Dealing with the loan estimate for the first time in life? Not sure about the costs given in those sections? Read this post to understand them in detail and make informed decisions.

Real estate transactions could be stressful for the buyer as a lot of them are first time home buyers. Their inexperience with the entire process makes them anxious and a bit confused when it comes to paying the closing fees. They want to be assured that they are not paying more and not cheated in any way. This is where the loan estimate gives them clarity.

The loan estimate is one of the important documents in the real estate closing stack that is specifically meant for the buyer. It comes with 8-9 types of costs, providing ballpark estimates on the various costs. The loan estimate is often followed by the closing disclosure that features a revised set of prices that the seller and the buyer mutually agree to pay. However, for the negotiation to begin, the loan estimate is necessary.

In this blog post, we will discuss what is a loan estimate and its various cost components. We will also look into the difference between the loan estimate and the closing disclosure in the end. So without further ado, let’s dive in.

Table of Contents

- What is a Loan Estimate?

- Components of a Loan Estimate

- How is a loan estimate different from closing disclosure?

What is a Loan Estimate?

A loan estimate is a detailed list of costs the buyer is projected to pay during the closing process. These figures are ballpark estimates allowing the buyer to predict the amount they would be playing. The loan estimate also allows the buyer to accept or reject the financial clauses associated with the mortgage.

The loan estimate is generally provided by the lender before buyers shop for a loan. The loan estimate gives buyers a perspective on the rate of interest and closing costs. Buyers look into multiple loan estimates and narrow down their choice to the one that suits them the best.

Once the buyer has chosen their best mortgage option, the buyer and seller sit for a final round of negotiation. The lender then sends them the closing disclosure that states the exact amounts that each party would be paying at the end of the transaction.

Now that we have developed a perspective on the loan estimate, let’s dig deep into its section to learn them in detail.

Components of a Loan Estimate

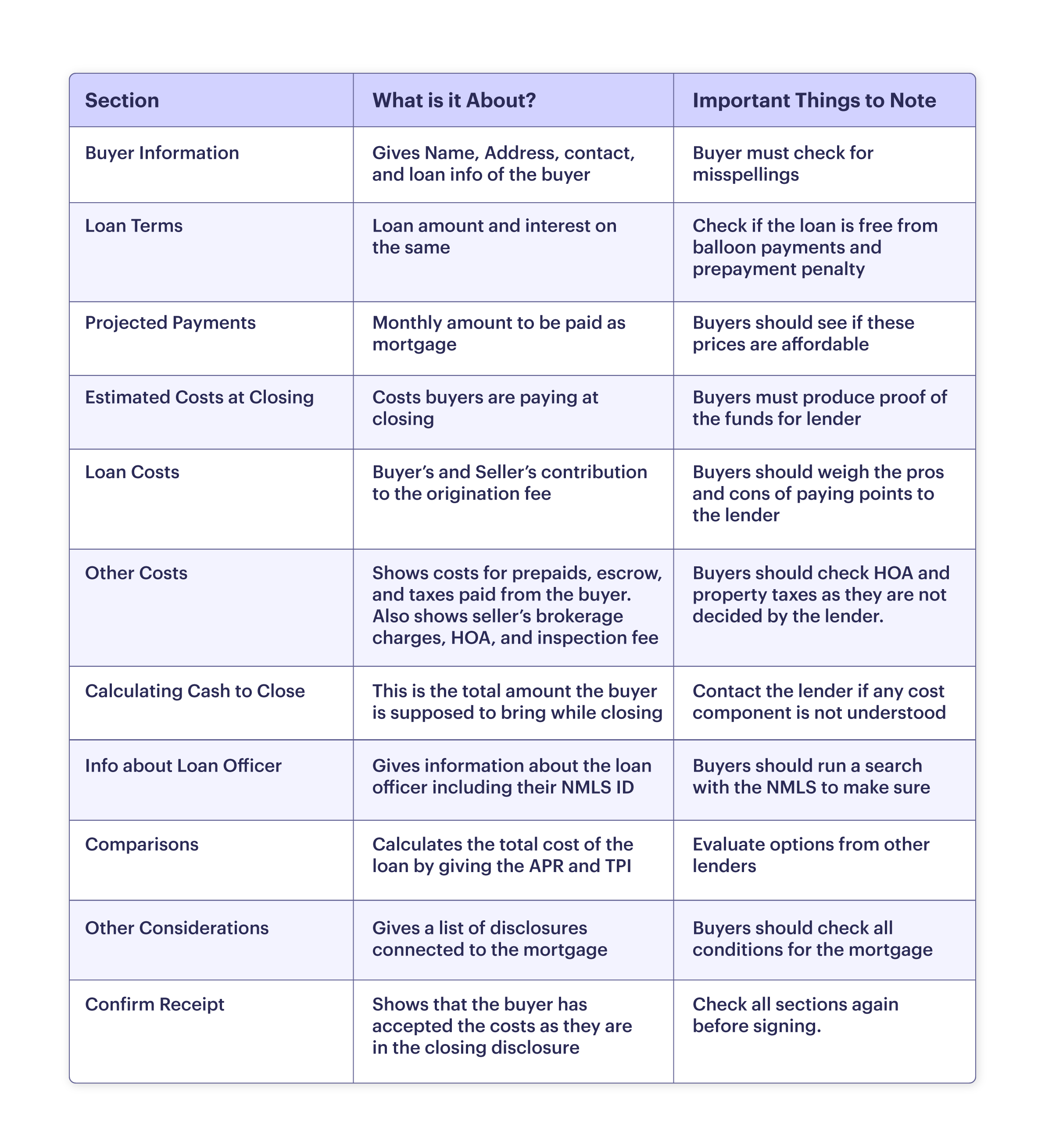

The loan estimate is divided into 9 major sections of costs. The following image gives you the list of all the costs associated with the Loan Estimate.

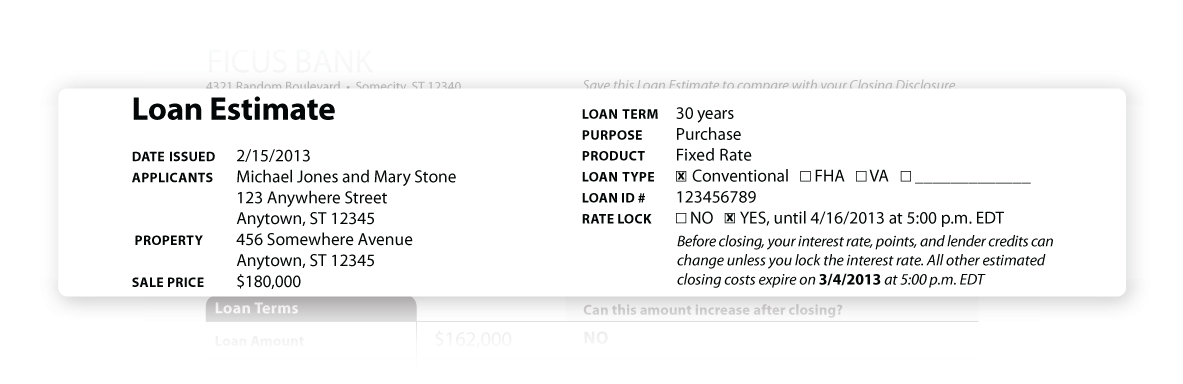

Buyer Information

This section shows personal information of the buyer including their name, address, and details of mortgage such as type of mortgage, the term of payment, the term of interest, etc.. Additionally, closing date, issue date, disbursement date, and the name of the settlement agent are also listed.

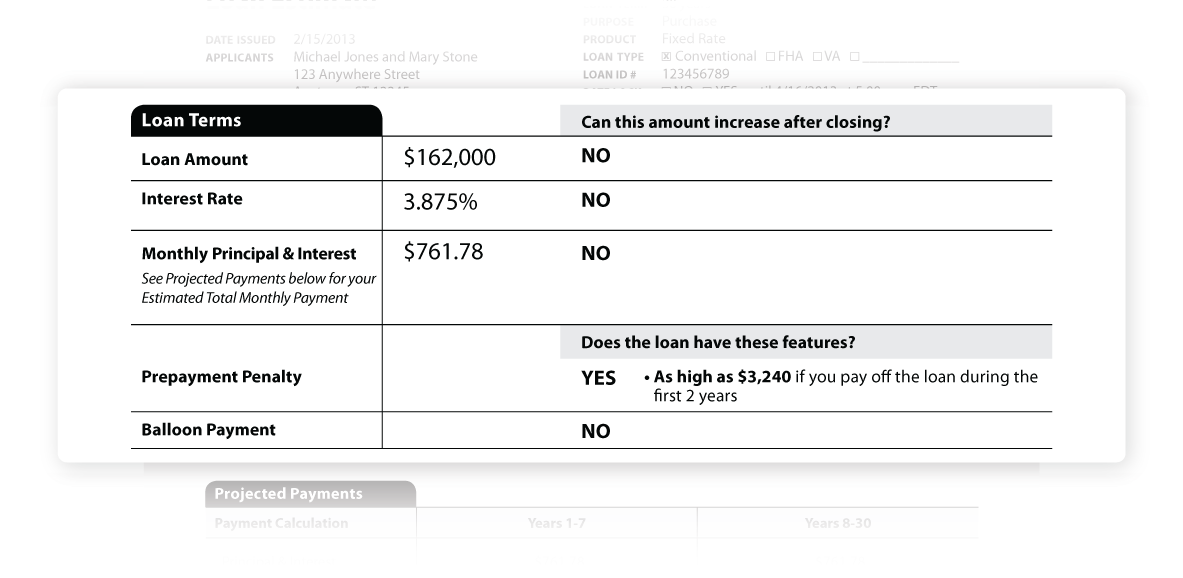

Loan Terms

This section shows the total loan amount that the buyer is anticipated to apply for. You can also check the tentative rate of interest and the monthly EMI that the buyer is obliged to pay. The buyer is supposed to tally these figures with that of the closing disclosure and see if they match or not. They are supposed to tell that to the lender if the amounts do not match.

In addition to that, the buyers should also make sure that their mortgage does not feature a prepayment penalty or balloon payment. It is better to opt for a mortgage that does not feature these options.

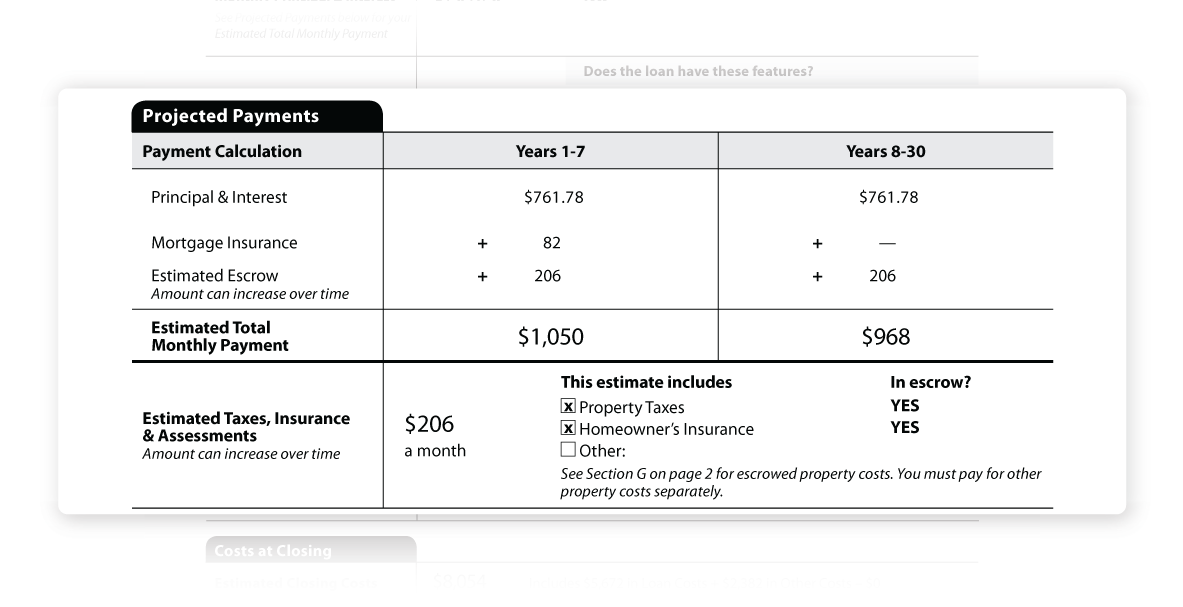

Projected Payment

This section features a list of all the costs that contribute to the projected payments. These are monthly mortgage payments including taxes, insurance, and HOA assessment costs.

The two columns in this section show projected payments for the first 7 years and 8th to the 30th year respectively. Buyers should evaluate if they would be comfortable paying these figures on a monthly basis or not. If not, they might look for other mortgage options. Alternatively, they can also choose to increase the down payment or lower their budget.

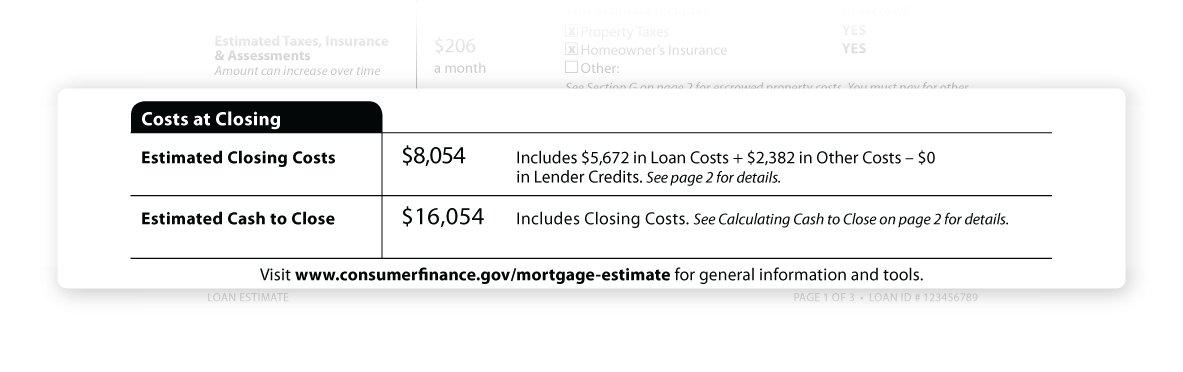

Estimated Costs at Closing

This section consists of two types of costs. These are estimated closing costs and estimated cash to close.

Estimated closing costs is the total cost of the loan that includes the origination charges as well. Estimated cash to close on the other hand is the amount the buyer will have to pay at closing that does not include any charges related to the mortgage. This payment is usually made by cashier’s check or wire transfer after the buyer has provided the proof of sourcing this amount.

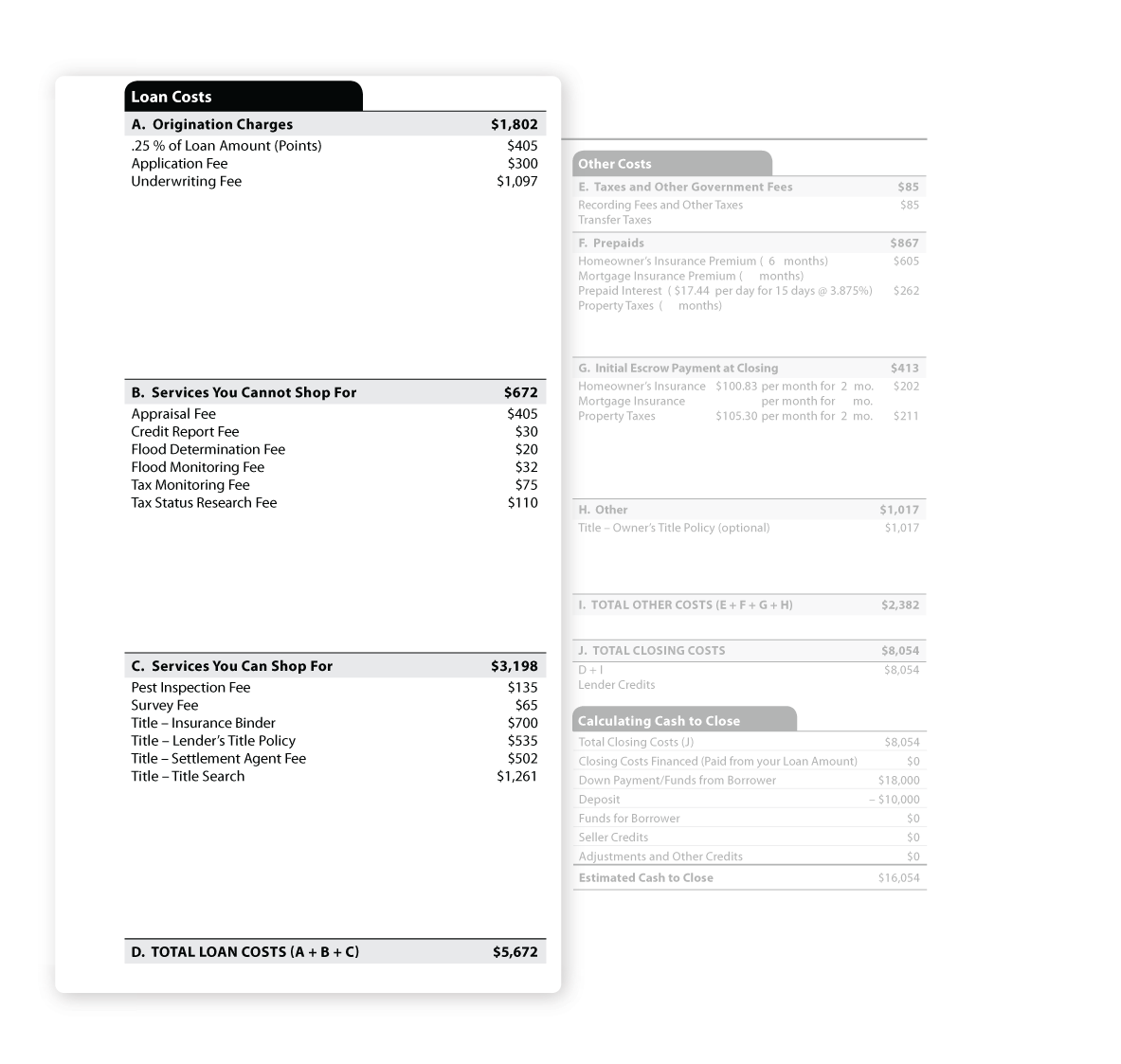

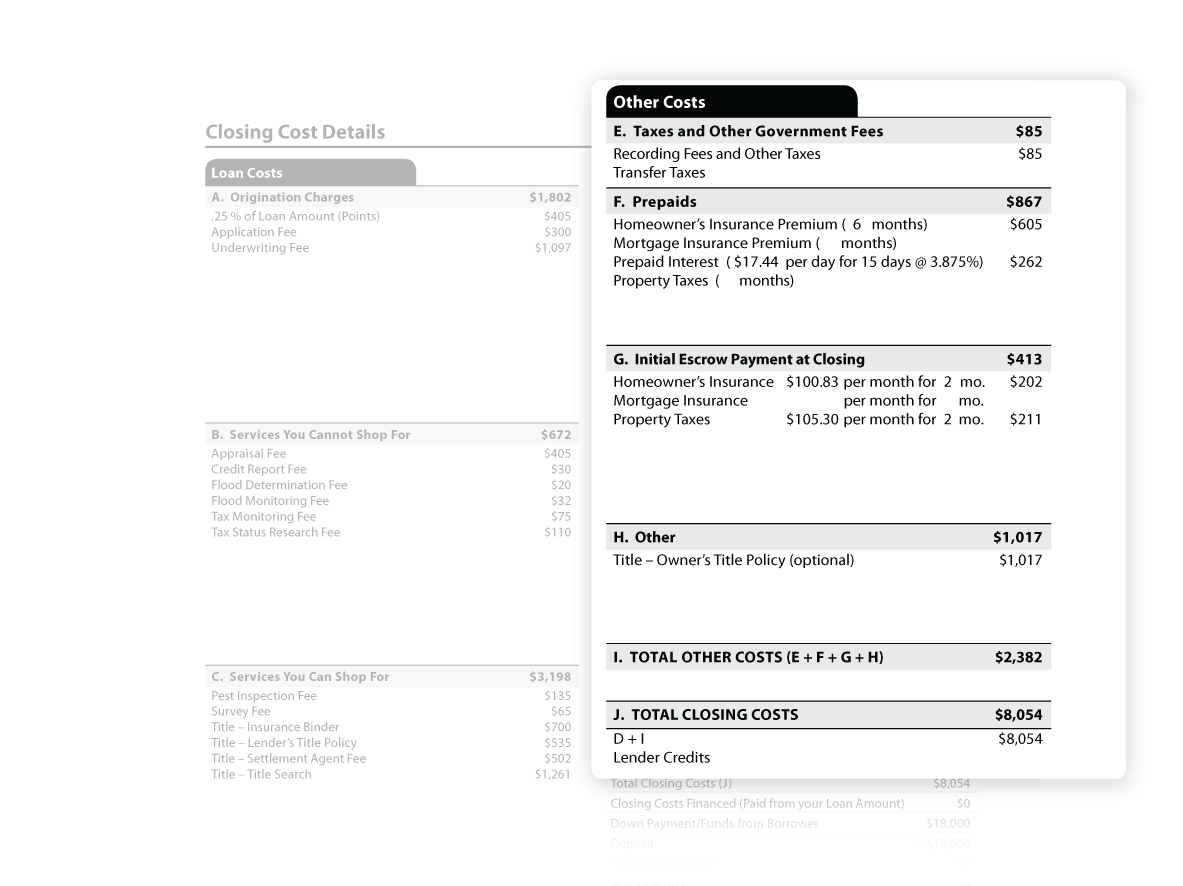

Loan Costs

This section is composed of three subsections of costs. The first part shows the cost of processing the loan. Buyers should look at quotes from other lenders and compare them to see if they are opting for a competitive mortgage loan. Buyers should also see if they are paying points to the lender. Paying points will reduce the interest rate but increase the lender’s share for processing the mortgage. Buyers should evaluate mortgage options with and without these points and then choose the right product.

Other Costs

This section of the loan estimate gives a list of 4 types of additional costs for closing. These are government fees, prepaids, initial payments for escrow at the closing, and other costs. This is an important section for buyers as some of the cost components can reduce or increase the price. For example, the homeowner's insurance premium and property taxes are not decided by the lender. Hence, buyers should evaluate offers from multiple lenders before coming to any conclusion.

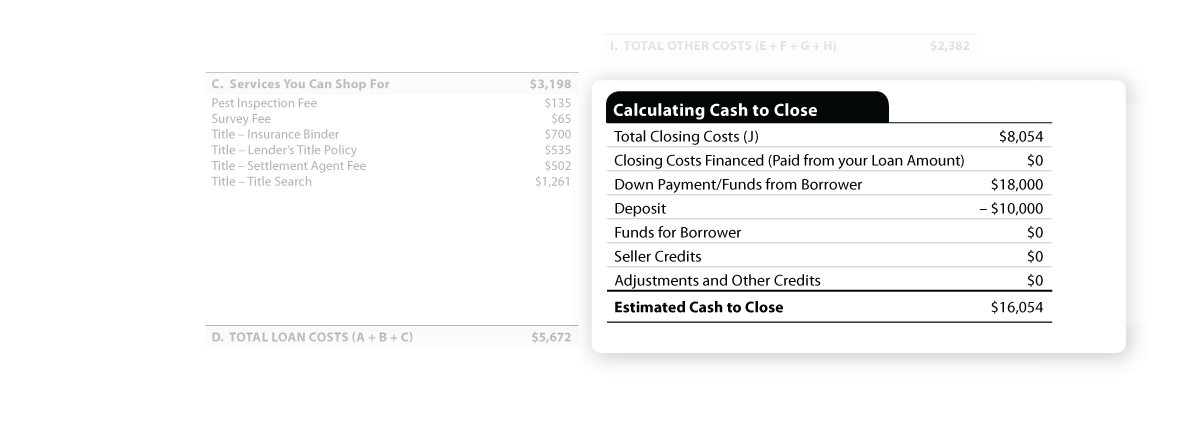

Calculating Cash to Close

This section gives an itemized list of costs that includes total closing costs, seller credits, downpayment, adjustments, and others. The total amount at the bottom is the amount that buyers are supposed to pay at the closing day. Buyers are supposed to pay this amount by wire transfer or cashier’s check. In case the components do not match their expectations, the buyer should contact the lender.

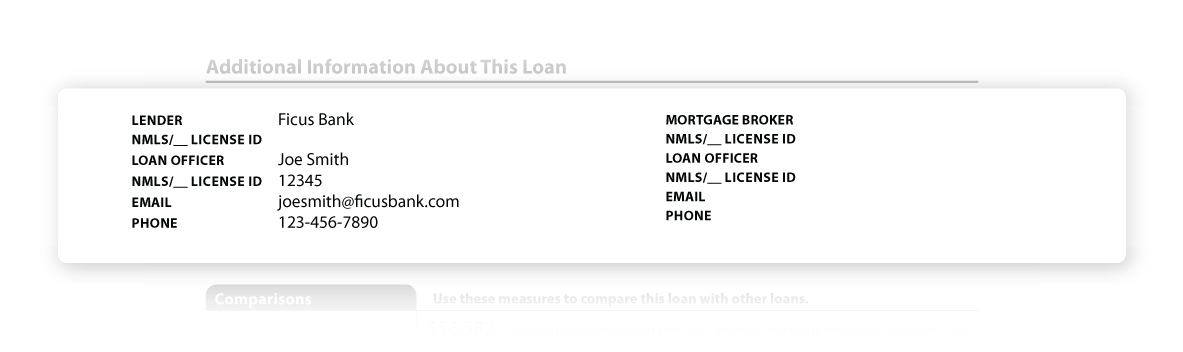

Info about the loan officer

This section gives details on the loan officer including their NMLS ID. Buyers should check if the officer is a certified professional or not. All loan officers are supposed to give their IDs in the loan estimate for buyers to verify them.

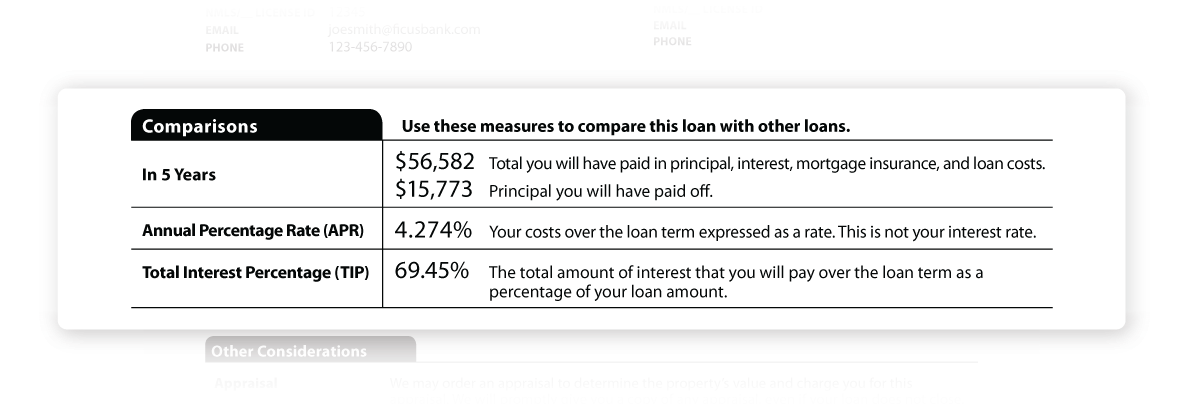

Comparisons

This section gives you a list of useful calculations that buyers would be paying in the next 5 years with a specific APR and TIP. This section is best if you wish to compare the difference between different mortgage offerings from lenders.

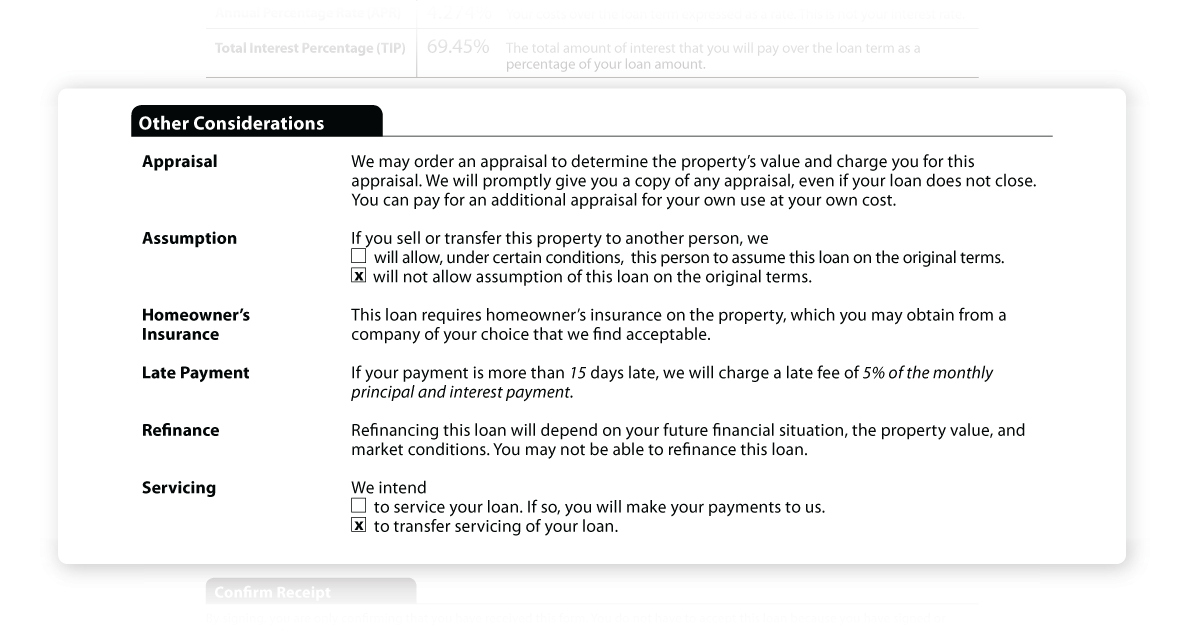

Other Considerations

This section gives a list of considerations that may or may not be associated with the mortgage a buyer is applying for. These are appraisal of the loan, the possibility of assumption of the loan, conditions on late payment of monthly EMIs, refinancing, and servicing of the loan. Buyers should look into the components and verify with the lender.

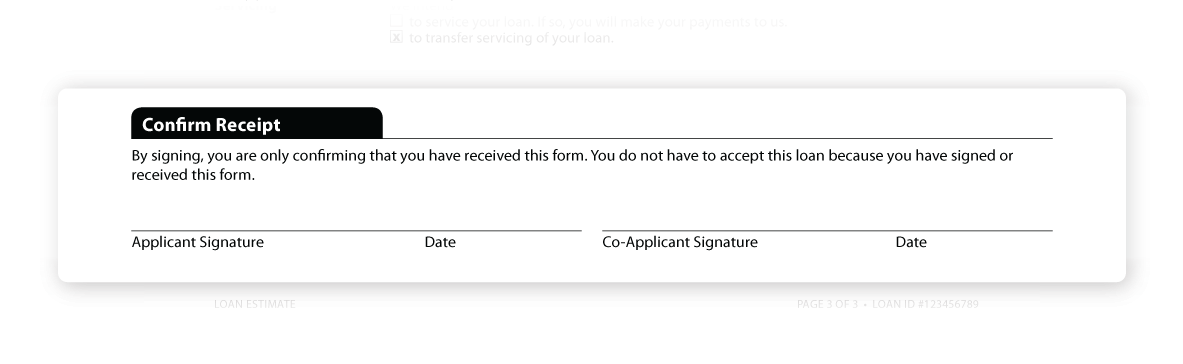

Receipt

This section features two spaces for the buyer(s) to sign and approve the acceptance of the document.

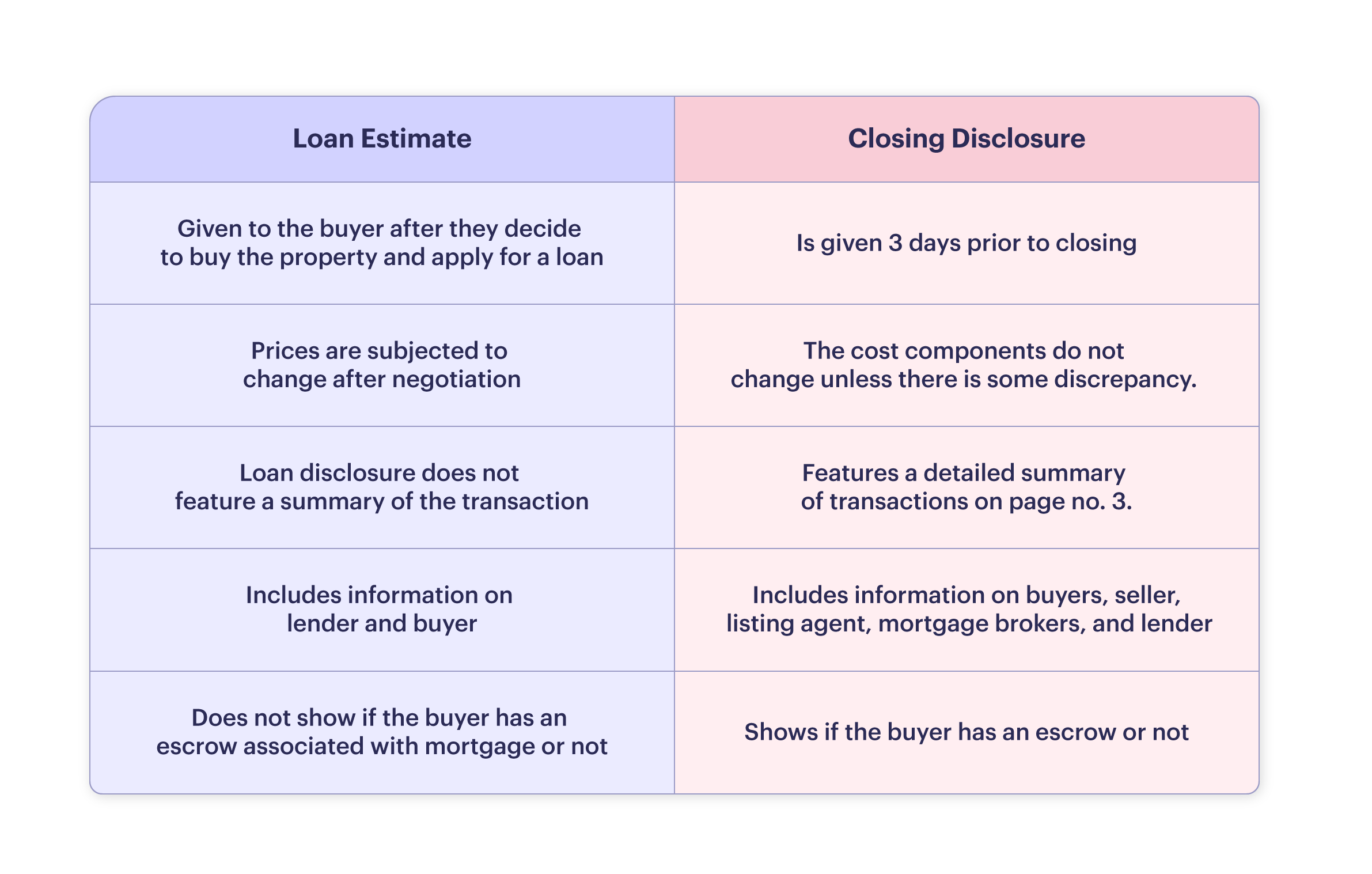

How is a loan estimate different from closing disclosure?

The Loan estimate is a 3 page document given by the lender to buyers as they start shopping for a mortgage. It gives a ballpark cost that may change after both parties negotiate. On the other hand, a closing disclosure lists the final cost components that the buyers and sellers have agreed to pay after many rounds of negotiations. The prices on the closing disclosure are usually final and do not change afterward. Let’s jot down a few differences between them.

Loan estimate is an important document as it allows buyers to pick the right mortgage and the right lender. The ballpark estimation of the loan estimate also helps them mentally calculate the figures for a transparent transaction.