Read this post to understand the complex cost components of a buyer cost sheet for a smooth home closing experience.

Real estate closing could be stressful for buyers who are probably buying their first home. The commitment towards a mortgage and a gamut of paperwork makes homebuyers anxious and one of the major reasons of anxiety is to understand the costs listed in the buyer cost sheet. The buyer cost sheet is segregated into 5 types of costs that could be puzzling to them to understand. Buyers want absolute clarity and do not want to be deceived into paying anything that they easily avoid.

Agents and lenders can use this situation as an opportunity to build trust and transparency by guiding the buyers on the costs that they must pay and the ones that can be avoided. There is nothing better than the buyer cost sheet to build this perspective and we will help you do that through this post.

In this post, we will look into all the cost components of the buyer cost sheet and explain them in detail. We shall also look into the price components that could be adjusted into the seller’s account and if it is possible to roll closing costs into the mortgage or not. So without further ado, let’s get started.

Table of Contents

- What is a buyer estimate?

- Property Related Fees

- Loan Related Fees

- Mortgage Insurance Fees

- Property Taxes

- Title Fees

- Can Closing Costs be Rolled into Mortgage?

What is a buyer estimate?

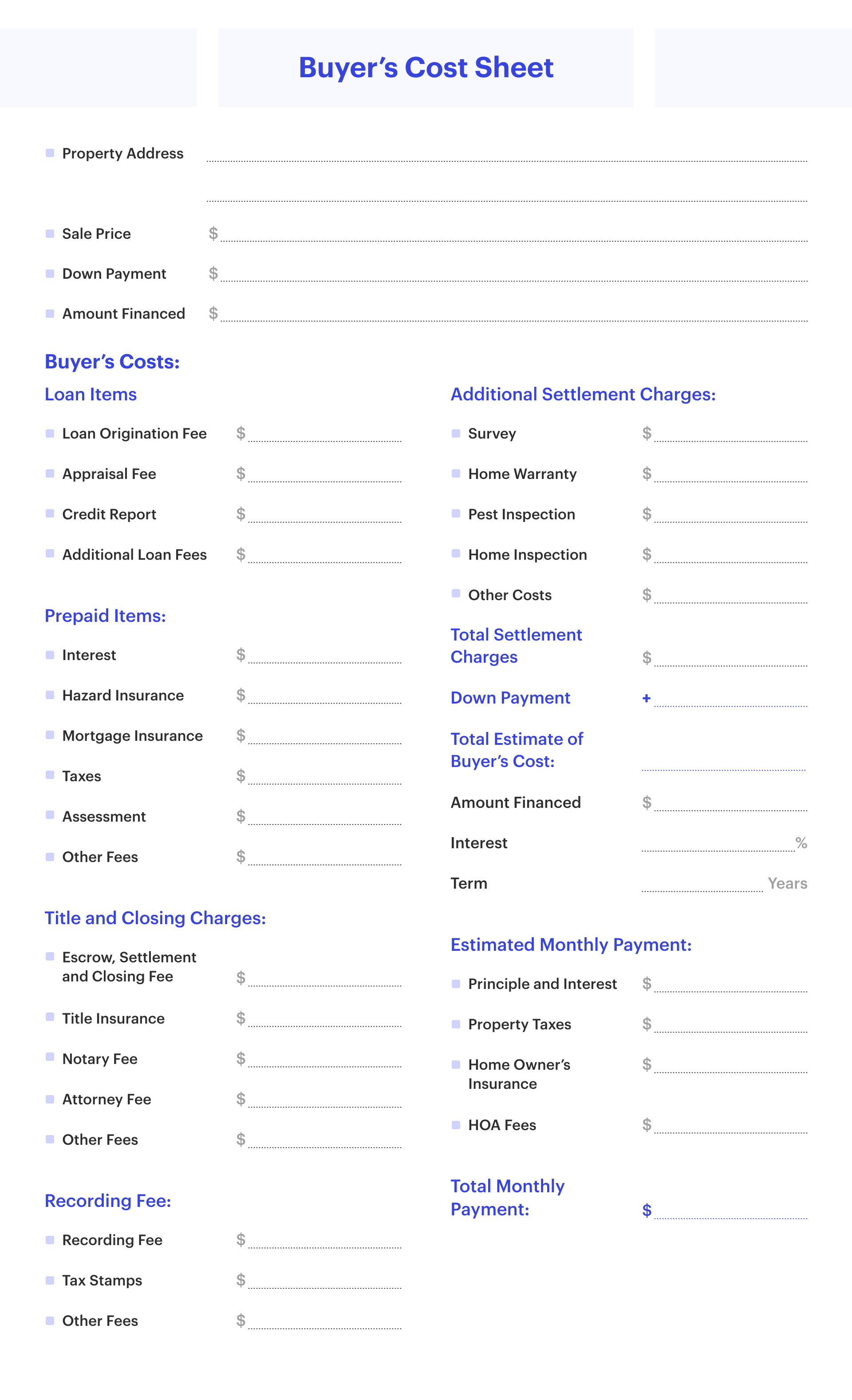

A buyer estimate or buyer cost sheet gives an estimated amount that the buyer must pay while buying a home. The document lists a number of costs including property fees, taxes, mortgage fees, and title fees that the buyer must pay in order to transfer the deed to their name.

The buyer cost sheet looks similar to the seller net sheet and may have 7-8 sections.

The buyer and seller both incur costs to close the property. The sellers mostly pay for the repairs and pending charges while the buyer pays the title transfer and escrow fees on a general basis. The following table clearly points out the closing costs that are unique to sellers and buyers respectively.

Closing costs for buyers can range anywhere between 2% - 5% of the total value of the property. Hence, for a $200000 home, buyers may expect to pay around $4000 to $10000 as closing costs with a 20% downpayment. The major chunk of this is attributed to the one time closing fees that include origination, title insurance, inspection charges, and so on. The other part of the cost comes from the escrow charges.

One of the things about the buyer cost is the variation of certain cost components across states. For example, the closing costs included in the buyer cost sheet also changes from one state to another. For example, the origination of fees in Miami is significantly higher than that of Los Angeles. A $200000 property will amount to $3205 as the origination fee in LA compared to $3600 in Miami. Here is a complete list of closing costs across for all 50 states.

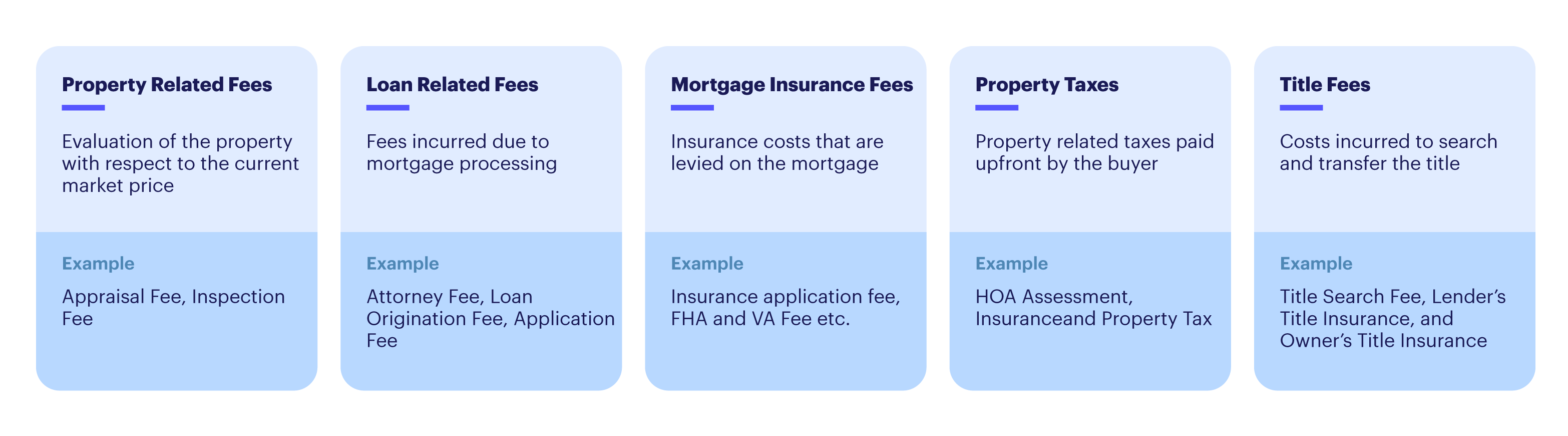

Now that we have a hawkeye perspective on the buyer cost sheet, let’s dig deep into the 5 major types of costs and further.

Property Related Fees

These cost components are connected to the evaluation of the property with respect to the current market price and trends. Property related fees include costs for inspections and appraisal most of the time.

Appraisal Fee. The lender must make sure that the value of the property is adjusted with respect to the current market prices. This is why the lender orders a home appraisal that comes at a cost, we call the appraisal fee. The appraisal fee falls between $300- $450 on average.

Home Inspection Fee. Lenders want to make sure that the property is free from any kind of structural defects. This is done with the help of home inspection professionals who pay a visit to the seller’s property and make sure that the home is good enough for the buyers to move in. The home inspection is an important step towards approval of the mortgage. It may cost around $200-$350. Larger homes may cost more.

Loan Related Fees

Loan related fees are charged when the mortgage is processed by the lender. These costs include attorney fee, loan origination fee, application fee, and other cost components.

Loan Application Fees. This cost is attributed to the administrative expenses to process the loan and varies depending on the lender you are working with. On average, you can expect to pay a maximum of $400-$500 as application fee to the lender.

Attorney Fees. The attorney fee will be levied in a number of states where attorneys are the only entity who is legally entitled to transfer the title to the buyer from the seller. Attorney Fees can vary depending on how many hours they have spent on your title. The attorney fee ranges from $100 - $300 per hour in most of the states.

Loan Underwriting Fee. Loan underwriting is the process of verifying the loan by the lender followed by the paperwork to approve it. Loan underwriting includes costs such as notary fee, lender’s attorney fee, document preparation and so on. Loan underwriting can cost buyers up to 0.5% of the total principal amount of the mortgage.

Prepaid Interest. Prepaid interest is the amount paid on the mortgage between the date of settlement and the due date for payment for the first monthly installment. This amount is paid during the closing process.

Mortgage Broker Fee. A lot of times buyers may need to work with a mortgage broker to find the right loan. In such cases, the broker will charge them around 1% -2% of the total transaction value as the brokerage fee.

Mortgage Points. Mortgage points are advanced payments that buyers can pay to the lender in advance. It cuts the interest rate for the buyers by a certain percentage on the loan.

Mortgage Insurance Fees

The insurance costs levied on the buyer’s mortgage is called the mortgage insurance fee. These costs may include paying the first year’s mortgage, the application fee for the insurance, and other additional costs.

Insurance on the mortgage. When the mortgage is approved, the buyer is supposed to pay the first month’s insurance upfront during the closing process. Buyers can also pay a lump sum at the end of the closing cycle that covers the insurance expenses for the entire duration of the mortgage.

Insurance Application Fee. This cost is incurred by the buyer if they choose to pay a downpayment of less than 20% of the total transaction amount. The buyer pays for private mortgage insurance which safeguards the lender if the buyer defaults.

FHA and VA Fees. Veterans loans that are insured by veterans affairs come for a price and so do loans that are approved by the Federal Housing Administration or FHA. This cost can range from 1%-3.3% of the total mortgage amount.

Property Taxes

These costs are incurred due to property taxes that buyers are supposed to pay upfront during the closing. These costs also include insurance premiums and annual assessments alongside.

HOA Assessment. Many times the homeowners association may require your buyer to pay an upfront annual fee during the closing process. This is the HOA assessment fee.

Property Tax. Buyers are also supposed to pay upfront property taxes of two months according to the county during the closing process.

Insurance on Home. Homeowner’s insurance should be purchased before the deal is signed. Lenders want buyers to purchase the insurance to safeguard them financially in the event of a fire, earthquake, or other unforeseen physical damages.

Title Fees

Title fees are levied when the attorney or escrow company begins the title search. Like taxes, title fees include insurance costs on part of the lender and the buyer as well.

Title Search Fee. The title search is the process of searching for any outstanding claims on the property or liens. It is essential to verify that the seller is the rightful owner of the property which can be transferred to the buyer without the buyer having to worry about any disputes in the future. A title search can cost around $100 but may go up if the escrow goes into manually verifying historical details of a disputed property.

Lender’s Title Insurance. Lenders want to make sure that they are safeguarded against any property disputes that may potentially arise from a discrepancy in the title search. This is why buyers must pay a sum for the lender’s insurance to protect them from such disputes. This coverage lasts until the buyers have paid off the entire mortgage amount.

Owner’s Title Insurance. Owner’s title insurance safeguards buyers from any title disputes that may arise in the future in the title or ownership of the property. The owner’s title insurance may cost up to 1% of the total mortgage amount.

Can Closing Costs be Rolled into Mortgage?

Closing costs can be rolled into the mortgage but not literally. It is a deceiving statement. What generally happens is that the seller may have sold the house at a higher price than the market value and adjust the total amount. This is called seller credit.

Alternatively, buyers may secure a lender credit in many cases. Here, the lender is supposed to pay the closing costs which are adjusted in the mortgage interest rate over the period of payback.

Mortgage types including Freddie Mac, Fannie May, and VA loans instruct buyers that they should opt for a seller credit if they do not want to pay the closing costs out of their pocket, or shall we say paying at the time of closing. FHA loans also require you to go for the lender’s credit as a form of contingency.

If you want to go for a seller’s or lender’s credit, you would be paying interest on the closing costs throughout the payback period. For example, if you qualify for a $200000 loan at 3.5% -4% interest over 30 years, you might end up paying $15k - 18k more on your loan over these 30 years in total. The decision comes down to a trade off between avoiding a chunky upfront payment and paying an additional amount on the mortgage every month.

The buyer cost sheet is one of the most important documents in the entire closing process. It is essential that they are thoroughly informed about the cost components to make informed decisions. We hope you found this post insightful in understanding the cost components of the buyer cost sheet. Happy Closing!