabitated with his/her parent for at least 2 years before them (parent) moving into assisted living and that the adult child has provided care that delayed the necessity of the parent to move into an assisted living facility.

Sibling Exemption. Sibling exemption is yet another tool that helps in Medicaid planning and avoids probate. It allows the transfer of property to be transferred to one of the siblings who has lived at least one year in the home prior to moving into an assisted living facility.

Some Important Q&As about Lady Bird Deed

Q. What is the tax basis for the property under a Lady Bird deed?

A. The tax basis for a Lady Bird Deed is at the time of death of the property owner.

Q.What happens if the recipient of the property has filed for a divorce?

A. Divorce of the recipient is a tricky condition. In such a scenario, the ex spouse could claim the property or a part of it. The same condition applies to debt or bankruptcy filed by the recipient. Creditors such as banks can rightfully claim a part of the property to recover losses.

Q. Can the beneficiary sell the property if they are in financial distress, paying healthcare bills for their parents?

A. No, under no circumstance, can the recipient sell the property until the owner has died.

Q. Can the owner change the deed to include more recipients in the future?

A. Yes! Since the recipients do not become the rightful owner of the property until the owner’s death, the details of the deed could be changed to include more recipients.

Q. What if the owner of the property is mentally ill to sign the Lady Bird Deed?

A.In such a scenario, the law allows an agent to sign the deed on the owner’s behalf. This is one of the major advantages of this deed.

Q. Can the recipients face claims by creditors if the owner died without clearing their debt?

A. Usually, the Lady Bird Deed protects against creditors so the property remains safe in most cases. However, a fraudulent track record of the owner could create problems.

While the Lady Bird Deed comes with its share of advantages and disadvantages, nonetheless, it is popular documentation, frequently used by real estate owners. We hope you found the post insightful and useful.