Are you a title company looking to transition to eClosings? Curious to know how the eClosing process works that how it delivers value to your business and customers?

All businesses including real estate need approvals and verifications that often come in the form of wet signatures and home closing is one of the most active spots for that. Home closing requires signatures from multiple parties to finalize the deal and complete the transaction.

However, this is changing fast with eSignatures and online notarization becoming mainstream across the majority of states. The title insurance space is all set for a huge transformation and eClosing might account for the majority of the closings. And with COVID-19 situation looking to stay as it is, for the time being, the change could well happen at an accelerated pace.

Table of Contents

- So What is eClosing After all?

- eDelivery

- eSignatures

- eClosing Platform

- eNotarization

- eStorage

- 3 Major Advantages of eClosing

- The Path Ahead for eClosing

In this post, we will give you a brief overview of eClosing, the process, its advantages, and an account on remote online notarization (RON). If you are a title company looking to digitize your workflow and embrace eClosing, keep reading.

So What is eClosing After All?

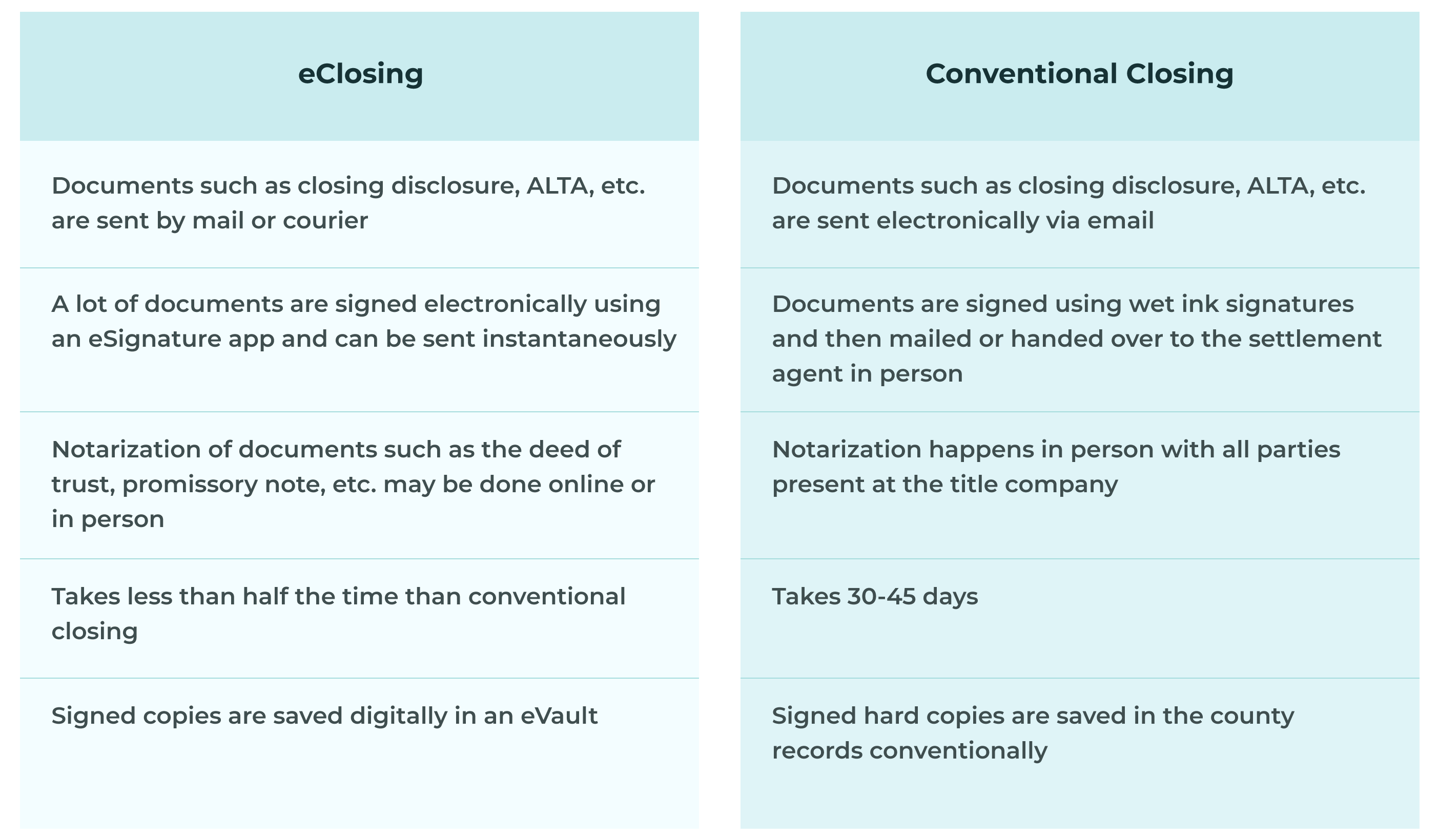

eClosing is nothing but the digitization of the closing process in a real estate transaction, whereby the mortgage is approved and the deed is transferred electronically without the parties needing to come together to approve it physically.

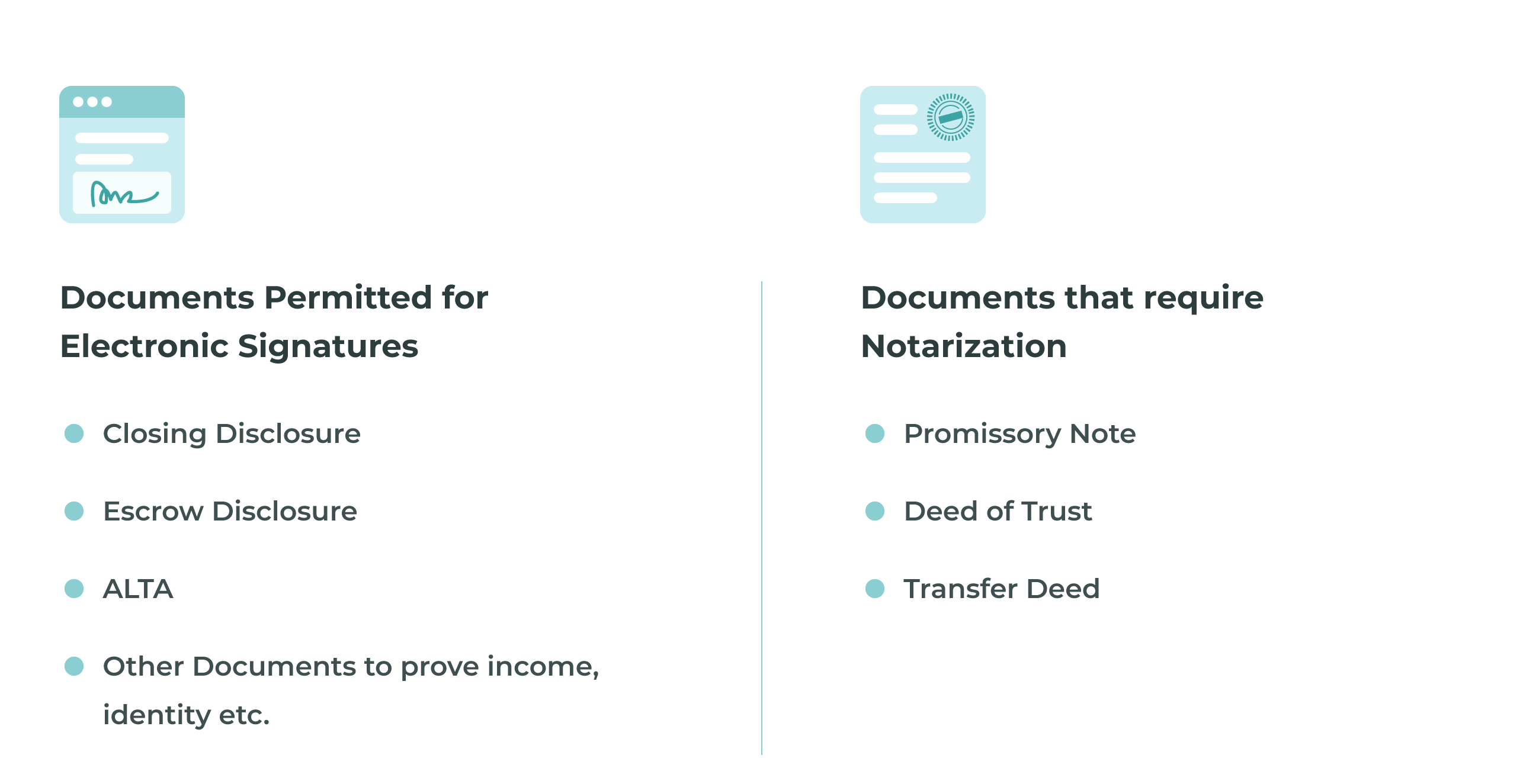

eClosing does not require wet signatures unlike conventional closing from the parties but uses eSignatures on non editable PDF files to express approval from the parties involved. The non editable pdf files are sent over email and signed using fingers or a stylus on an eSigning app.

Hence, the parties exchanging the documents and expressing their consent need not meet or sit face to face to make this happen, unlike conventional closing. Here are a few points that differentiate eClosing from conventional closing.

eSigning apps are essential to eClosing but they do not make eClosing possible alone. A host of other technologies is necessary to send, accept, view, and process the information between multiple parties and execute the process.

Overall, the eClosing process can be said to be composed of 5 different elements. These are

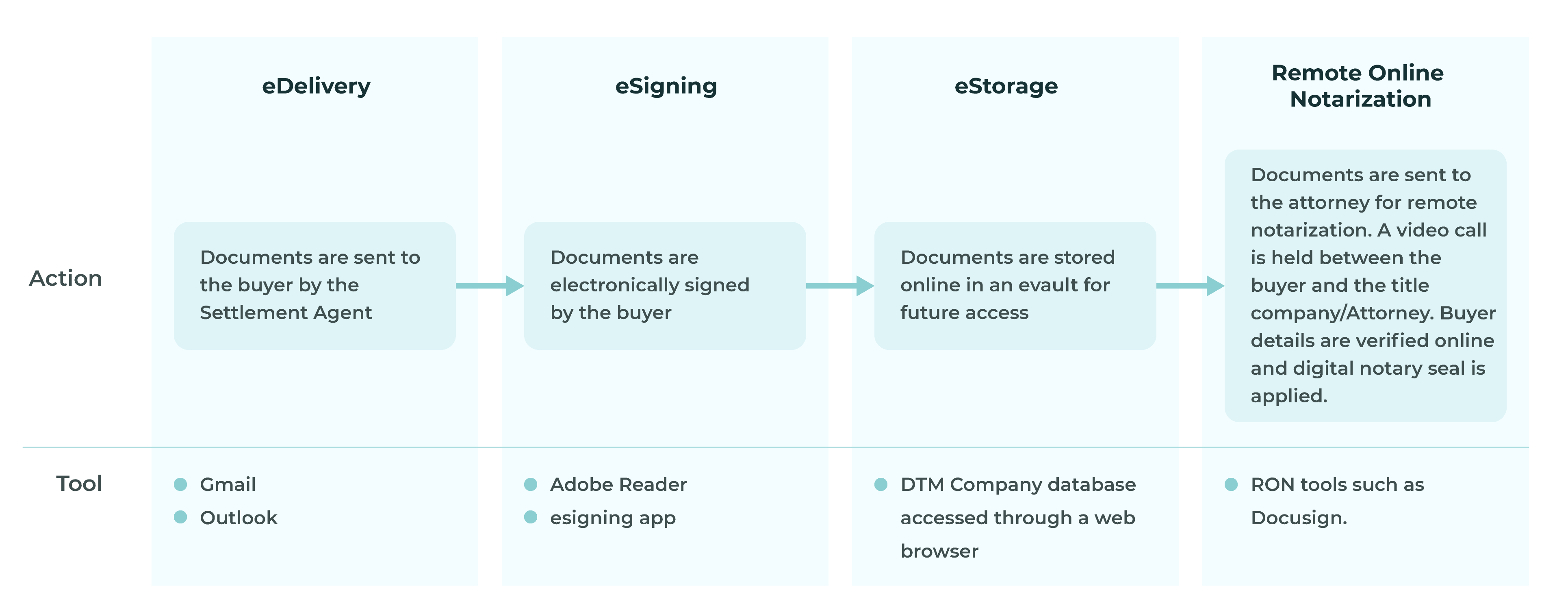

eDelivery

eDelivery includes the electronic transfer or delivery of documents from the buyer to the settlement agent and from the settlement agent to other parties including the lender, county recorder, and obviously back to the buyer.

Documents for acknowledgment of receipt can be sent to the buyer while documents such as eNote and security instrument are sent to the latter parties.

eDelivery tools can include email services such as Gmail, Outlook, or other software that allows attaching and sending pdf files.

eSignatures

This is the most important part of eClosing process where the consent of the respective parties is expressed using electronic signatures instead of traditional wet ink signatures.

Electronic signatures are applied on documents using eSignature apps that are ESIGN and UETA compliant.

DocuSign is a popular eSignature app used by a lot of real estate professionals. You can get started with a $10 plan and start signing documents right away.

eClosing Platform

An eClosing platform allows parties to upload documents and review them online before signing them electronically. These apps allow lenders and title agencies to keep track of the entire process and paperwork from a user friendly interface.

Qualia is a popular SaaS based eClosing platform that allows multiple parties to coordinate, upload, and track documents.

eNotarization

Notarization is the final part of the eSigning process in which the parties appear in the notary office after which the records of the property are verified and transferred to the new owner. eNotarization triggers the disbursal of funds from the escrow account to that of the seller and legal transfer of the ownership of the property to the buyer from the seller.

eNotarization could be fully or partly digital. Fully digital notarization is also called remote online notarization or RON in which the parties meet over a video call in the presence of the attorney. The attorney then applies the digital notary seal on the documents to complete the transaction.

eNotarization is not yet legal in all US states. However, a majority of them have either approved it or passed laws to bring it to action due to the recent pandemic.

eStorage

After the deed is transferred to the new owner and funds disbursed, the documents are then stored in an online vault. The respective parties involved can only access the documents when required. One of the prime services in this domain is that of MERS for lenders.

Now that we understand the structure and process of eClosing, let’s look into its major advantages that justify a full fledged implementation of eClosing.

3 Major Advantages of eClosing

There are many advantages of eClosing but safety has surely emerged as the prime factor making lenders and title companies.

Smaller Turnarounds. eClosing cuts down the total time that it takes to complete the process. The closing process spans for more than a week in which a lot of time is expended on sending the physical documents to the borrower and then receiving the signed copies back.

eClosing is not bound by this time lag. The documents are received, signed, and sent instantaneously which cuts down the turnaround time drastically.

Peace of mind and empowered customers. eDelivery of documents to borrowers can be done way before the signing date. It allows the borrower to review all documents and approve them at their will.

eClosing also cuts down on the time, effort, and anxiety for the borrowers that come due to a need of visiting the title company and sitting through a long process to verify documents. In addition to that, handling the large chunk of documents for the borrower is stressful. eClosing eliminates that stress and allows a smooth and hassle free experience.

Title companies and lenders trying to get more business by boosting customer experience should look into this aspect of eClosing to plan ahead.

Reduced costs and errors. We have seen that eClosing leads to smaller turnarounds. Smaller turnarounds mean less time spent on the process and fewer costs. However, the biggest cost saving benefit in eClosing comes from an error free process.

In conventional closings, borrowers, lenders, and other parties tend to make frequent errors with name, address, and various other details. Redoing the document involves making copies, resending it, and notarizing it again to be accepted as a legal document. All of this comes for a cost. These costs are drastically reduced by the implementation of eClosing.

The Path Ahead for eClosing

Broader adoption by the industry holds the key for a technology to become mainstream. While COVID 19 has certainly accelerated this process, the speed of adoption in the future is an important aspect when it comes to making eClosing the industry norm.

We believe that bringing uniform laws across states will cut down a number of operational and legal barriers and boost eClosing. eClosing is a multi step process and states have differing laws for each of the steps. All states should form uniform laws when it comes to eSigning, digital signing, and eNotarization as early as possible.

We are already seeing progressive steps being taken in this direction and hope to see rewards in a few years of time. According to the Consumer Financial Protection Bureau, the number of eRecording jurisdictions has increased 4 times over the last 5 years which is another encouraging signal that suggests that the future is likely to be digital for closings.

To conclude, eClosing is a cost efficient, fast, and efficient way towards real estate closings. The benefits not only cut down costs for all the parties involved but also boost customer experience significantly.