Confused about the numerous costs in the closing disclosure? Read this post explaining each cost component of the closing disclosure in detail

In other words, the closing disclosure shows all the costs connected to the closing process making it an important document for the buyers. Hence, it is necessary that we understand all the sections and various details within them. This is what we aim to accomplish in this post.

In this post, we will help you understand the 13 sections of the document along with some other important details that may still put your mortgage on hold despite the lender has issued the closing disclosure.

Table of Contents

- What is the Closing Disclosure?

- Closing Disclosure Timeline

- Components of a Closing Disclosure

- Does a Closing Disclosure mean I am approved?

What is the Closing Disclosure?

The closing disclosure is a 5 pager document that is given to the buyer by the lender. The closing disclosure shows the final closing costs for the mortgage along with some terms and conditions established by both parties for the transaction.

The closing disclosure is the final statement in the closing process that follows the loan estimate. While both of them have the same cost components, the loan estimate is only meant to provide a ballpark cost to the buyer. The buyer either approves the costs or may choose to negotiate with the seller to reach a new closing cost break up for both parties.

Note, the closing disclosure is meant for buyers and the seller net sheet caters to the sellers exclusively.

When both parties agree on the final break up, the closing disclosure is generated. In other words, the costs listed in the closing disclosure are often don't change.

A lot of people often confuse the settlement statement or HUD-1 with the closing disclosure. However, both are different. The HUD-1 and the Truth in Lending (TIL) disclosures have been discontinued and replaced with the loan estimate and closing disclosure since 2015. The majority of the lenders support this decision as the initial documents were quite confusing in nature.

Closing Disclosure Timeline

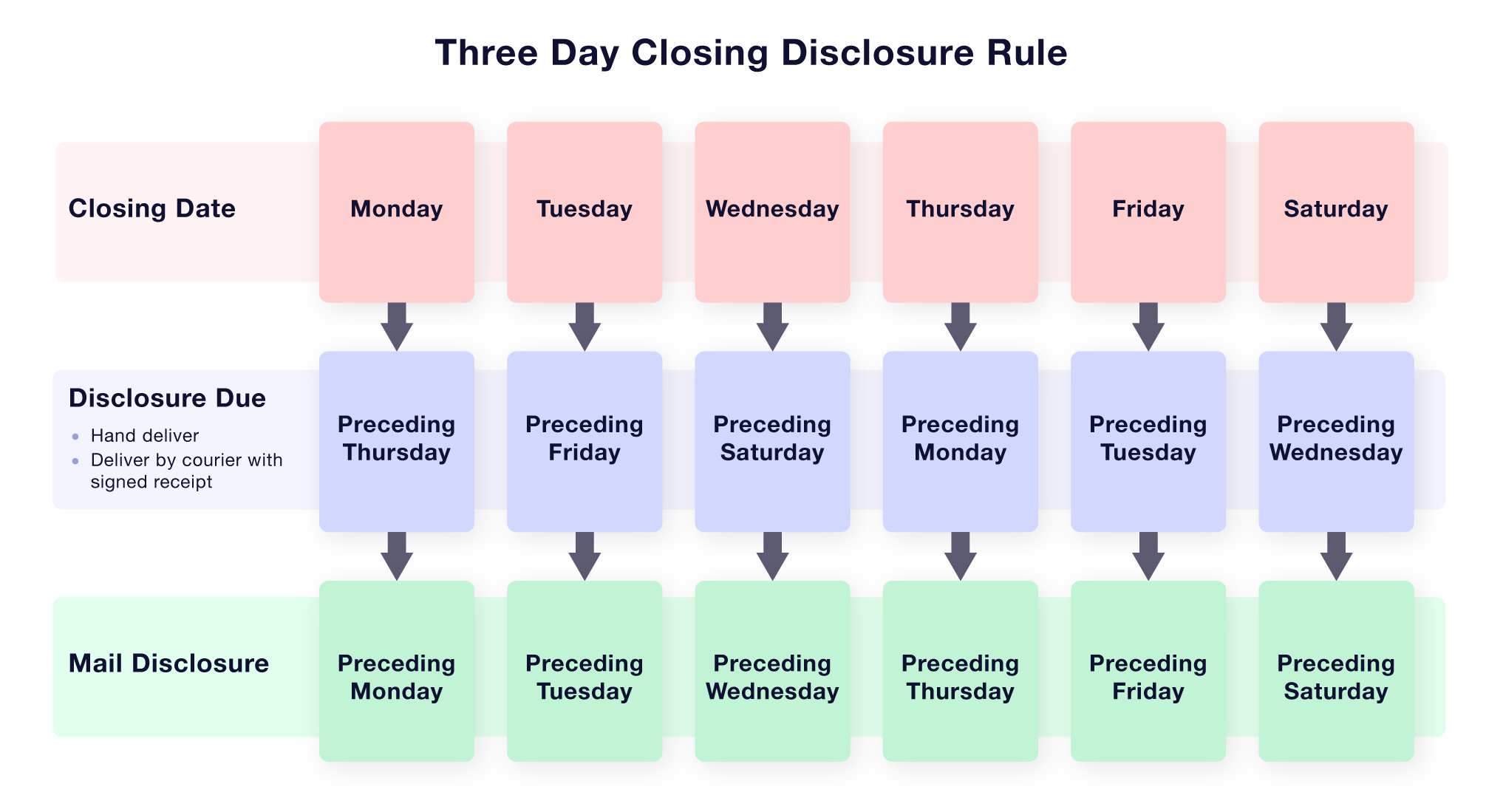

TheThe 3 day rule for closing disclosure means that the closing is scheduled in 3 days counted from the day they receive the closing disclosure. For example, closing disclosures delivered by hand or email will reach the same day. Hence, if they are Emailed or hand delivered on a Monday, the signing date will be scheduled on Thursday in the same week, and Friday will be the loan funding date.

On the other hand, if they are sent by US mail (USPS), It will take 2-3 days for the closing disclosure to reach the buyer. For example, if the disclosure is mailed on a Thursday, it will possibly reach the buyer the next week Monday. According to the 3 day rule then, the closing will take place on Thursday. Private couriers may cut down this 7-8 day duration to 5-6 days.

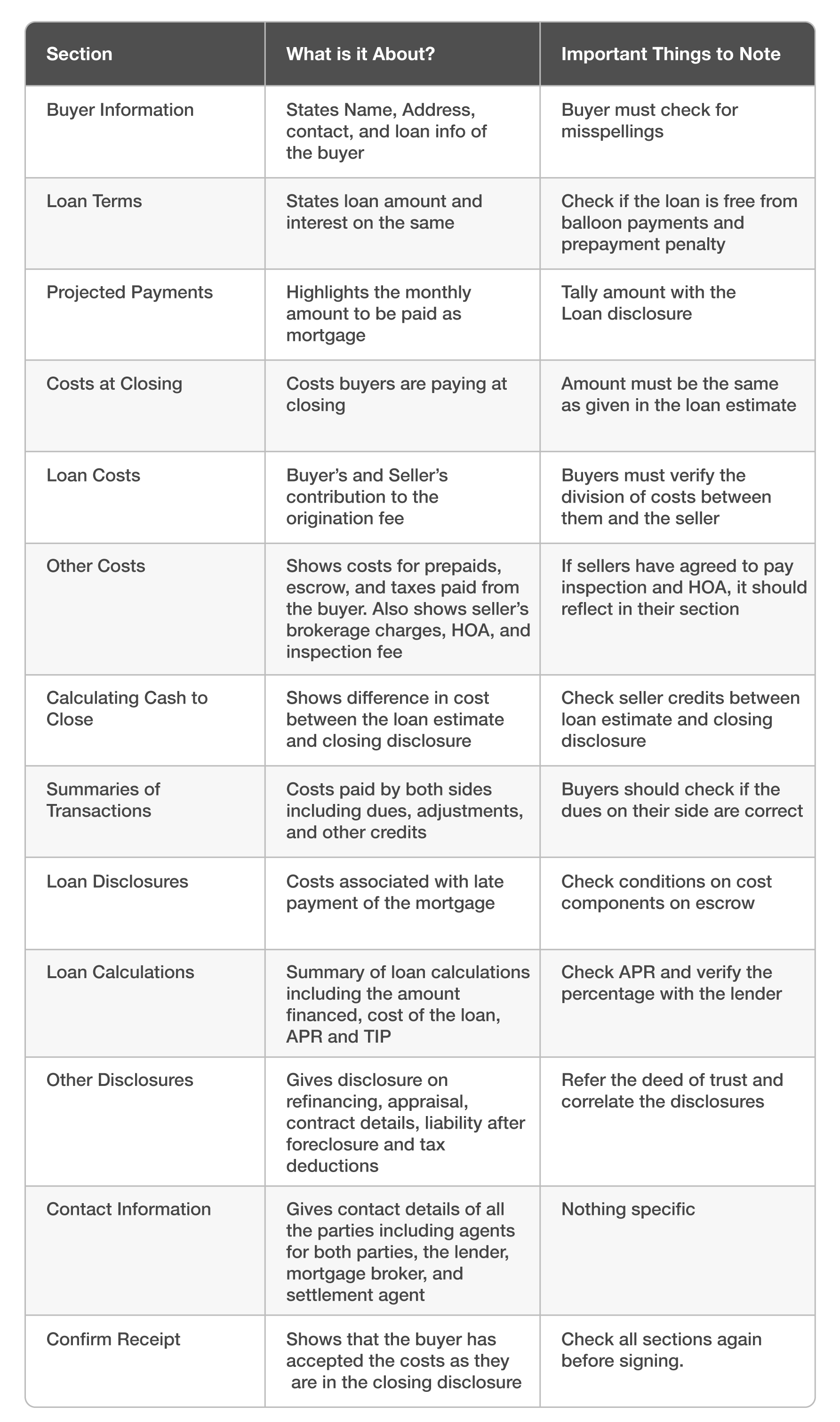

Components of a Closing Disclosure

The closing disclosure is divided into 13 different sections that show the costs and terms between the buyer and seller and the mortgage in detail. The following image gives a brief overview of all the 13 sections.

Let’s look at them in detail.

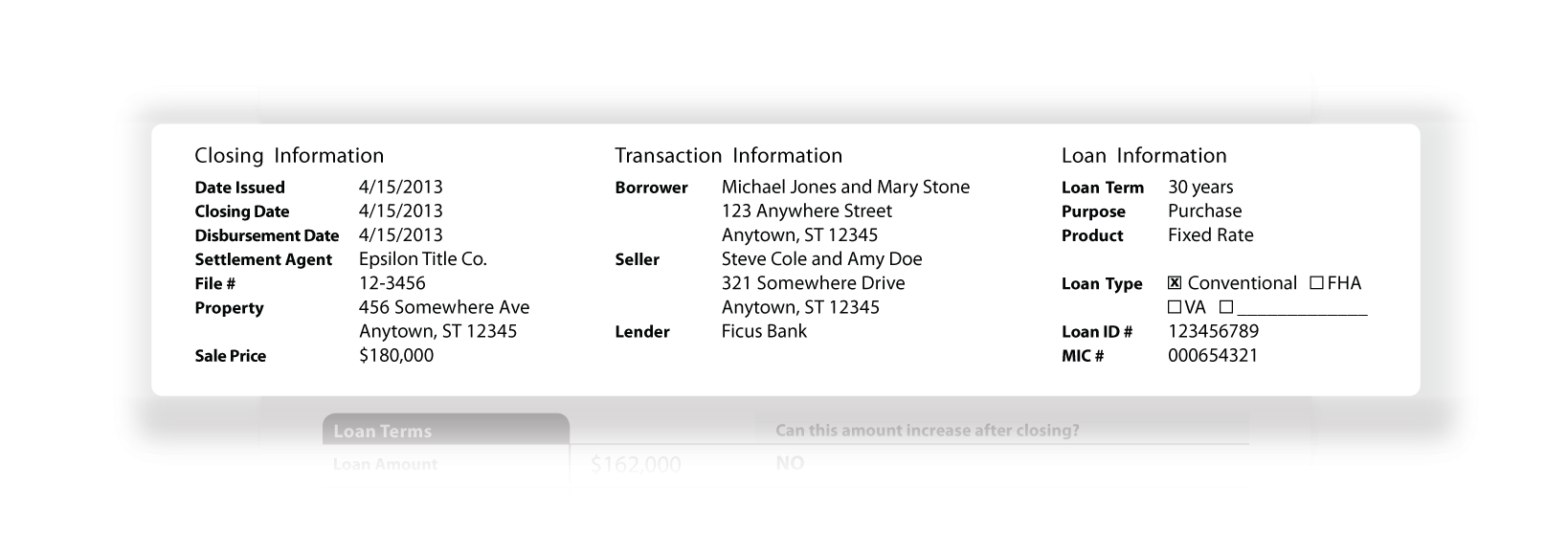

Buyer Information

This section highlights personal information of the buyer such as their name, address, and details of mortgage such as type of mortgage, the term of payment, the term of interest, and much more. You can also see details pertaining to the closing date, issue date, disbursement date, and name of the settlement agent as well.

Note: Buyers should check that their names are correctly spelled in this section. They should reach their agent or inform the lender and make corrections promptly in case of a discrepancy.

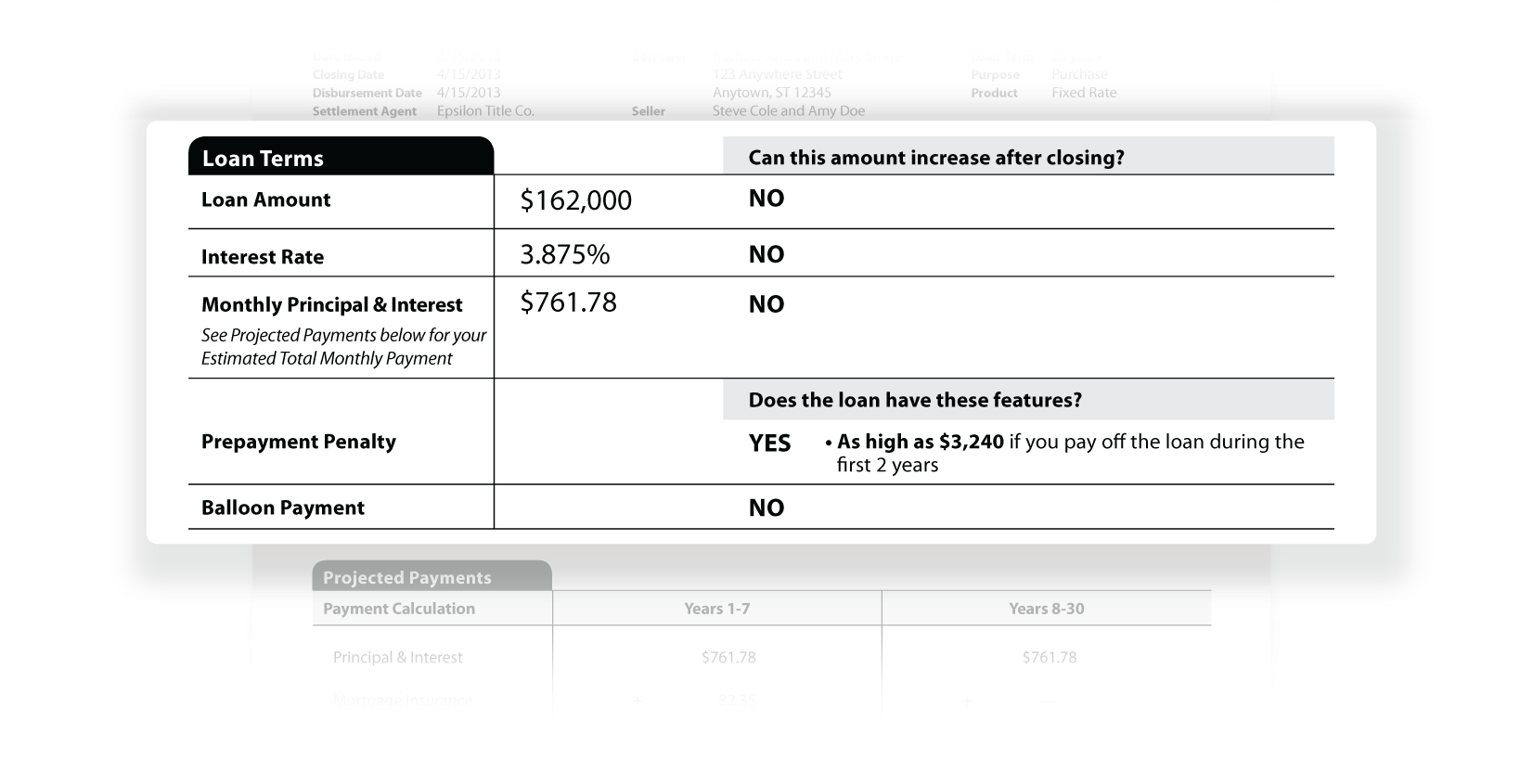

Loan Terms

This section shows the total loan amount approved for the buyer as the mortgage. In addition to that, you can also see the rate of interest charged and the monthly payments that the buyer is supposed to pay. The buyer is supposed to contact the lender and understand to redo the document for any discrepancy in these cost components.

Note: There are two additional costs in this section. These are the prepayment penalty and a balloon payment. The buyer must make sure that their mortgage is free from these charges as they denote a risky loan.

Projected Payment

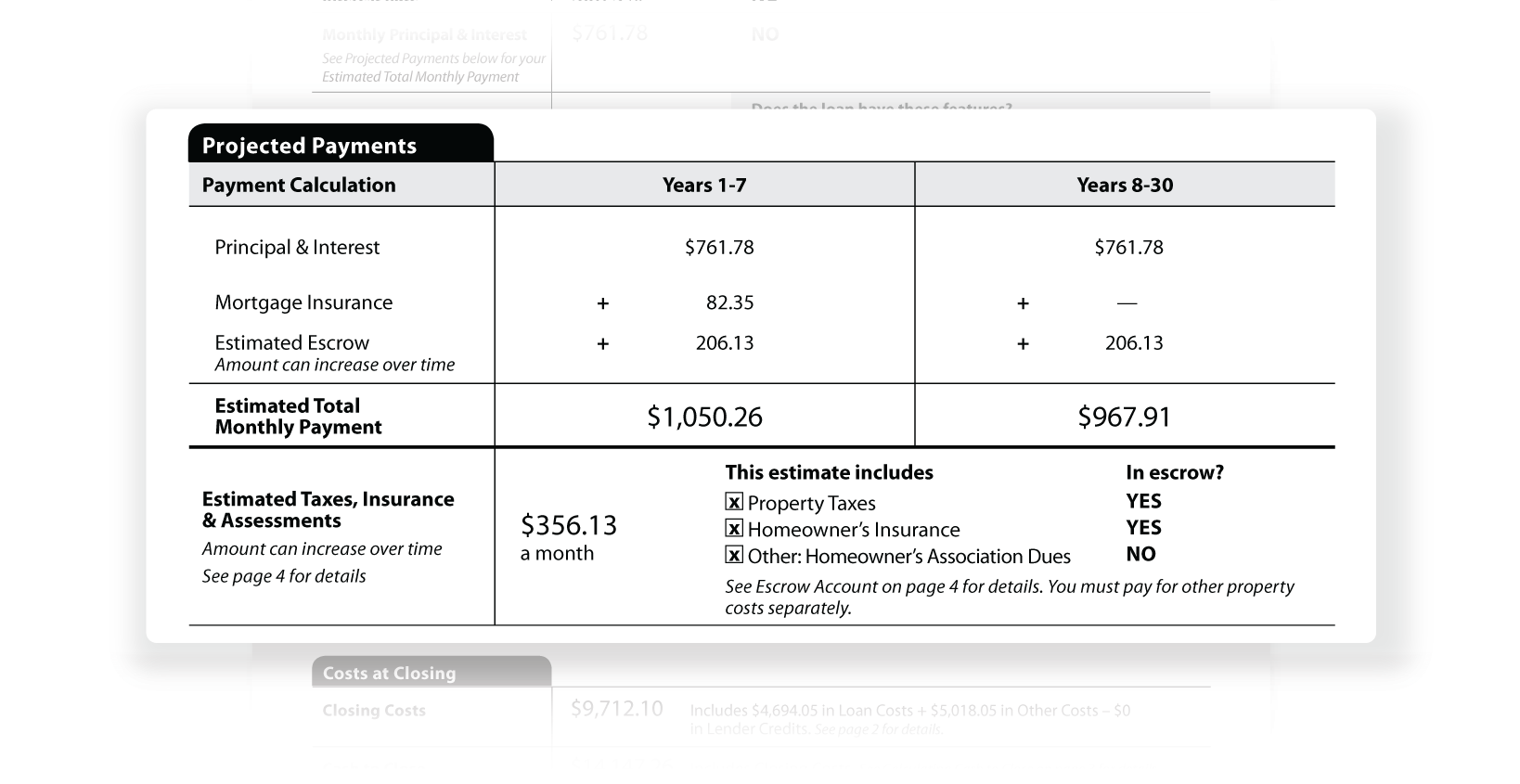

This section gives a list of all the costs that constitute the monthly mortgage payment such as taxes, insurance, and HOA assessments. There are two columns in this section, one with price projections for the first 7 years and the second for 8th to the 30th year.

Note: Buyers should check the figures against the loan estimate and report to them if they see any changes.

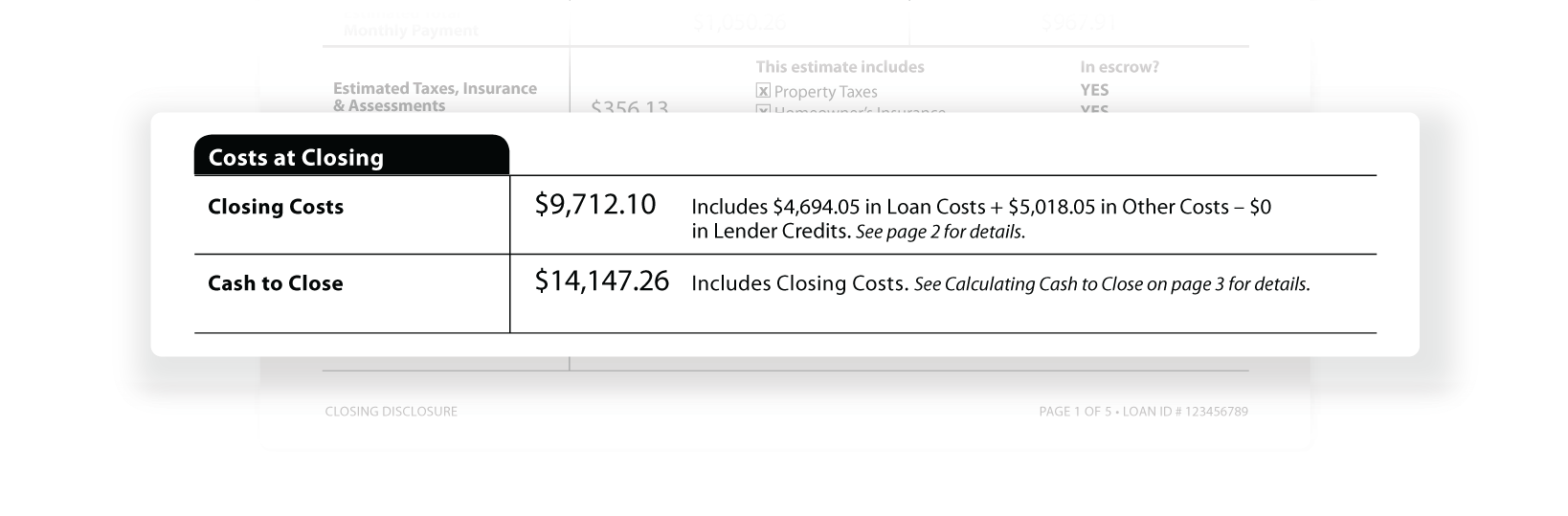

Costs at Closing

This section consists of two types of costs. The total loan costs, that includes origination charges and settlement services. In addition to that, the transaction includes government taxes, initial escrow payment, and some other closing amount.

Total Cash to Close consists of, total closing costs, closing costs to be financed, down payment and other funds from the borrower, deposits to seller or escrow for the borrower, Seller credits, adjustments and other credits paid by persons other than the originator, creditor, borrower or seller.

Note: It is important to check the seller credits and look for any differences between the costs in closing disclosure and the loan estimate.

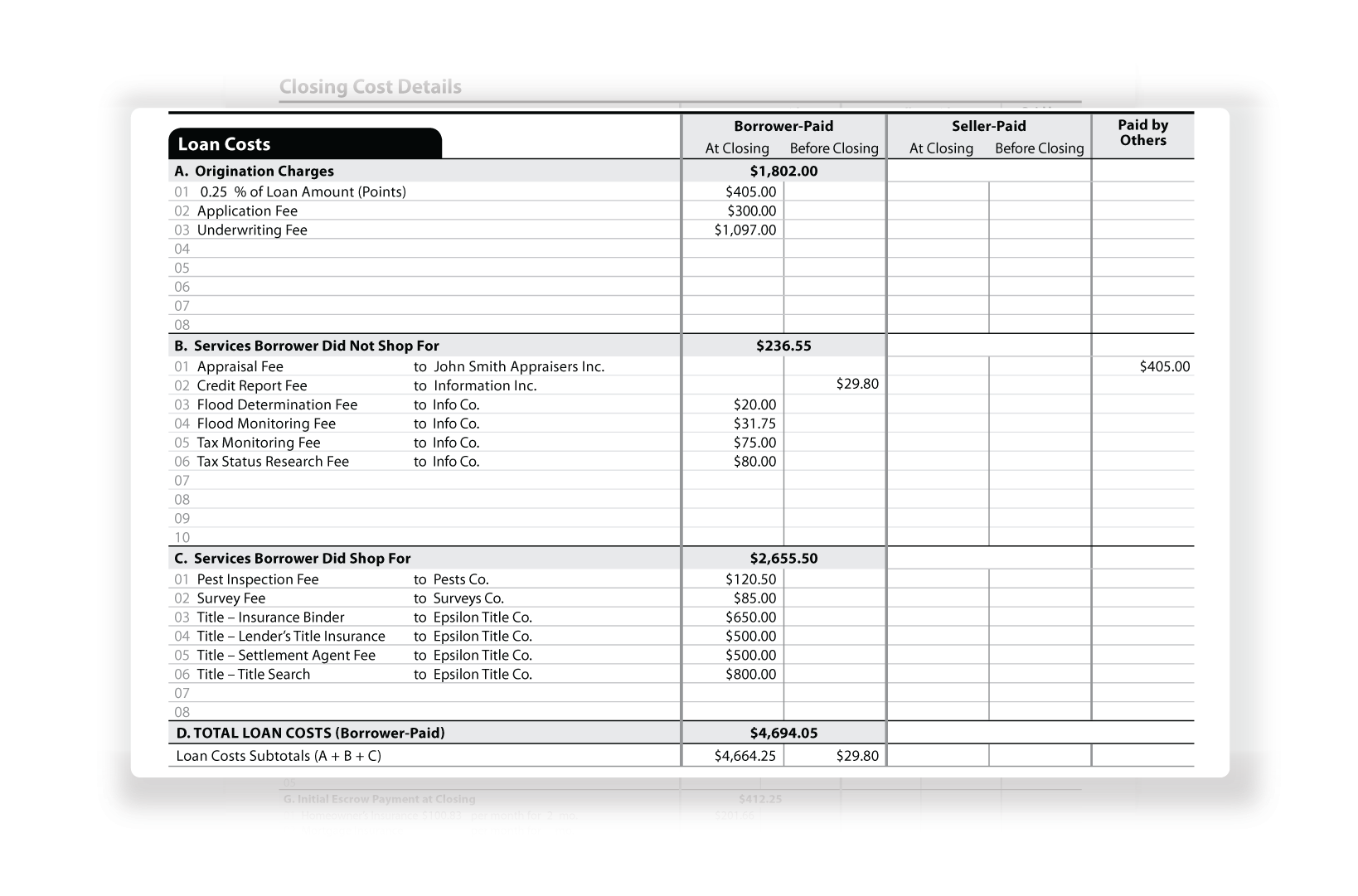

Loan Costs

The loan costs are segregated into 3 different parts which accrue due to origination charges and costs that are paid to third parties but not the lender.

The origination charges are paid by the buyer that includes an underwriting fee, application fee, and certain percentage (0.25%) of the loan amount that is transferred to the originator from the buyer’s account. Section B and C of Loan Costs refer to the costs paid to third parties who assist in the closing process. Section D gives the consolidated amount for all the loan costs paid by the buyer.

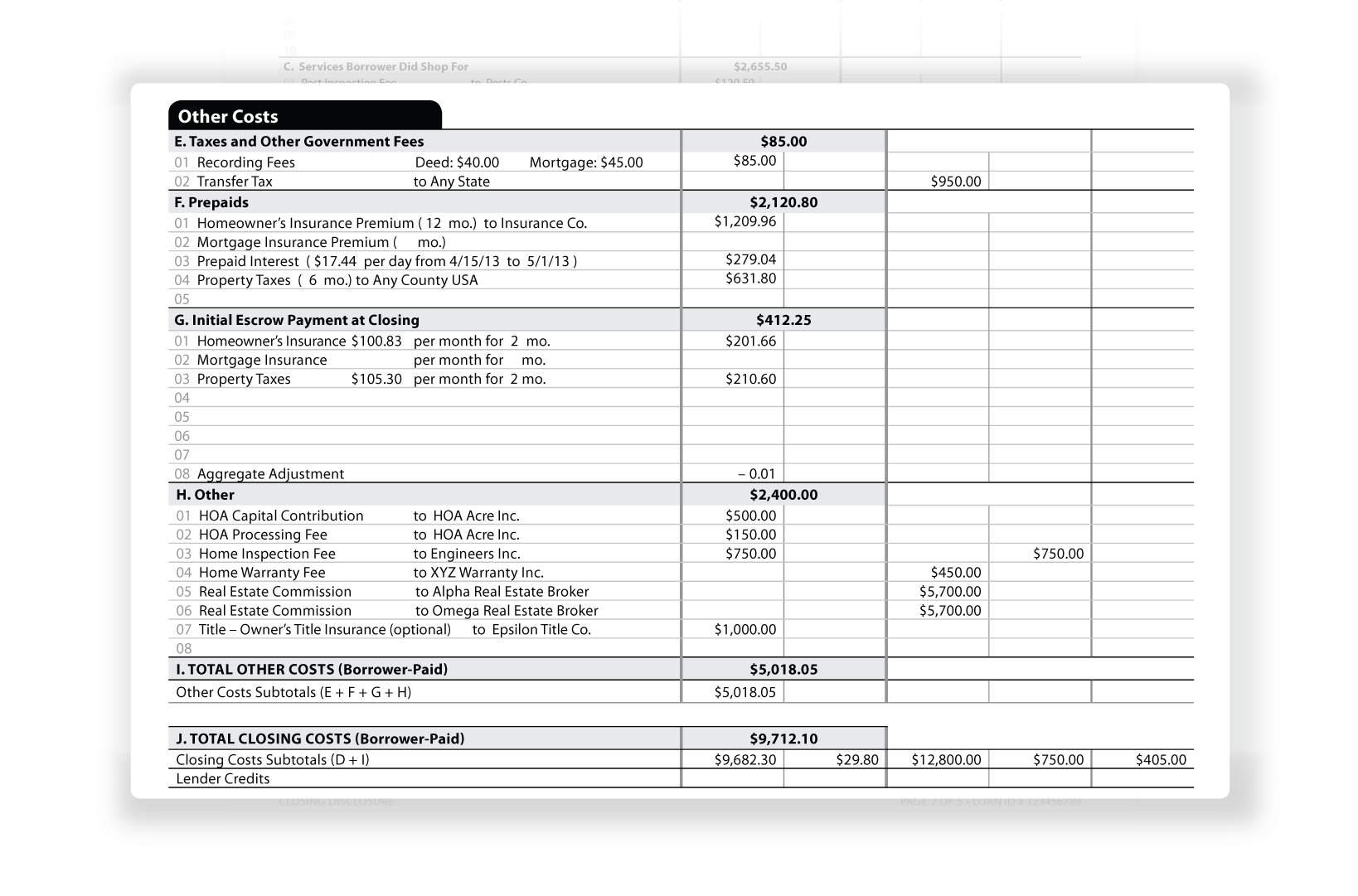

Other Costs

This section is composed of a total of 6 sub sections. The first one shows costs paid to state and local governments in the form of taxes and government fees. The second one is an itemized list of prepaid costs. There could be multiple parties that could show up in this section. The 3rd section includes an itemized list of aggregate costs included in the escrow. The subsection 'H' shows us an itemized list of costs the buyer owes to third parties for the home inspection, warranty fees, broker's commission, etc.

The aggregate of these costs are added and then further added to the loan costs from the previous section. This gives the total closing costs.

Note: A lot of times the seller will agree to pay the inspection and HOA charges. In that case, those costs should appear in the seller’s section.

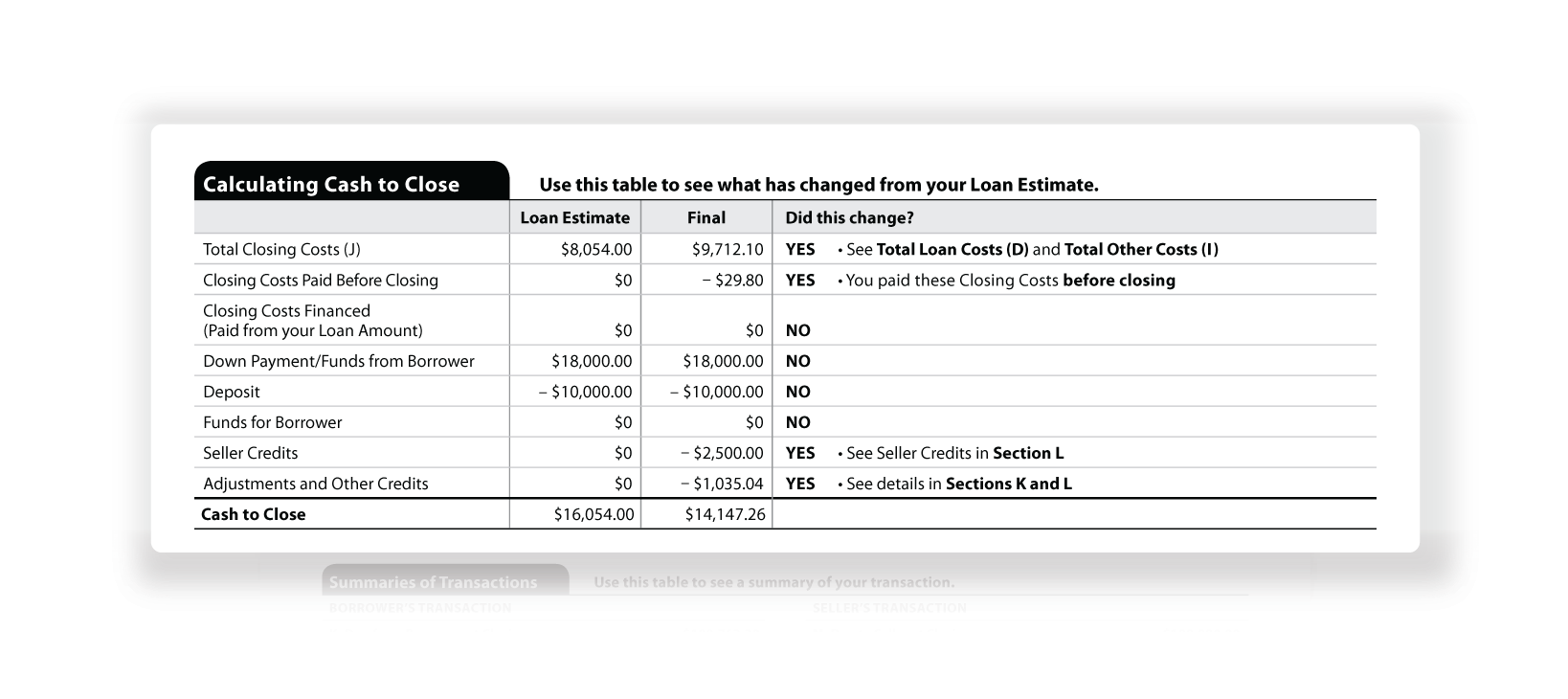

Calculating Cash to Close

This section gives an itemized list of costs that changed compared to the loan estimate, making it an important block in the disclosure. This section includes total closing costs, seller credits, downpayment, adjustments, and many others. The column on the right says if the cost changed or not.

Note: The section for seller credit must always be checked by the buyer. This is what increases or reduces the total cash to close.

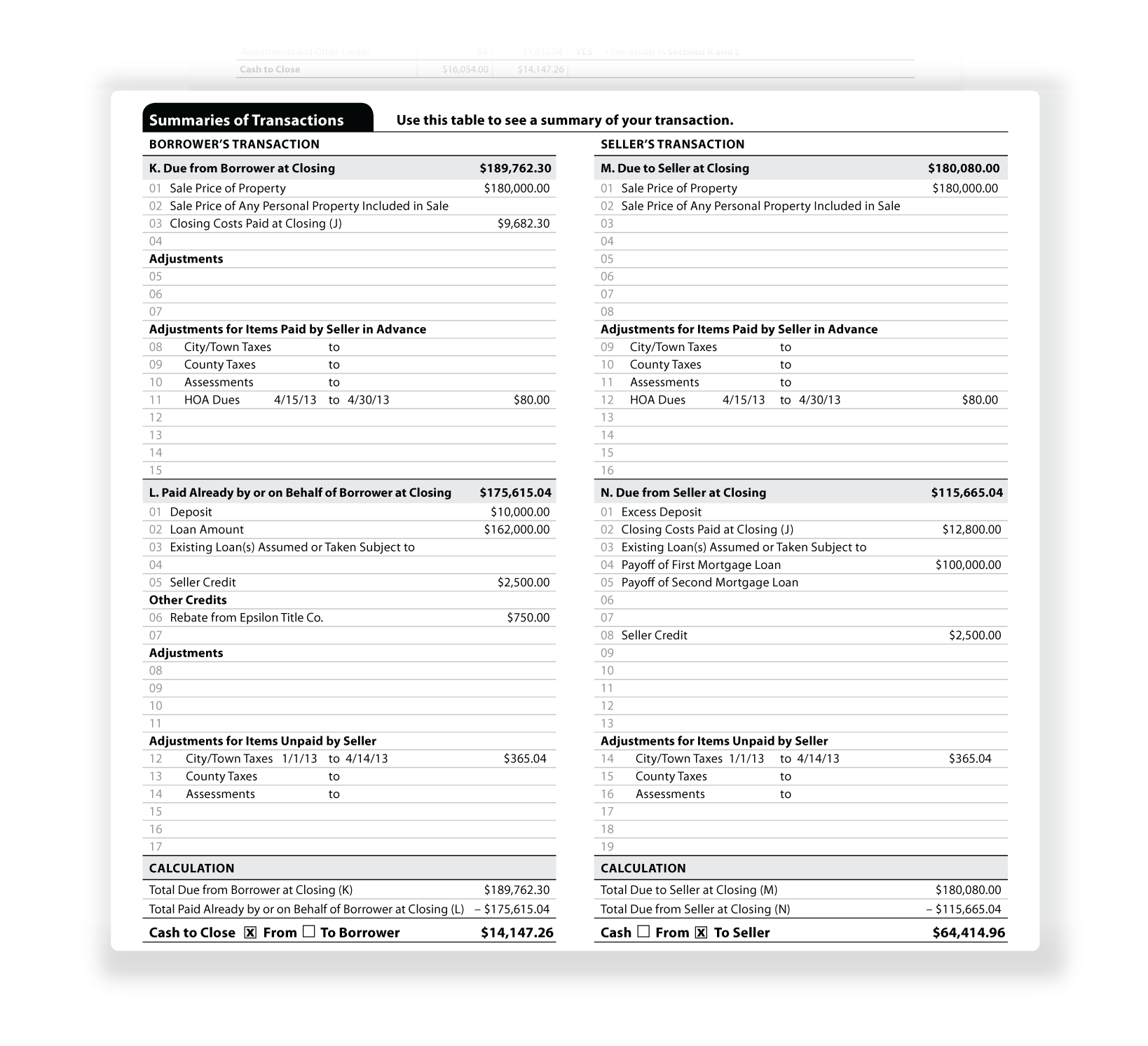

Summaries of Transactions

Summaries of transactions provide a consolidated financial value of total dues that must be paid to the seller along with the dues that are paid by the buyer. This section has 4 sub sections highlighting costs that are due from the buyer, amounts already paid on behalf of the buyer including escrow fees, loan amount, etc. It also highlights the amount that must be credited to the seller’s account, excluding costs paid that are not associated with the closing directly.

Note: Buyers should check if the dues on their part are correct and report to the lender if things do not add up.

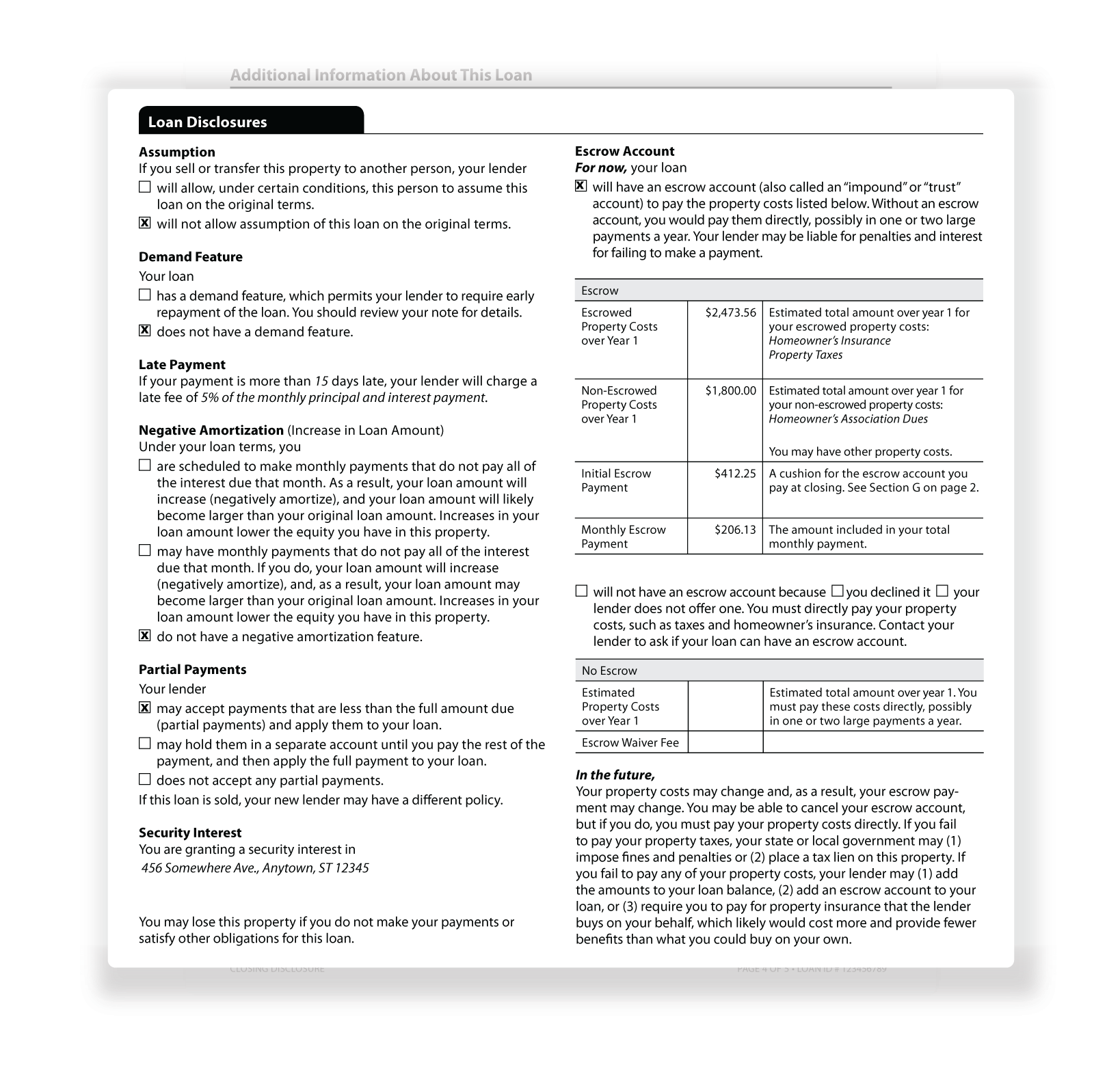

Loan Disclosures

This section highlights all terms and conditions associated with the mortgage. It shows if the buyer has an escrow account to pay the monthly installments. It also highlights the costs associated with escrow. Additionally, it states the condition of the mortgage under the same lender and whether the loan has a demand feature, partial payments, the penalty for late payments, and negative amortization conditions.

Note: If any of the disclosure applies to your mortgage, the adjustable payment table and adjustable interest rate table will appear in the closing disclosure. It is better that the loan does not feature these conditions.

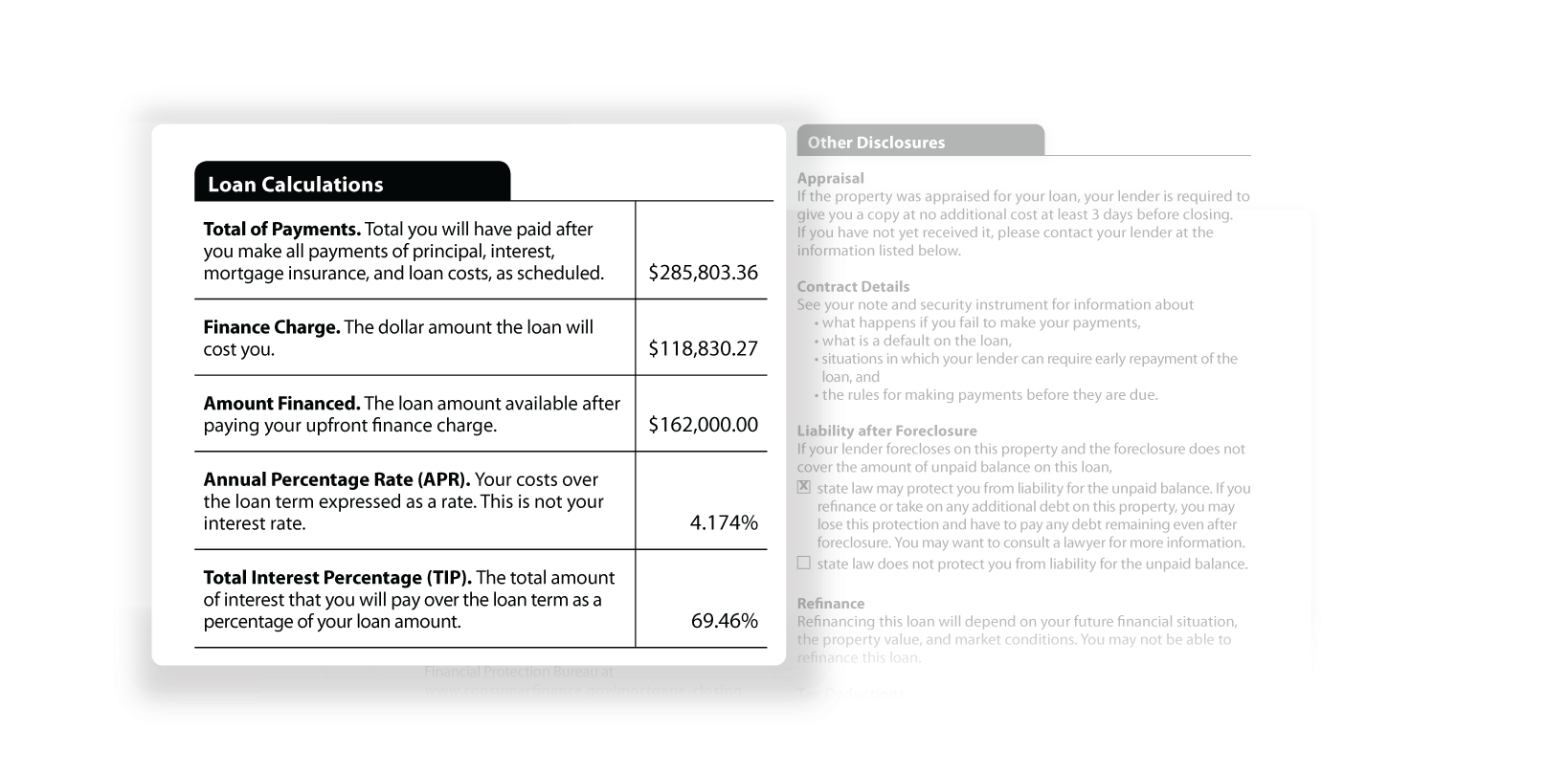

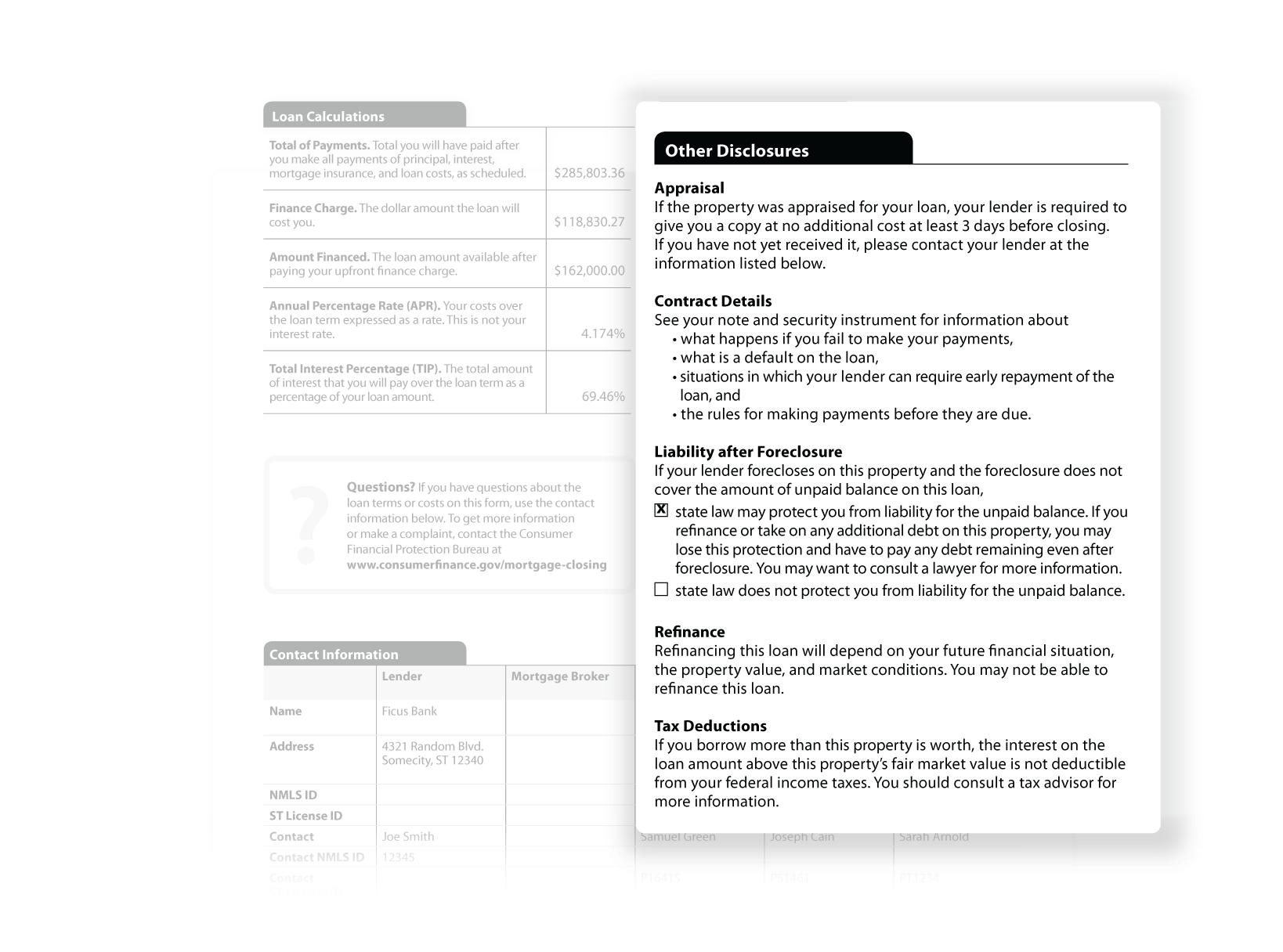

Loan Calculations

The section for loan calculation gives you the exact cost of the loan which is the sum of processing fee and the interest rate on the loan. This section also shows the APR or annual percentage rate, and the TIP or Total interest percentage on the loan.

Note: Buyers should verify the APR with the lender they have the closing disclosure in their hands.

Other Disclosures

This is another section that gives some additional disclosures on the unpaid balance, refinancing, appraisals, tax deductions.

Note: Buyers must refer to the deed of trust and correlate that with the closing disclosure.

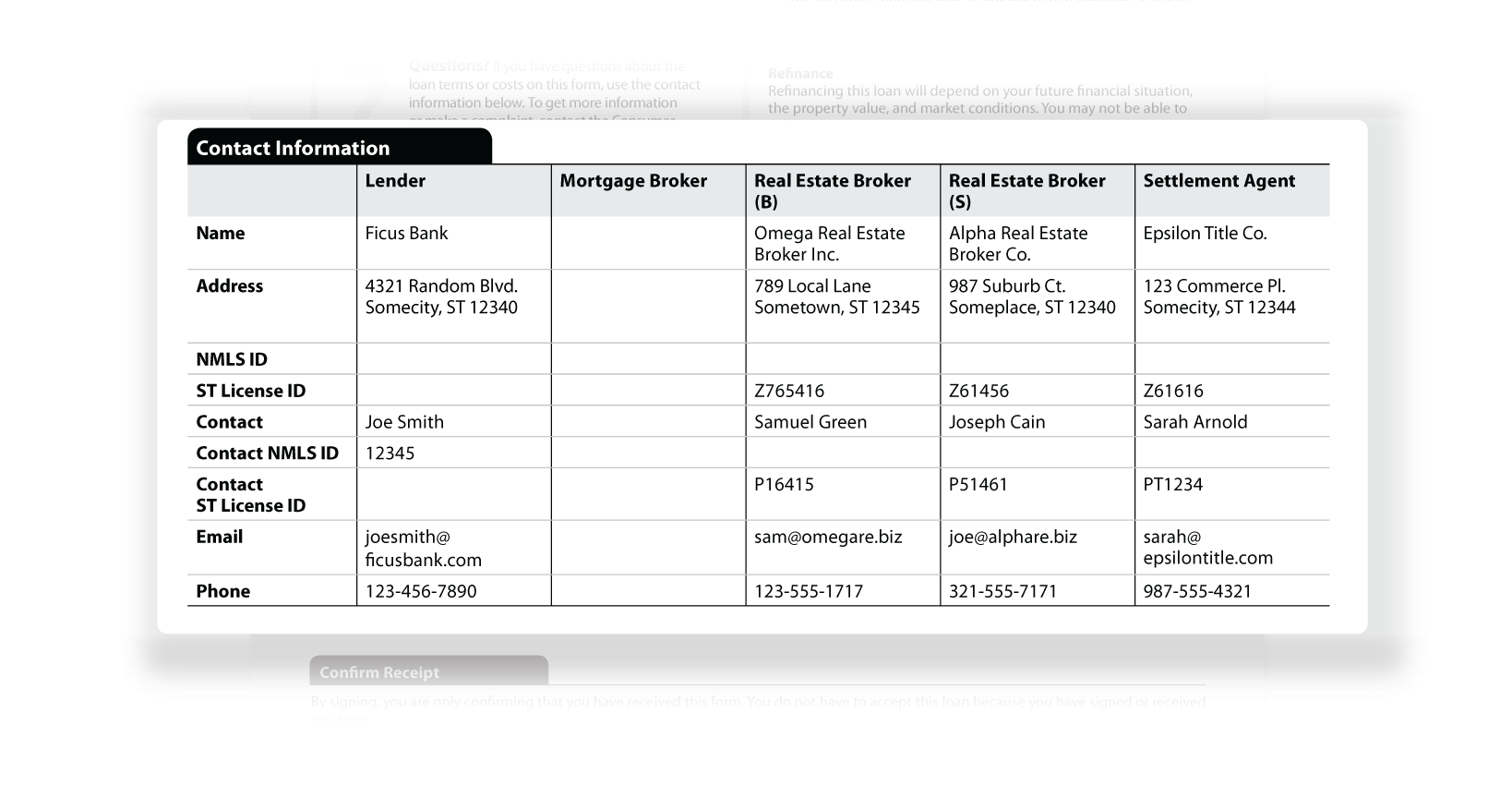

Contact Information

This section gives contact information for all the parties involved in the transaction including agents for both parties, the lender, the settlement agent, the mortgage broker, and the listing agent.

Note: Buyers should check their information and contact the lender in case of a discrepancy.

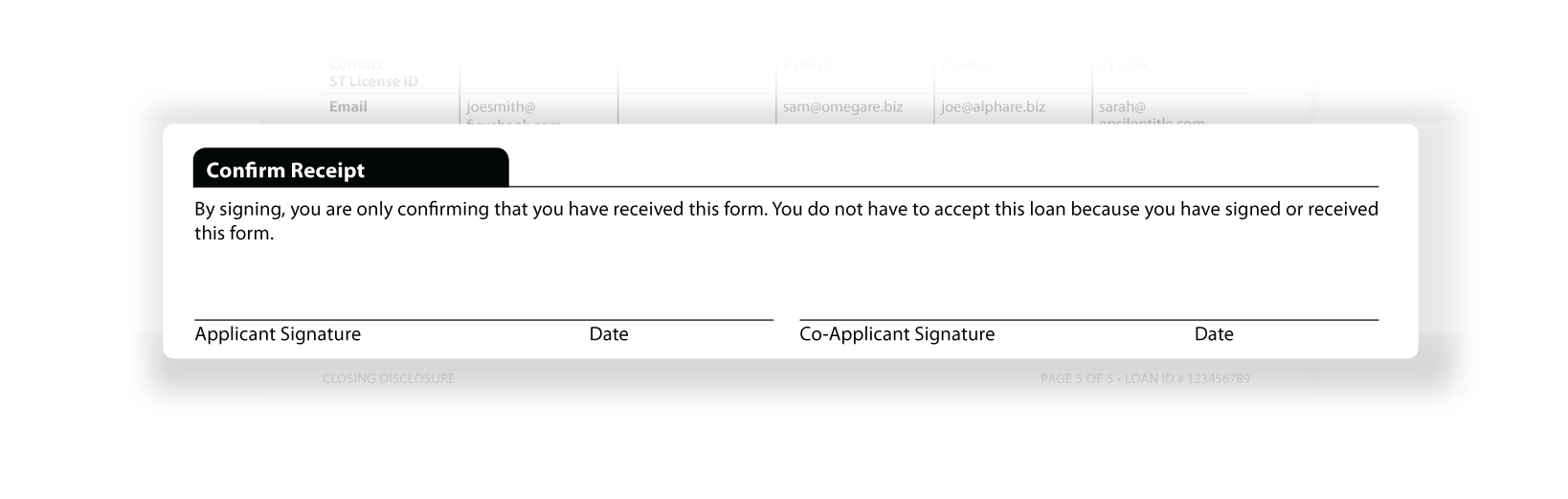

Confirm Receipt

This section has two spaces that are meant for the signatures of the buyer(s). Buyer(s) are supposed to sign here as they receive the closing disclosure and agree with the costs and conditions if they agree to them.

Note: Buyers should double check the prices and then sign the disclosure.

Does a closing disclosure mean I am approved?

It is one of the common questions asked by home buyers during the closing process. The answer is No. The closing disclosure is a document that is surely a step towards mortgage approval and the dream home. However, it may be rejected even after you have signed the disclosure. There could be multiple reasons for that.

Title Issues. There could be title related issues with the property that may crop up during title search. The seller must be the rightful owner of the property but if that is not the case, then the mortgage may be not approved.

Inspection issues. The deal can go sour If the inspection reveals the need for a serious renovation. The buyer might retract and may not want to go for the mortgage. In other cases, if the seller is found to be shady, the mortgage might still be put on hold.

Loss or Change of Job. A loss of job for the buyer prevents the lender from taking risks and disburse any funds in the buyer’s name.

Credit Issues. While in many cases the buyer’s agent helps them improve their FICO score, some buyers might still have credit issues. A poor FICO score will finally result in an unapproved mortgage.

Debt to income ratio. Lenders prefer debt to income ratio that is less than 35% for any buyer seeking a mortgage. If buyers have an ongoing student loan or a loan for an expensive car the lender may not entertain the buyer much.

Closing disclosure is one of the pivotal steps towards the mortgage. It is an important document that must be carefully examined by the buyer before they step into the escrow office to sign the deal.