Curious about how to read and understand an ATLA Settlement Statement? Overwhelmed by all those costs in the ALTA Settlement Statement? Read this post to learn everything about the ALTA Settlement Statements in absolute detail.

Real estate closing requires processing a number of documents, each one with their exclusive importance and recipient. One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

Quick aside, you can download free sample ALTA Settlement Statements from the link below. The pack features all 4 types of ALTA statements.

Unlike the Closing Disclosure that is meant to show the closing costs exclusively to the borrower (buyer), the ALTA statement is like a receipt given to agents and brokers on both sides of the transaction.

In other words, the ALTA statement serves as an acknowledgment receipt for all the parties involved including the buyer's and seller's agent that breaks down the whole real estate transaction in great detail.

Please note that the Closing Disclosure is an exclusive document for buyers while the seller net sheet is meant exclusively for sellers.

There are four different types of ALTA Settlement Statements serving their own recipient types and purpose. So, what are these four types of ALTA statements, and what is their importance in the home closing process? Who are the other recipients apart from the seller, and how to read the ALTA statement in the first place?

Here's a video for you to quickly understand ALTA Settlement Statements in all its details.

We will begin the post explaining the four ALTA statement types and then proceed to explain each segment of the statements.

Table of Contents

What is the ALTA Statement?

The ALTA statement is an itemized list of all the cost components that the seller and the buyer are supposed to pay during the home closing process to multiple parties.

The statement segregates these cost components into 8-9 sections. Each cost component could either be debited or credited to the concerned party. The ALTA statement thus gives a complete ledger of all the debits and credits marked against individual cost components.

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

- ALTA Statement for the Seller. A statement of cost components that the seller is supposed to receive.

- ALTA Statement for the Borrower/Buyer. ALTA statement with the same cost components made exclusively for the buyer.

- Combined ALTA Statement. This shows all the costs debited from the seller or buyer and the costs credit to the buyer or the seller in the same document.

- ALTA Statement for Cash Transactions. This ALTA statement features the same cost components as the other ones but only used for cash transactions. A cash transaction allows buyers to save costs associated with the mortgage like the origination fee, the interest, costs for the mortgage broker, and so on.

We are going to consider the combined ALTA statement in this post for the sake of simplicity and explain all the cost components in detail. In addition to this, we will see the differences between the HUD -1 and ALTA as well. So let’s get started with all the cost components of the ALTA statement.

The sections in the ALTA settlement statement

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

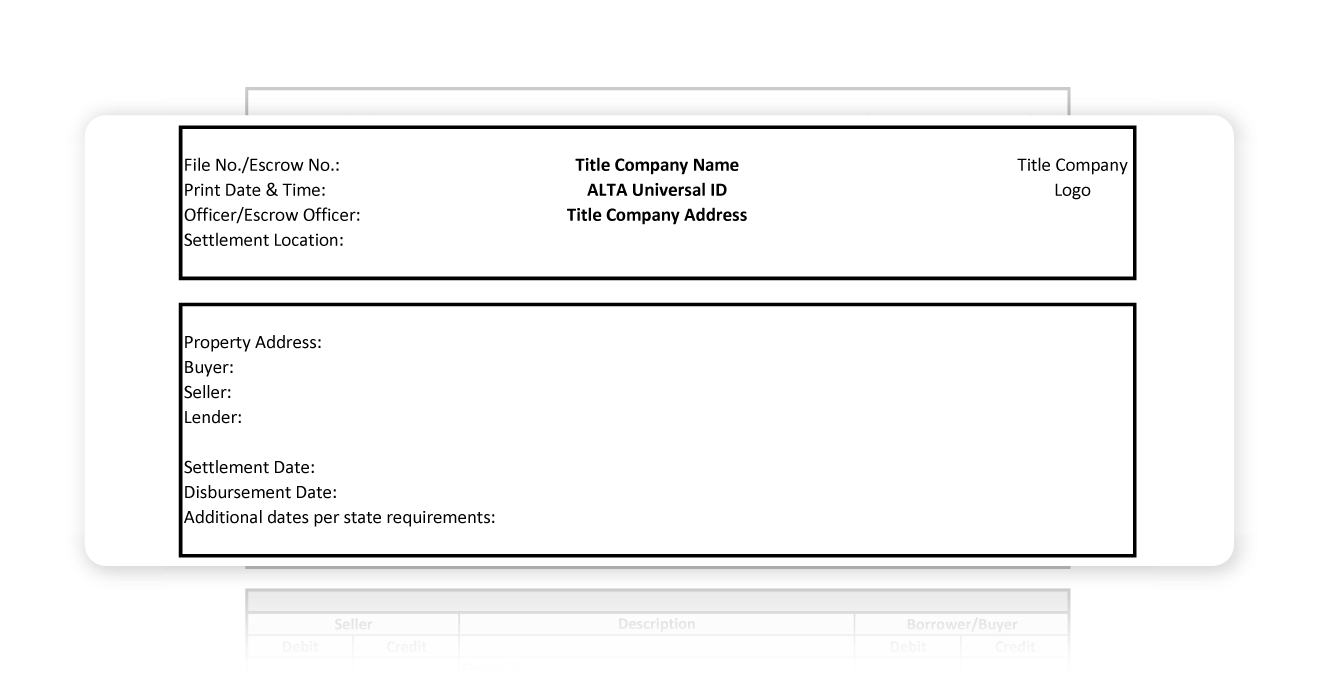

Information on the Parties Involved

The first section of the document features basic information about the parties involved in the transaction. These are:

Escrow File no. This number is unique to every transaction and one can easily pull all the details using the file number.

Names. Names of the settlement agent, buyer, seller, escrow officer, and lender are also written in this section.

Print Date and Time. Shows the time and date the document was printed.

Title Company Logo. The right hand side of this section is where the logo of the title company is placed.

Settlement Location. The location where the closing is happening. Generally, it is the same where the title company is located.

Property Address: The address of the property that is being sold/bought.

Settlement Date. The date scheduled for closing.

Disbursement Date. The day when the seller is supposed to receive the payment in their bank account. The disbursement date is the same as the settlement date in most cases

Other Dates: Dates given for recording or anything that relates to transferring the title of the property.

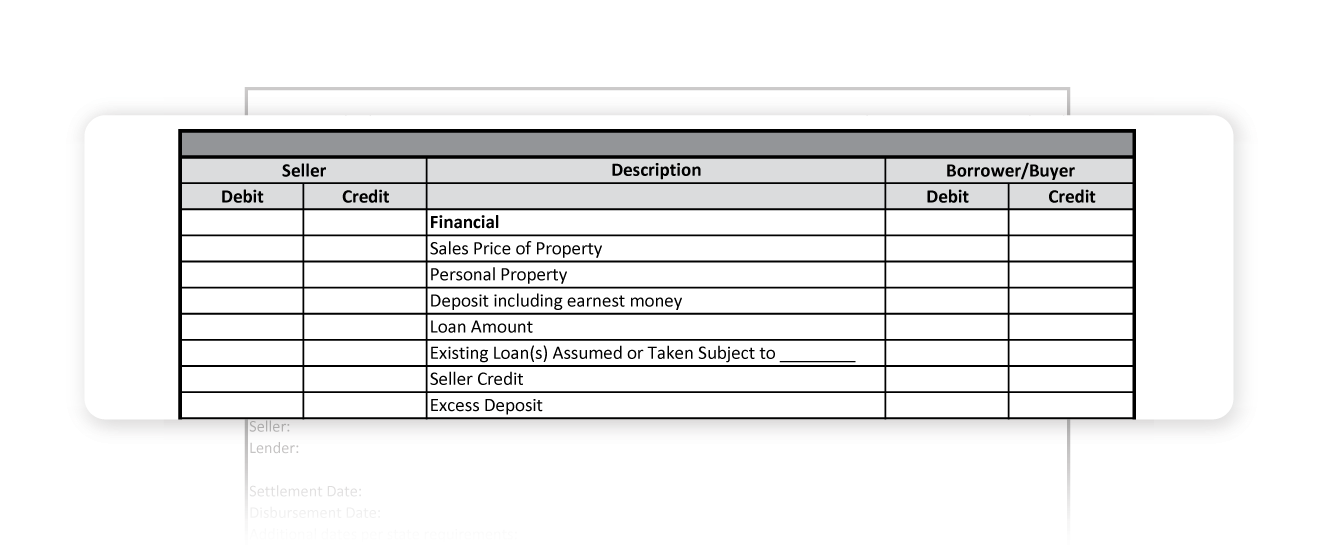

Financial

Costs under financials are paid by the buyer. Hence, they show up as debits on the buyer side and as credits on the seller’s side. Costs that appear under these sections are:

Sales Price of the Property. The price of the property in which the seller has agreed to sell before any deductions.

Personal Property. These costs are paid by the buyer provided they want to purchase appliances or any furnishings along with the property. The amount is credited to the seller’s account and debited from the buyer’s.

Deposit including earnest money. Earnest money is the amount paid by the buyer in good faith to the seller when they have agreed to buy and sell respectively. It can range from 1%-2% of the total purchase price of the property.

Loan Amount. The total loan amount approved by the bank or lender.

Existing Loan(s) Assumed or Taken Subject to. If the buyer has decided to take over the existing mortgage from the seller, that amount will show up in this section.

Seller Credit. This section highlights closing costs that the seller has agreed to pay after reaching a mutual agreement with the buyer.

Excess Deposit. Any amount in the escrow that the buyer and seller have agreed to pay.

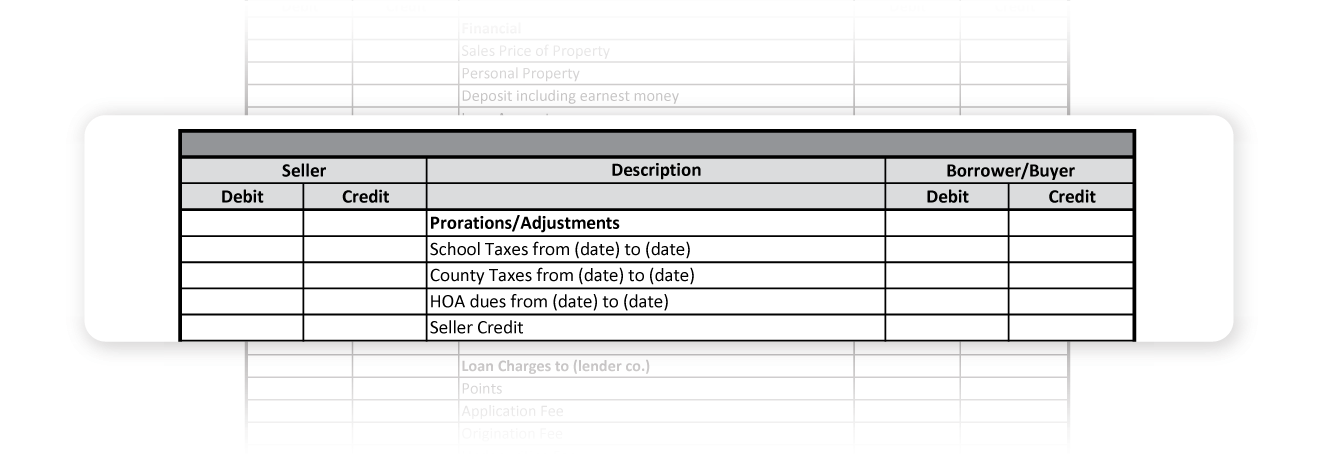

Prorations / Adjustments

These cost components are due on the seller that comes from Homeowners Association dues and County taxes. The price is generally adjusted from last month's payment until the date of the transfer of ownership.

School Taxes from (date) to (date). School taxes due from the last payment until the title is transferred.

County Taxes from (date) to (date). This depends on the county tax schedule but mostly accrued in a similar fashion.

HOA dues from (date) to (date). HOA dues are debited from the seller’s account in the same fashion as explained above.

Seller Credit. If both parties have negotiated that some prorations are paid by the seller, then that amount will show up here.

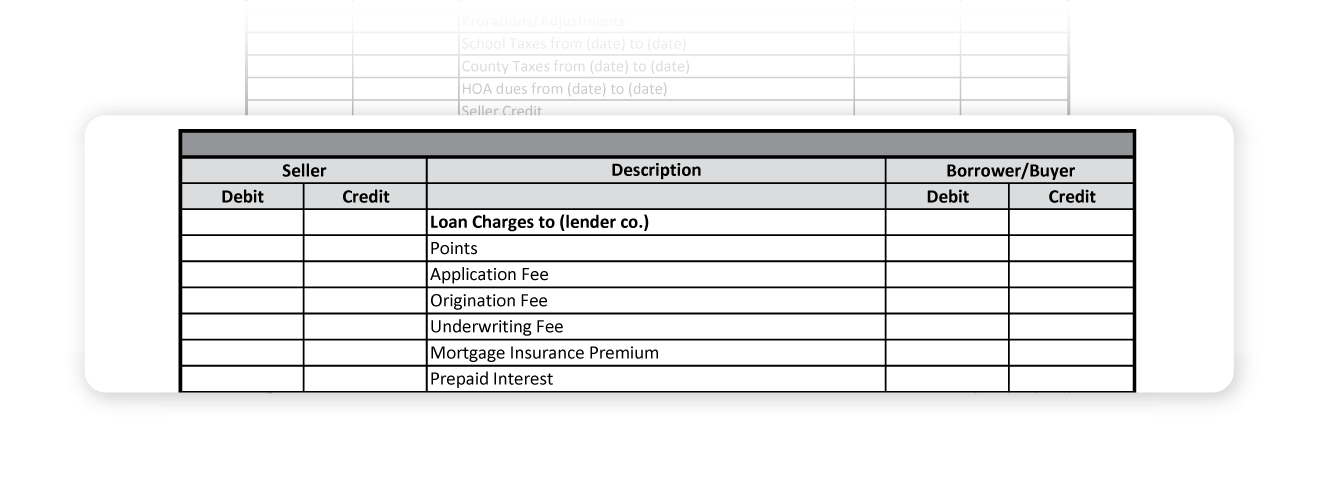

Loan Charges to (lender co.)

These costs are paid by the seller to their lender. Hence, they show up as a debit on the buyer’s part. However, if the seller has agreed to pay some of the charges, it will appear on their side under the debit column. Here are the cost components for Loan Charges.

Points. Mortgage points are given to the lender for which they reduce the interest rate for the buyers. This amount is paid upfront during closing.

Application Fee. Charged by the lender to process the mortgage application.

Origination Fee. Fees incurred when the lender creates an account in the bank as a part of processing the mortgage.

Underwriting Fee. Underwriting relates to paperwork that goes behind preparing the mortgage.

Mortgage Insurance Premium. This cost may not appear in the list a lot of time as it must only be paid for down payments that are less than 20% of the total mortgage.

Prepaid Interest. It is the amount calculated from the date of closing to the date of the first monthly mortgage for the buyer.

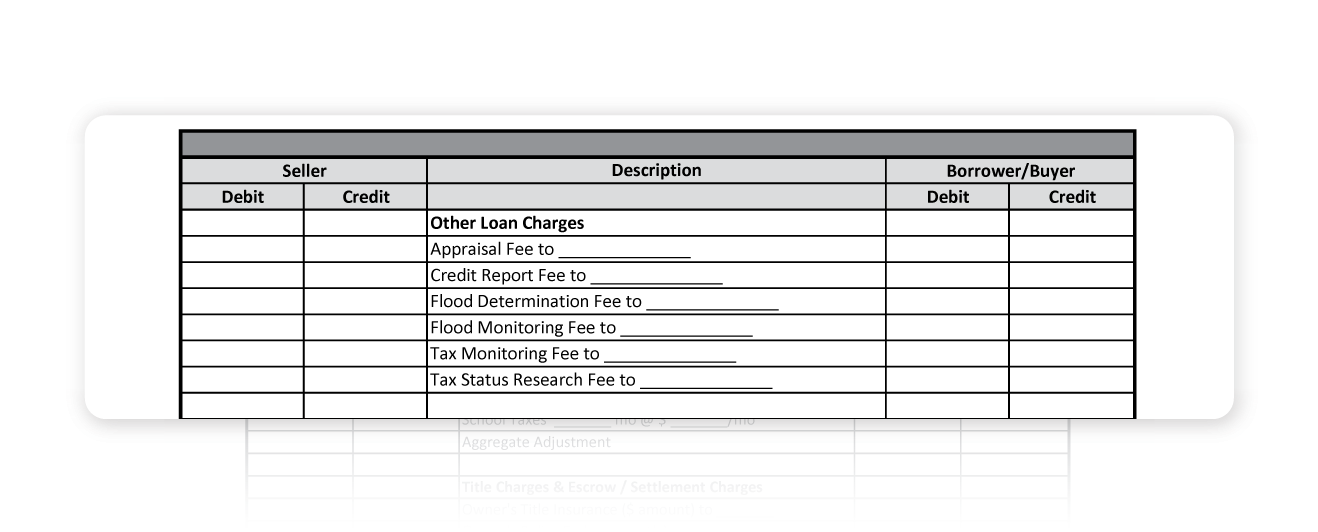

Other Loan Charges

These are additional charges that are charged from the buyer’s account. In addition to the lender, these cost components are often paid to third parties as well.

Appraisal Fee to. Paid to the lender or an appraisal company to determine the current value of the property.

Credit Report Fee to. This cost is charged to process the buyer’s credit report. It is usually paid by the buyer themselves.

Flood Determination Fee to. It is paid to get government approval on the property and that it is not located in an area prone to flooding.

Flood Monitoring Fee to. The buyer pays this amount to keep an eye on flood related conditions.

Tax Monitoring Fee to. Paid to a third party that checks for pending taxes for buyers. The buyer is charged for this amount.

Tax Status Research Fee to. Paid to a third party to check late payments are made to the lender.

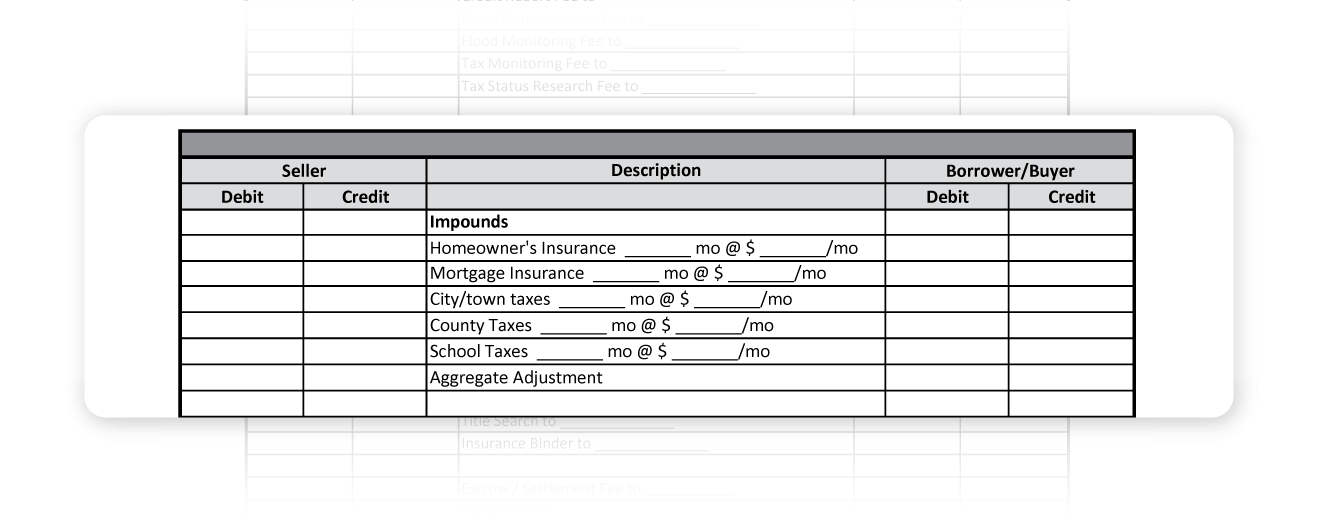

Impounds

Impounds are nothing but a consolidated bundle of charges incurred to process the mortgage.

Homeowner's Insurance. The amount of homeowner’s insurance that is due and owed.

Mortgage Insurance.The amount of mortgage insurance that is due and owed.

City/town taxes. The amount of city/town that is due and owed.

County Taxes. The amount of county taxes that are due and owed.

School Taxes. The amount of school taxes that is due and owed.

Aggregate Adjustment. A calculation to prevent the buyer’s lender from collecting more money from the buyer than is allowed by RESPA (the Real Estate Settlement and Procedures Act). (They can’t hold onto more than ⅙ of the new homeowner’s property tax and insurance payments).

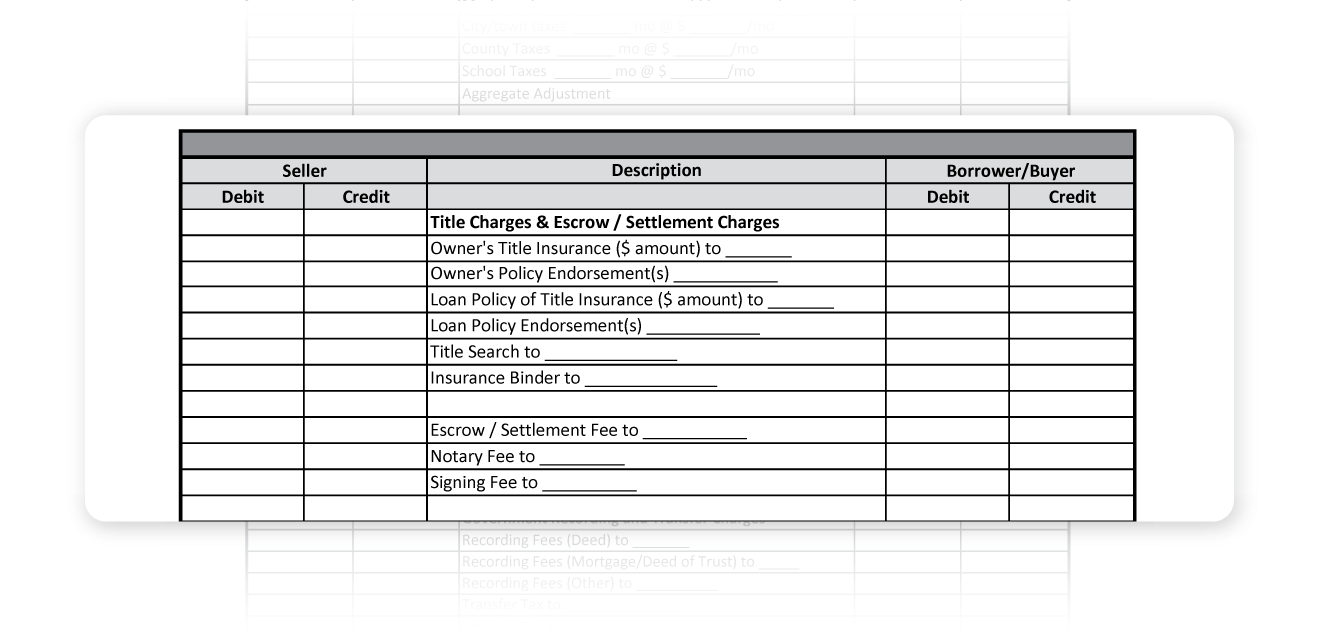

Title Charges & Escrow / Settlement Charges

The escrow or title company charges buyers for settlement charges and escrow costs. These costs are debited from the buyer’s side.

Owner's Title Insurance. Amount paid to protect the title ownership of the buyer.

Owner's Policy Endorsement(s). Presents the owner’s policy towards the transaction.

Loan Policy of Title Insurance. Amount paid to protect the lender if the title is found to be disputed.

Loan Policy Endorsement(s). Tailors lender’s title insurance policy to the specific transaction.

Title Search to. The cost of running a title search, often paid by the buyer.

Insurance Binder to. The buyer buys an insurance binder for two years to commit to issuing a title policy.

Escrow / Settlement Fee to. Charges to carry out the settlement.

Notary Fee to. Paid to the notary for overseeing and witnessing the signing of documents.

Signing Fee to. Paid to the notary as an additional fee.

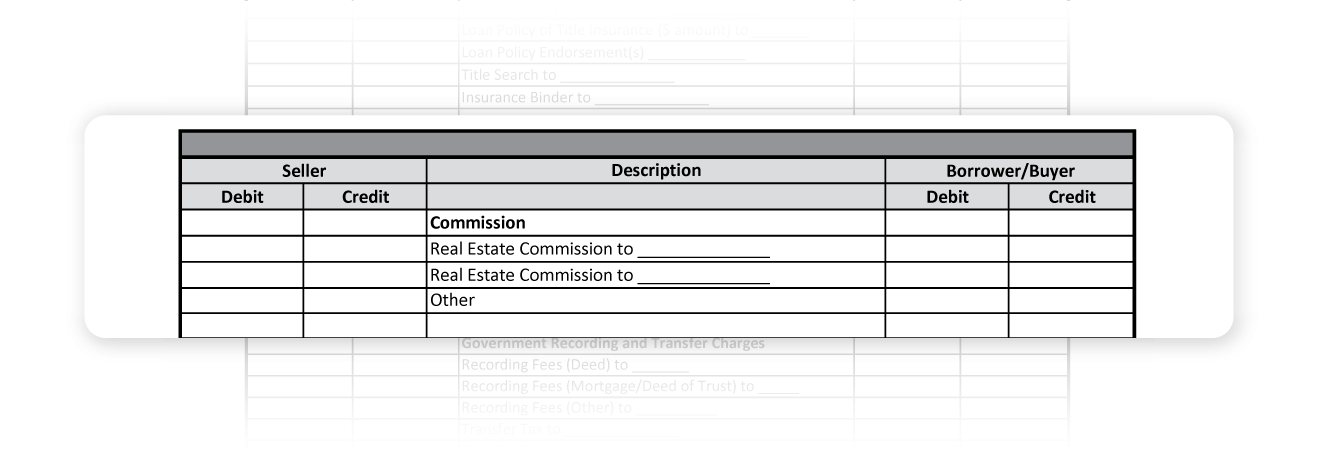

Commission

This section shows the commissions paid to agents of both parties along with some additional charges.

Real Estate Commission to. Paid to the buyer’s agent. Generally ranges within 5%-6% of the total value of the property.

Real Estate Commission to. Paid to the seller’s agent. Generally ranges within 2%-3% of the total value of the property.

Other. Any other commission that any party could receive.

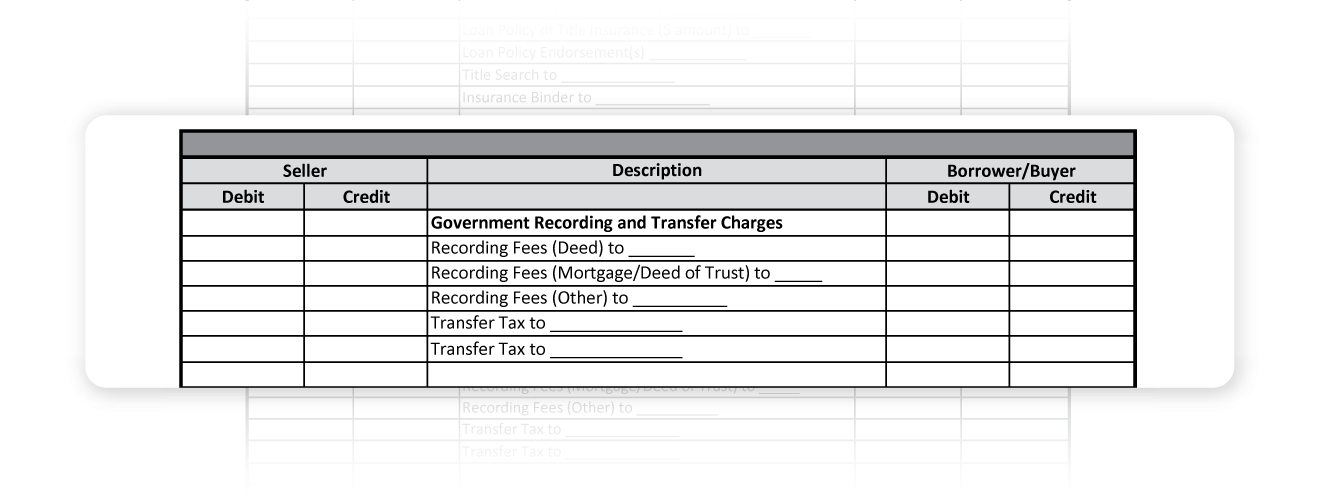

Government Recording and Transfer Charges

These costs are levied by the county for recording the new title and mortgage for the new owner.

Recording Fees (Deed). A fee charged to record the new need. Paid by the buyer most of the time.

Recording Fees (Mortgage/Deed of Trust). A fee charged to record the mortgage approval. Paid by the buyer most of the time.

Recording Fees (Other). Additional recording fees charged.

Transfer Tax. Goes to the state government for title transfer. Paid by the buyer but can be negotiated.

Transfer Tax. Tax for other transfers

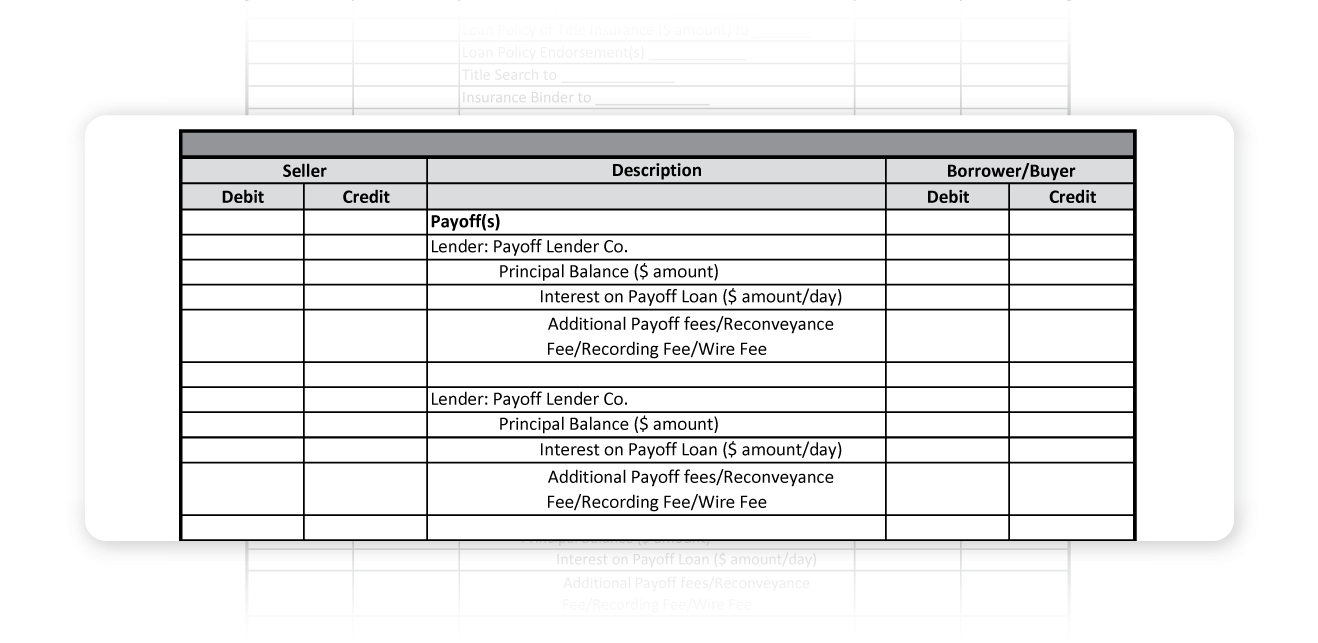

Payoff(s)

Many times sellers pay off their remaining mortgage by the money they get from the sale of the house. This is called the payoff. There are various types of payoffs. These are:

Principal Balance ($ amount). Amount of loan unpaid without considering the rate of interest.

Interest on Payoff Loan ($ amount/day). If the sellers owe any interest, it is paid on during the closing.

Additional Payoff fees/Reconveyance Fee/Recording Fee/Wire Fee. Payoffs connected to recording, reconveyance, etc. for the sellers to get out of the mortgage.

Note that these elements appear twice in the combined ALTA statement, unlike the buyer and seller statements where they appear only once.

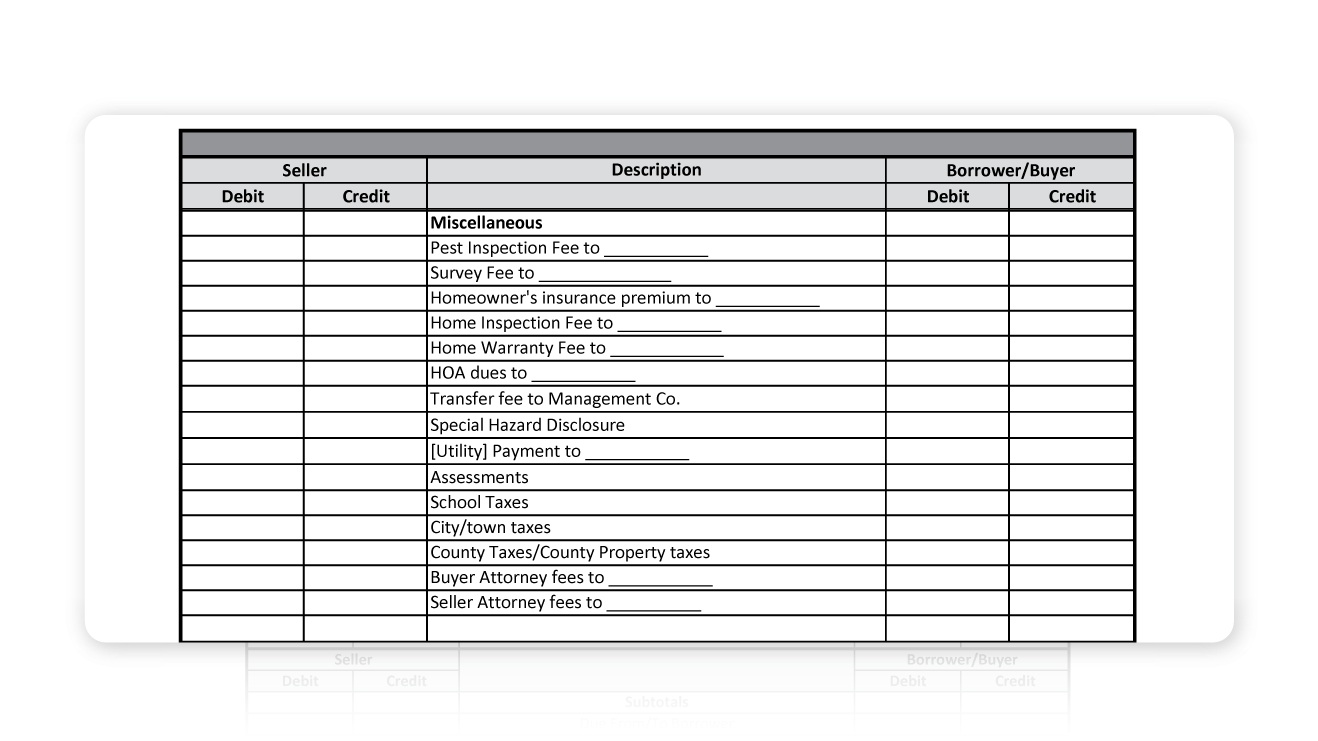

Miscellaneous

These costs are associated with mortgage processing and title transfer, but cannot be categorized within the previous sections. Miscellaneous costs are debited from the buyer’s account most of the time. However, a lot of time the sellers may agree to pay apart as well, and the costs are debited from the seller’s side. Here is the list of all miscellaneous costs.

Pest Inspection Fee. Pest infection fee is paid by the buyers to check if the property has any form of pest infestation.

Survey Fee. The amount paid to the surveyor to survey the property.

Homeowner's insurance premium. A small amount paid to the lender as HOA insurance premium.

Home Inspection Fee. Property inspections professionals ensure that there are no major structural issues before the ownership is transferred. This fee is usually paid by the buyer.

Home Warranty Fee. The cost paid for repair and replacement of home appliances. Paid by the seller a lot of times.

HOA dues. HOA dues are generally paid by the seller before the title is transferred.

Transfer fee to Management Co. The fee incurred to transfer the HOA membership from the seller’s name to that of buyer’s.

Special Hazard Disclosure. Cost of the hazard disclosure form.

Utility Payment. Any pending utility bills for telephone or electricity or other recurring services. Paid by the seller a lot of times.

Assessments. HOA assessment charges paid upfront during closing.

School Taxes. Taxes paid for school in a particular neighborhood.

City/town taxes. Taxes levied with respect to the town.

County Taxes/County Property taxes. Taxes levied with respect to the county.

Buyer Attorney fees. Fees paid to the buyer’s attorney.

Seller Attorney fees to. Fees paid to the buyer’s attorney.

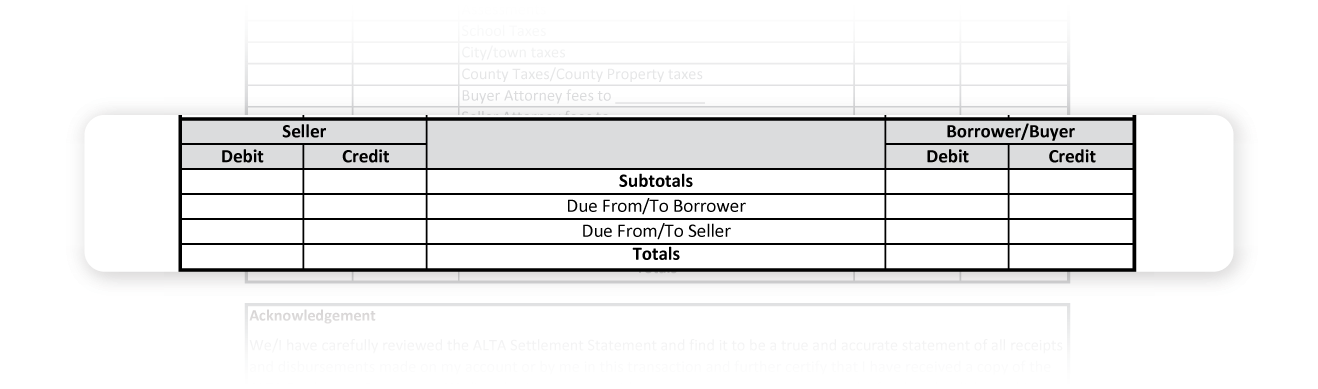

Subtotal

The sum of costs on both sides of the document that shows the total debit and credit for both buyer and seller.

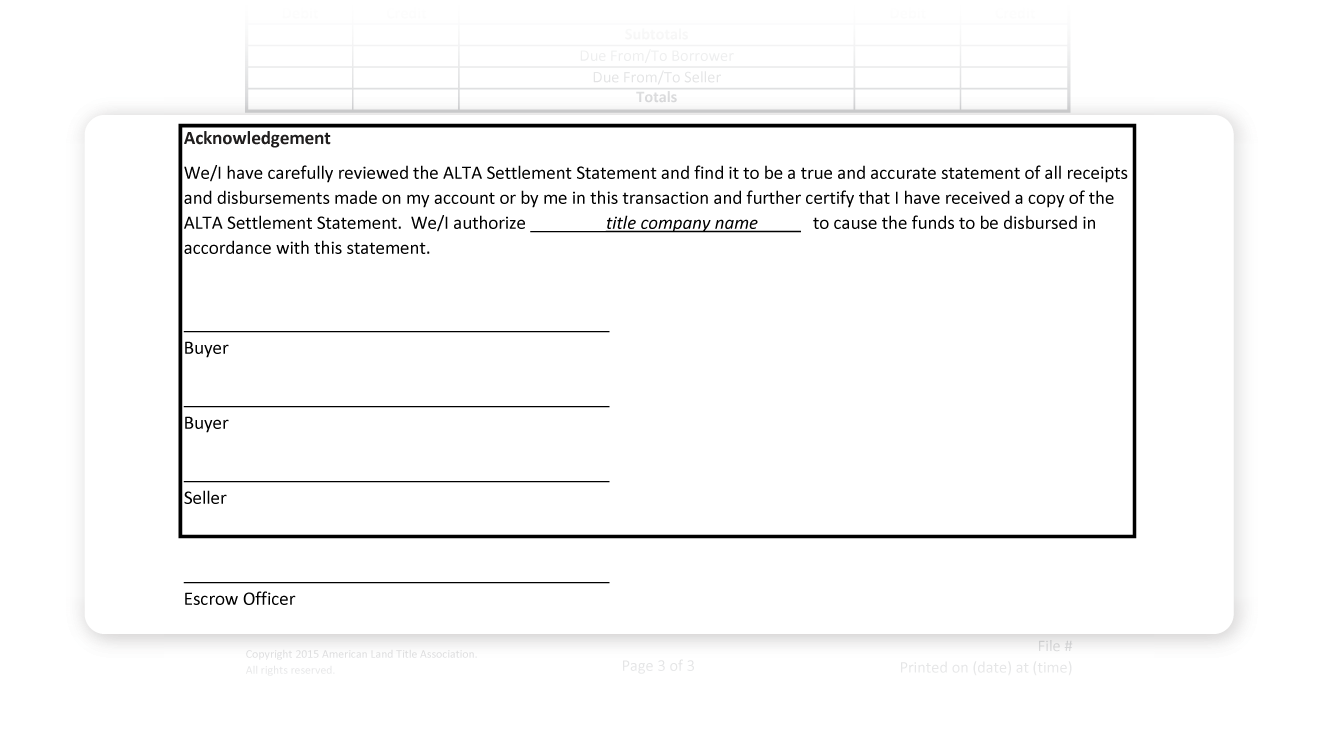

Acknowledgment

Acknowledgment by the buyer and the seller to have received the ALTA statement and checked it for approval. It also states that both parties allow the title company to disburse the funds in accordance with the terms stated in the document.

ALTA clearly shows the flow of costs with respect to the buyer and the seller. It gives a clear picture of what both parties should expect to pay and receive at the end of the closing process.