What is Title Insurance in Georgia?

Title insurance is an important cost component within Closing Costs that always intrigues a first time home buyer. Title insurance in Georgia protects buyers and lenders from financial liabilities that may arise due to a title defect or a hidden lien.

Have a look at our Title Insurance explainer video to see how title insurance can protect your lender and your ownership in case of a title defect.

There are two types of Georgia title insurance policies: Lender’s Title Insurance Policy and Owner’s Title Insurance Policy.

Lenders in Georgia often require borrowers to purchase a Georgia Lender’s Title Insurance Policy which guarantees protection for Georgia lenders against issues arising out of defects on the title of a Georgia property. On the other hand, the Georgia Owner's Title Insurance Policy protects the buyer against claims and liens.

Title insurance policy premiums in Georgia show up as an itemized list of a closing cost worksheet for a buyer and seller such as a Closing Disclosure, Loan Estimate, HUD-1, or an ALTA Settlement Statement. If you're looking to get a preview of what these costs look like, use this free Georgia title insurance calculator.

How much does title insurance cost in Georgia?

For a $250,000 property, you are going to pay a total of $1,118 to simultaneously issue both owner’s and lender’s policy.

Here are some more use cases based on a simultaneous issue of both lender’s and owner’s policies for standard coverage.

- For a purchase price of a $300,000 property in Georgia with a 20% down payment ($60,000), the cost of title insurance policy and lender's policy are $1,150 and $150 respectively.

- For a purchase price of a $300,000 property in Georgia bought with full cash, the cost of the title insurance owner's policy is $1,150.

- For a purchase price of a $500,000 property in Georgia with a 20% down payment ($100,000), the cost of the title insurance owner's policy and lender's policy are $1,880 and $150 respectively.

- For a purchase price of a $500,000 property in Georgia bought with full cash, the cost of the title insurance owner's policy is $1,880.

- For a purchase price of a $1,000,000 property in Georgia with a 20% downpayment ($200,000), the cost of the title insurance owner's policy and lender's policy are $3,430 and $150 respectively.

- For a purchase price of a $5,000,000 property in Georgia bought with full cash, the cost of the title insurance owner's policy is $3,430.

How is Title Insurance Calculated in Georgia?

Georgia has multiple pricing slabs based on the type of policy. There’s the ALTA Policy that gives you standard coverage while the Eagle Policy gives you extended coverage and costs more than the ALTA Policy. Here we will consider the prices for the ALTA Policy.

| Property Rate | ALTA Cost of Owner’s Policy (per $1000) |

| Upto $100,000 | $4.20 |

| $100,001 - $500,000 | $3.65 |

| $500,001 - $1,000,000 | $3.10 |

| Above 1,000,000 | $3.00 |

The minimum charge of the policy is $200 while the simultaneous issue of the lender’s policy with the ALTA Owner’s policy will cost you $150 in Georgia.

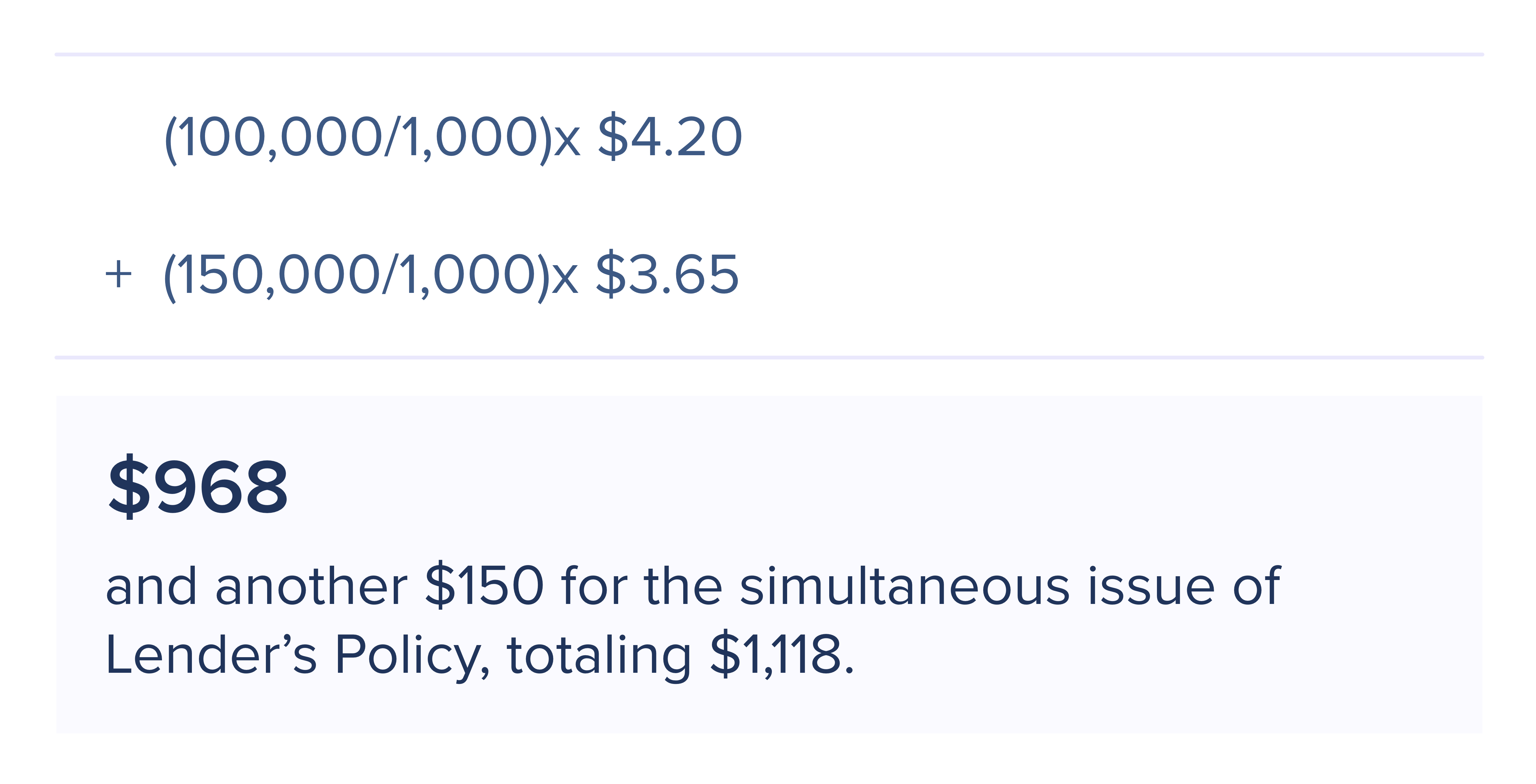

Say you want to calculate the cost of the owner's title policy for a $250,000 property in Davidson County. The total cost will be:

What is the Owner's Title policy in Georgia?

The owner's policy is a legal document that shields the owners from unknown defects such as missing heirs, incorrect documentation, unjust court proceedings, and protects their ownership. The owner’s policy contributes to the majority of the costs that go into purchasing the title insurance.

What is Lender’s Title policy in Georgia?

The lender’s policy is often purchased along with the owner’s policy. It protects the lender from title defects such as a pending construction lien on the property, errors in the title, and other issues that may arise after the title has been transferred to the buyer.

What is not covered in Title Insurance in Georgia?

Title insurance may not cover the following:

- Damages due to natural calamities such as thunderstorms.

- Losses due to infestation

- Financial losses due to repair and maintenance of items

- Damage due to a fire

How long is the title policy valid in Georgia?

The title policy remains valid till the time you remain the owner of the property. Only when you decide to sell, a new policy must be made in the name of the buyer.

Who regulates Title Insurance in Georgia?

The Office of Commissioner of Insurance and Safety Fire is responsible for the title insurance landscape in Georgia.

Who pays for Title Insurance in Georgia?

Title insurance fees can be paid by either of the parties and it remains mostly negotiable in the state of Georgia.

Is Title insurance required in Georgia?

Title insurance is not required by law in Georgia however it is always best to purchase a title policy before a deal is signed between the buyer and the seller.

Should you shop for title insurance in Georgia?

You can definitely shop for title insurance in the state of Georgia by approaching any reputable title company. However, if you are skeptical, you can ask your agent or lender to help you out with the process.

Is there any discount on Title Insurance Policy in Georgia?

Technically there is no discount on title insurance in Georgia. But what you can do is go for simultaneous issuing of both Owner’s Policy and Lender’s Policy at the same time. This way you only pay a fixed amount of $150 for the Lender’s Policy.